Investment Blog & Analysis

Comprehensive analysis of mutual funds, stock market research, and investment strategies to help you make informed financial decisions in 2025.

Categories

Brigade Enterprises: Can Residential Demand Rebound Sustain Margins Amid Rising Input Costs and Project Del

Brigade Enterprises Ltd.

AXISCADES Engineering Technologies: Can Space Sector Partnerships Drive Sustainable Growth Amid Execution Risks?

AXISCADES Engineering Technologies, an Indian engineering and technology solutions provider, has been gaining investor attention due to its strategic positioning in high-growth sectors like aerospa...

Novartis India Ltd.: Can Strategic Divestment and Open Offer Unlock Value for Remaining Shareholders?

Novartis India Ltd.

RailTel Corporation of India: Can Government Project Wins Drive Sustained Profitability Amid Execution Risks?

RailTel Corporation of India, a 'Navratna' Public Sector Undertaking (PSU) under the Ministry of Railways, holds a unique position at the nexus of telecommunications and railway infrastructure in I...

Gujarat Gas: Can Infrastructure Expansion and Industrial Demand Sustain Growth Amid Volatility and Alternative Fuels

Gujarat Gas Limited (GGL) stands as India's largest city gas distribution (CGD) company, playing a pivotal role in the nation's energy transition by supplying natural gas to industrial, commercial,...

Thermax Ltd.: Can Order Book Growth Translate to Sustained Profitability Amid Cyclical Demand?

Thermax Ltd.

Ion Exchange (India) Ltd.: Can Water Management and Recycling Solutions Drive Sustainable Growth Amid Industrialization

Ion Exchange (India) Ltd.

ABB India: Can Record Order Momentum Sustain Margins Amid Execution Complexity and Input Cost Pressures?

ABB India's Q3 FY26 reveals a paradox: record order inflows of Rs 4,096 Cr (+52% YoY) but net profit declined 18% to Rs 433 Cr as operating margins contracted 413 bps, challenging the 70x P/E v...

CDSL: Can Demat Account Dominance Sustain Margins Amid Regulatory Fee Compression and NSDL Competition?

CDSL controls 80% of India's demat accounts with 17.27 crore accounts, but SEBI-driven fee compression and NSDL's IPO-fueled competitive push challenge its premium valuation at 50x P/E.

Private Markets Liquidity: Can Institutionalization of Secondary Trading Unlock Value Amid Valuation Pressures and Exit Constraints?

India's burgeoning private markets, now exceeding Rs 15 lakh crore in AIF assets, face persistent liquidity bottlenecks that secondary trading aims to resolve, spotlighting listed players like Mult...

Yes Bank: Can Turnaround Momentum Sustain Margins Amid Asset Quality Risks and Competitive Lending Pressures?

Yes Bank remains a critical case study for Indian retail investors tracking private sector bank turnarounds post-2020 reconstruction.

Bajaj Auto: Can EV Two-Wheeler Localization Sustain Margins Amid Subsidy Phase-Out and Import Competition?

Bajaj Auto, a cornerstone of India's two-wheeler industry with over Rs 50,000 crore in annual revenue, derives more than 50% of its profits from internal combustion engine (ICE) motorcycles like Pu...

Trent: Can Retail Expansion and Private Label Growth Sustain Margins Amid Inventory Risks and Competitive Pressures?

Trent Limited, the Tata Group's retail arm, operates in India's increasingly competitive organized retail sector with brands like Westside for mid-premium fashion and Zudio for value fashion, along...

Persistent Systems: Can Auto Embedded Systems Growth Sustain Margins Amid Client Concentration and Supply Chain Risks?

Persistent Systems, a mid-tier IT services player listed on NSE and BSE, has built a reputation for steady growth in software product engineering, particularly in embedded systems for automotive an...

BSE: Can Exchange Technology Upgrades Sustain Dominance Amid Regulatory Changes and Competition?

BSE Ltd (BSE: BSE), operator of India's oldest stock exchange, commands a pivotal position in the nation's capital markets infrastructure, processing equity, derivatives, and debt trades while gene...

Utilities Sector Renaissance: Can Power Demand Surge from AI and Electrification Drive Sustainable Growth Amid Grid Infrastructure Constraints?

Power Grid Corporation of India Ltd (POWERGRID), India's largest transmission utility, operates at the heart of the nation's power sector where surging demand from AI data centers, electrification,...

Havells India: Can Consumer Durables Expansion Sustain Margins Amid Premiumisation Pressures and Input Cost Volatility?

Havells India operates in India's competitive electrical equipment space, spanning cables, switchgears, and consumer durables like fans and appliances, with a market cap placing it among mid-to-lar...

IRCTC: Can Digital Ticketing Dominance Sustain Margins Amid Fare Regulation and Competition?

IRCTC, the monopoly provider of online railway ticketing, catering, tourism, and packaged water for Indian Railways, commands a market cap exceeding Rs 80,000 crore despite single-digit revenue gro...

Paytm: Can UPI Dominance and Regulatory Normalization Sustain Growth Amid Competitive Intensity and Compliance Costs?

One 97 Communications (Paytm), India's leading fintech platform, operates in a hyper-competitive digital payments landscape where UPI dominance by rivals overshadows its merchant strengths.

Trident: Can Textile Export Diversification Sustain Margins Amid Global Demand Shifts and Raw Material Volatility?

Trident Ltd, a major player in India's textile and paper segments, derives over 70% of its revenue from exports, particularly home textiles to the US market, making it highly sensitive to global tr...

NTPC Green Energy: Can Green Capacity Ramp-Up Sustain Margins Amid Execution Risks and Policy Dependencies?

NTPC Green Energy Limited (NGEL) has emerged as India's largest renewable energy developer by capacity, with recent commissioning of 410 MW across Khavda and Bhadla solar projects bringing total ca...

Dixon Technologies: Can EMS Localization Sustain Margins Amid Rising Competition and Component Costs?

Dixon Technologies (India) Ltd stands as India's leading electronics manufacturing services (EMS) provider, with over 90% revenue from mobile phones and related EMS, making it highly exposed to sma...

Adani Green Energy: Can Renewable Capacity Expansion Sustain Margins Amid Execution Risks and Financing Costs?

Adani Green Energy (AGEL), India's largest pure-play renewable energy company, commands a massive market presence with over 17 GW operational capacity, riding the nation's push towards 500 GW non-f...

Biocon: Can Biosimilars Expansion Sustain Margins Amid Patent Expiries and Global Pricing Pressures?

Biocon Limited stands at a pivotal juncture in India's biopharma evolution, transitioning from generics dominance to biosimilars leadership amid shifting disease burdens toward oncology, diabetes, ...

Data Center Infrastructure Stocks: Can India's AI Power Demands Drive Secular Growth Amid Grid Capacity Constraints?

Anant Raj Ltd (NSE: ANANTHRAJ), a diversified real estate developer with a growing tilt towards data centers, is at the intersection of India's booming digital infrastructure needs and persistent p...

Bajaj Housing Finance: Can Affordable Housing Lending Scale Sustain Margins Amid Rising NPAs and Competition?

Bajaj Housing Finance Limited (BHFL) has emerged as India's second-largest housing finance company by loan disbursement, with Assets Under Management (AUM) crossing Rs 1,26,749 crore as of Septembe...

Kaynes Technology: Can Electronics Manufacturing Localization Sustain Margins Amid Import Duties and Supply Chain Localization?

Kaynes Technology India Ltd (NSE: KAYNES) operates in India's burgeoning electronics manufacturing services (EMS) sector, capitalizing on government-led localization under PLI schemes and rising do...

Zomato: Can Quick Commerce Scale Sustain Margins Amid Rising Competition and Logistics Costs?

Zomato stands at the intersection of India's food delivery and quick commerce markets, commanding a market cap exceeding Rs 2 lakh crore as of early 2026, yet its path to sustained profitability hi...

Suzlon Energy: Can Wind Turbine Revival Sustain Margins Amid Supply Chain Constraints and Policy Shifts?

Suzlon Energy, India's leading wind turbine manufacturer with a 35% market share in installations, is riding a wave of renewable energy demand driven by India's net-zero ambitions and hybrid power ...

L&T Finance: Can Retail Lending Expansion Sustain Margins Amid Rising Credit Costs and Regulatory Scrutiny?

L&T Finance Holdings (LTFH), a leading non-banking financial company (NBFC) listed on NSE and BSE, matters today as it executes a high-stakes pivot from wholesale to retail lending amid India's com...

Varun Beverages: Can Volume Growth and Geographic Expansion Sustain Margins Amid Input Cost Pressures?

Varun Beverages, PepsiCo's largest franchisee outside the US, operates in a highly competitive Indian beverage market where volume growth and geographic expansion have driven impressive financials,...

Borosil Renewables: Can Solar Glass Export Growth Sustain Margins Amid Global Supply Chain Shifts?

Borosil Renewables Ltd (NSE: BORORENEW), India's leading solar glass manufacturer, operates in a high-growth but volatile segment tied to global photovoltaic (PV) module demand and domestic renewab...

Private Markets Liquidity: Can Democratized Access to Unlisted Equities Reshape Retail Investment Portfolios?

NSE-listed CAMS (Computer Age Management Services Ltd) operates as a critical intermediary in India's mutual fund ecosystem, processing transactions and maintaining investor records for asset manag...

Mazagon Dock: Can Defence Order Pipeline and Export Push Sustain Margins Amid Geopolitical Shifts?

Mazagon Dock Shipbuilders (MDL) has emerged as a focal point for Indian defence investors following reported progress on an $8 billion Indo-German submarine deal involving air-independent propulsio...

Apollo Tyres: Can Global Expansion and Premiumisation Sustain Margins Amid Raw Material Volatility?

Apollo Tyres operates in the cyclical tyre industry, where India's replacement market drives steady volumes but global expansion into Europe exposes it to volatile raw material costs and competitiv...

Bajaj Auto: Can EV Transition and Export Diversification Sustain Margins Amid Rising Competition?

Bajaj Auto, a leading two-wheeler and three-wheeler manufacturer, commands a significant share of India's domestic market while deriving nearly half its revenue from exports, making it a key player...

JSW Infrastructure: Can Port Privatization and Capacity Expansion Sustain Margins Amid Global Trade Volatility?

JSW Infrastructure, India's second-largest private port operator by capacity, operates in a sector critical to India's trade ambitions amid global supply chain shifts.

Persistent Systems Stock Analysis 2026: Record Q3 Deal Wins & US Growth Ignite IT Services Rally

Persistent Systems, a mid-tier Indian IT services firm listed on NSE (PERSISTENT) and BSE (533179), operates in a hyper-competitive sector where growth hinges on US client spending and talent reten...

IRCON International Stock Analysis 2026: Record Railway Order Wins & Navratna Upgrade Ignite Infra Rally

Ircon International Ltd, a Navratna PSU specializing in railway infrastructure and engineering projects, operates in India's capital-intensive infra cycle where government spending drives order flo...

HCL Technologies Stock Analysis 2025: Q3 Revenue Beat & AI Deal Wins Ignite IT Rally

HCL Technologies, a major player in India's IT services sector with a market cap exceeding Rs 4 lakh crore as of mid-January 2026, remains a key holding for many retail investors seeking exposure t...

Tata Communications Stock Analysis 2025: Record Q3 Profit Surge & Submarine Cable Wins Ignite Telecom Rally

Tata Communications, a key player in India's telecom infrastructure with a global footprint in digital connectivity, operates in a sector critical to the country's Digital India push and enterprise...

India’s Union Budget 2026: Infrastructure Spending Surge, Tax Relief Impacts & Retail Investor Opportunities

India's Union Budget 2026 is poised to be a pivotal moment for the nation's economic trajectory, with experts advocating a massive surge in infrastructure spending to ₹12 lakh crore, building on th...

BYJU'S 2025: Edtech Unicorn's Restructuring Roadmap and Path to $5B Revival

Imagine a phoenix rising from the ashes of India's edtech boom and bust – that's BYJU'S in 2025, the once-$22 billion unicorn now charting a bold restructuring roadmap toward a $5 billion revival b...

Trent Stock Analysis 2025: Q3 Zudio Expansion & Record Same-Store Sales Ignite Retail Rally

Trent Limited, the Tata Group's retail powerhouse, has ignited a fresh rally in the Indian retail sector with its stellar Q3 FY26 results announced on January 12, 2026.

India’s Rupee Volatility 2025: USD-INR Pressures, RBI Defenses & Hedging Strategies for Retail Investors

The Indian Rupee (INR) experienced unprecedented volatility in 2025, breaching the 91 per USD mark for the first time amid US tariffs, record FII outflows of $18 billion, and restrained RBI interve...

Ola Electric 2025: EV Unicorn's Battery Tech Leap and Path to $10B Profitability

The search results provided contain **contradictory and incomplete information** that makes it impossible to write an accurate article titled "Ola Electric 2025: EV Unicorn's Battery Tech Leap and ...

Polycab India Stock Analysis 2025: Record Q3 Wire Exports & ITI Capacity Expansion Ignite Multibagger Rally

Polycab India Ltd (NSE: POLYCAB), India's leading wires and cables manufacturer, has ignited investor excitement with its record-breaking Q3 FY26 results announced on January 16, 2026.

Paytm 2025: Post-Listing Revival, Revenue Diversification and Path to Sustainable Profits

Imagine a phoenix rising from the ashes of regulatory turmoil – that's Paytm in 2025.

BSE Stock Analysis 2025: Record Listing Surge & Exchange Tech Upgrade Ignite Multibagger Momentum

The Bombay Stock Exchange (BSE) Limited, India's premier stock exchange operator, has emerged as a standout multibagger candidate in 2025, fueled by a record surge in new listings and groundbreakin...

India’s AI-Driven Fintech Revolution 2025: Cross-Border UPI Expansion, Wealth Tech Monetisation & Investor Plays

India's fintech sector is undergoing a seismic transformation powered by artificial intelligence, positioning the nation as a global leader in digital financial innovation by 2025.

Meesho 2025: Social Commerce Unicorn's $5B IPO Path and Rural Reseller Economics

Imagine a Bengaluru garage in 2015 where two IIT Delhi alumni, Vidit Aatrey and Sanjeev Barnwal, spotted a goldmine in India's overlooked Tier-2 and Tier-3 cities.

VST Tillers Tractors Stock Analysis 2025: Record Q3 Tractor Sales Surge & Rural Revival Ignite Small-Cap Rally

VST Tillers Tractors Ltd (NSE: VSTTILLERS), a pioneer in India's farm mechanization sector, has ignited a small-cap rally with its record Q3 FY25 tractor sales surge, reporting 29% YoY revenue grow...

India’s REIT Renaissance 2025: Real Estate Yield Surge, Commercial Revival & Portfolio Diversification Strategies

India's Real Estate Investment Trusts (REITs) are experiencing a remarkable renaissance in 2025, marking a pivotal shift from nascent experimentation to robust market maturity.

PhonePe 2025: From UPI Dominance to $20B Valuation — Can India's Fintech Giant Go Public?

Imagine a world where every street vendor in Mumbai's bustling markets, every kirana store in rural Uttar Pradesh, and every online shopper in Bengaluru swipes their phone to pay seamlessly – that'...

Dixon Technologies Stock Analysis 2025: Record Q3 Electronics Orders & PLI Scheme Boost Ignite Rally

Dixon Technologies (India) Ltd, a leading electronic manufacturing services (EMS) powerhouse in India, has ignited a massive stock rally following its blockbuster Q3 FY25 results announced on Janua...

India’s Cryptocurrency Regulation Pivot 2025: Crypto Tax Reforms, Adoption Surge & Portfolio Allocation Strategies

India's cryptocurrency landscape is undergoing a transformative pivot in 2025, marked by refined tax reforms, surging adoption, and clearer regulatory frameworks that signal maturation from uncerta...

CRED 2025: Credit Unicorn's AI Lending Pivot and Path to $10B Profitability

Imagine paying your credit card bill and unlocking not just rewards, but a gateway to instant, AI-powered personal loans tailored precisely to your spending habits.

Adani Green Stock Analysis 2025: Record Renewable Capacity Addition & FPO Funds Ignite Green Energy Rally

Adani Green Energy (NSE: ADANIGREEN), India's largest renewable energy player, is witnessing a remarkable rally in 2025, fueled by record renewable capacity additions and strategic fundraising thro...

India's Nifty Valuation Reset 2026: Bottom-Up Investing Strategies as Market Momentum Shifts from Broad-Based Bets

India’s equity markets enter 2026 at a critical valuation juncture.

Swiggy 2025: AI-First Logistics, ONDC Synergy and the New Economics of Hyperlocal Delivery

In less than a decade, Swiggy has gone from a Bengaluru food-delivery upstart to a listed platform orchestrating millions of hyperlocal transactions every day across food, grocery, and convenience.

Biocon Stock Analysis 2025: USFDA Clearance, Biosimilar Approvals & Q3 Margin Rebound Spark Pharma Re‑rating

Biocon Ltd (NSE: BIOCON, BSE: 532523) has re‑emerged at the centre of investor interest after a series of positive USFDA outcomes and key biosimilar approvals, setting up the stock for a potential ...

India’s Sovereign Green Bonds 2025: Climate Finance Boom, Yield Prospects and Portfolio Strategies for Indian Investors

India’s sovereign green bonds (SGrBs) are rapidly emerging as a core building block of the country’s climate finance architecture and a relevant asset class for Indian investors.

Zomato 2025: Food Delivery Unicorn’s Adtech, ONDC Bet and New Profit Pools for Indian Investors

In less than a decade, Zomato has gone from being India’s favourite restaurant discovery app to the core of Eternal Ltd – a listed tech platform straddling food delivery, quick commerce, B2B supply...

Welspun Corp Stock Analysis 2025: Q3 Earnings Beat, New Oil & Gas Orders and Buyback Announcement Spark Small-Cap Rally

Welspun Corp Ltd (NSE: WELCORP, BSE: 532144), a leading Indian manufacturer of large-diameter pipes and line pipes for the oil & gas and water transmission sectors, has entered 2025 on a strong foo...

India’s Digital Rupee Shift 2025: How RBI’s CBDC Rollout Could Transform UPI, Banking Liquidity and Retail Portfolios

India’s financial system is entering a pivotal phase as the Reserve Bank of India (RBI) accelerates its central bank digital currency (CBDC) journey with the digital rupee (e₹).

Razorpay 2025: UPI Fee Winds, Cross-Border Payments and the Next Profit Engine for India’s Fintech Unicorn

In 2014, a young Razorpay team was pitching UPI before most Indian consumers had even heard of it.

Zomato Stock Analysis 2025: Block Deals Spike, Q3 Profit Surprise & Hyperpure Expansion Ignite Mid‑Cap Rally

Zomato Ltd, one of India’s leading food delivery and quick-commerce platforms, has entered 2025-26 at the centre of market attention, driven by a mix of strong top-line growth, unexpected profitabi...

India's Earnings Growth Acceleration 2026: Large-Cap Outperformance and Sector-Specific Investment Opportunities

India enters 2026 at a critical inflection point for corporate earnings and equity returns, with a growing consensus that the next leg of market performance will be driven more by earnings growth t...

Zepto 2025: Dark Stores, Subscription Loyalty and the New Economics of Indian Quick Commerce

India's quick commerce sector has undergone a seismic transformation, with Zepto emerging as one of the most aggressive players reshaping the landscape of instant delivery.

Suzlon Energy Stock Analysis 2025: Record Wind Order Wins & Debt Reduction Drive Renewables Re‑rating

Suzlon Energy Limited, India’s largest pure-play wind turbine manufacturer listed on NSE and BSE, has re-emerged at the centre of the renewables narrative after delivering record wind turbine deliv...

India’s New Tax Code Shake-Up 2025: How Direct Tax Reforms Will Reshape Returns for Indian Investors

India’s direct tax landscape is on the cusp of its biggest reset in over six decades, with the Income-tax Act, 2025 and related Direct Tax Code–style reforms set to take effect from 1 April 2026, r...

Blinkit 2025: Quick Commerce Unit Economics, Dark Store Expansion and Path to Sustainable Profitability

In less than three years, Blinkit has gone from a struggling grocery app to the sharpest weapon in Eternal Ltd’s (Zomato’s parent) arsenal, reshaping how urban India buys milk, maggi, and masalas.

PNB Housing Finance Stock Analysis 2025: Q3 AUM Growth, Asset Quality Improvement & Promoter Stake Sale Drive Re‑rating

PNB Housing Finance Limited has emerged as a compelling investment opportunity in India's affordable housing segment, driven by exceptional Q3 FY25 performance that showcases robust growth across k...

India’s Precious Metals Overheat 2026: Gold & Silver Valuation Risks and Retail Rebalancing Strategies

India's precious metals market has entered uncharted territory in early 2026, with gold prices hovering around ₹1,39,000 per 10 grams and silver surpassing ₹2,40,000 per kilogram, following explosi...

Lenskart 2025: From Eyewear D2C to $8B IPO — Unit Economics and Profitability Breakthrough

Lenskart's journey from a bootstrapped D2C eyewear startup to an ₹8 billion IPO represents one of India's most compelling profitability turnarounds.

Varun Beverages Stock Analysis 2025: Record Q3 Volume Surge & Africa Expansion Ignite FMCG Momentum

Varun Beverages Limited (VBL), India's leading PepsiCo bottling partner, has emerged as a compelling investment opportunity following its Q3 2025 results announcement in late October.

India’s RBI Rate Cuts 2026: Inflation Cooling, Growth Boost & Retail Portfolio Strategies

India's Reserve Bank of India (RBI) has ushered in a transformative phase for 2026 with strategic rate cuts, heralding a 'rare goldilocks period' of sub-1% inflation and over 8% GDP growth, despite...

Gupshup 2025: Conversational AI Unicorn's $2B Valuation Surge and WhatsApp Commerce Boom

Imagine a world where your WhatsApp chat doesn't just buzz with memes and family updates, but powers a multi-billion rupee e-commerce empire.

L&T Finance Stock Analysis 2025: Q3 Microfinance Surge & Gold Loan Expansion Ignite NBFC Momentum

L&T Finance Limited, the non-banking financial company (NBFC) subsidiary of Larsen & Toubro, has emerged as a compelling investment opportunity following its Q3FY26 business update announced on Jan...

India's Small-Cap Correction Risk 2026: Why Large-Caps Will Outperform and How Retail Investors Should Reposition

As India enters 2026, the equity markets are at a pivotal juncture following a stark divergence in performance across market caps in 2025.

Bajaj Finance Stock Analysis 2025: Q3 Loan Growth Surge & festive Demand Ignite NBFC Rally

Bajaj Finance, one of India's leading non-banking financial companies (NBFCs), has delivered a robust Q3 FY26 performance that signals sustained momentum in the consumer lending space.

India’s ESG Investing Surge 2025: Green Bonds, Sustainable Funds & Climate-Resilient Portfolio Strategies for Retail Investors

India's ESG investing landscape is experiencing unprecedented momentum in 2025, driven by regulatory mandates, surging retail investor interest, and alignment with national goals like Net Zero by 2...

PolicyBazaar 2025: Post-IPO Performance Analysis and Insurance Unicorn's Growth Roadmap

Imagine logging into a platform where comparing and buying insurance feels as simple as ordering biryani on Zomato – that's the magic PolicyBazaar has woven into the lives of over 4.

Mazagon Dock Stock Analysis 2025: Record Defence Order Wins & Navratna Status Ignite Multibagger Rally

Mazagon Dock Shipbuilders Ltd (NSE: MAZDOCK), India's premier defence shipyard, has emerged as a standout multibagger in the equity markets, driven by record defence order wins and its coveted Navr...

India’s FII Flow Revival 2026: Triggers for Foreign Capital Inflows and Retail Portfolio Boosts

India's equity markets are poised for a significant revival in Foreign Institutional Investor (FII) flows in 2026, following a challenging 2025 marked by net outflows of Rs 1.

Mamaearth 2025: D2C Skincare Unicorn's Path to $5B IPO and Profitability

Imagine a startup born in a Delhi garage in 2016, promising 'toxin-free' skincare for India's worried moms, scaling to unicorn status in just five years, going public at a whopping ₹5,000 crore val...

Havells India Stock Analysis 2025: Q3 Earnings Beat & Promoter Buying Ignite Consumer Durables Rally

Havells India Limited, a leading player in the electrical equipment and consumer durables sector, has emerged as a focal point for investors following its Q3 FY2025-26 performance and strategic cap...

India’s Trump Tariff Shield 2026: US Trade War Risks, Export Boosts & Defensive Portfolio Strategies for Retail Investors

As 2026 unfolds, India's economy stands at a pivotal crossroads amid escalating US trade tensions under a Trump administration reinstating aggressive protectionism.

boAt 2025: Lifestyle Unicorn's D2C Audio Empire and Path to $2B IPO Profitability

Imagine a bootstrapped dream turning into India's audio revolution: boAt, the Gurugram-born lifestyle unicorn, has scripted one of the most remarkable turnaround stories in D2C history.

Yes Bank Stock Analysis 2025: RBI Reconstruction Scheme Approval Sparks Turnaround Rally

Yes Bank, once a darling of the Indian private banking sector, has staged a remarkable turnaround since its near-collapse in March 2020, when the RBI imposed a moratorium and reconstruction scheme.

India’s Manufacturing PMI Surge 2025: GDP Boost, Job Creation & Portfolio Plays for Retail Investors

India's Manufacturing Purchasing Managers' Index (PMI) has surged into 2025, signaling robust expansion in the sector despite global headwinds like US tariffs.

Unacademy 2025: Edtech Unicorn's AI Pivot and Path to Post-BYJU'S Profitability

Imagine a phoenix rising from the ashes of India's edtech winter – that's Unacademy in 2025.

Tata Power Stock Analysis 2025: Q3 Earnings Beat & AI Power Demand Surge Ignite Rally

Tata Power Company Limited (NSE: TATAPOWER), one of India's leading integrated power utilities, has ignited a powerful stock rally following its stellar Q3 FY25 earnings beat announced in early 2026.

India’s Auto Sector Revival 2025: GST Cuts, RBI Loan Easing & Premium Demand Surge for Investors

India's auto sector is experiencing a remarkable revival in 2025, propelled by transformative GST cuts, RBI's accommodative monetary policy easing loan access, and a surge in premium vehicle demand.

Ola's Path to Profitability: Can India's Ride-Hailing Giant Beat Uber's Economics?

Imagine a Bengaluru entrepreneur hailing a ride in 2010, frustrated by unreliable taxis in a city choking on traffic.

Persistent Systems Stock Analysis 2025: Block Deal Frenzy & Q3 Revenue Surge Ignite Mid-Cap Momentum

Persistent Systems Ltd (NSE: PERSISTENT), a leading mid-cap IT services player, is capturing investor attention amid a block deal frenzy and robust Q3 revenue surge as of December 2025.

India’s Banking AI Revolution 2025: GenAI, Wealth Tech & Open Banking Transforming Retail Portfolios

India's banking sector is undergoing a seismic shift in 2025, propelled by Generative AI (GenAI), Wealth Tech innovations, and Open Banking frameworks that are fundamentally reshaping retail invest...

Groww 2025: Fintech Unicorn's $10B Valuation Surge and Rural Investor Boom

Groww's journey from a Flipkart founder-backed startup to India's largest fintech IPO of 2025 represents a watershed moment for the country's retail investing revolution.

IRFC Stock Analysis 2025: Record Railway Capex Orders & Debt Resolution Fuel Multibagger Momentum

Indian Railway Finance Corporation (IRFC), the dedicated financing arm of Indian Railways, is poised for multibagger potential in 2025, driven by record railway capital expenditure (capex) orders s...

India’s Retail Wealth Shift 2025: How Fractional Real Estate, Art Funds & Alternative ETFs Are Rewiring Portfolios

India's retail wealth landscape is undergoing a seismic shift in 2025, driven by a burgeoning affluent class, digital innovation, and evolving regulatory frameworks.

Nykaa 2025: From Beauty Retail to Financial Services — Can the D2C Giant Build a Profitable NeoBank?

Imagine a beauty empire that doesn't just sell lipstick and skincare but could soon power your digital wallet, offer instant loans for that impulse buy, and manage your everyday finances—all under ...

Delhivery Stock Analysis 2025: Q3 Logistics Volume Spike & New Fulfillment Hub Expansion Drive Re-rating

Delhivery has re-emerged as a market focus in late-2025 after the company reported a strong Q3 operational beat driven by a logistics volume surge and announced a material expansion of its fulfillm...

India’s Rupee Internationalization 2025: What Rising INR Cross-Border Settlements Mean for Investors

India's push to internationalize the rupee (INR) has accelerated since 2023 and reached a practical inflection point by 2025 as the Reserve Bank of India (RBI) and the government expanded the toolk...

Flipkart 2025: Walmart-Backed E-commerce Giant's $40B IPO Path and Profitability Pivot

Flipkart's move from a Singapore holding structure back to India is the prologue to what could be the marquee listing of India's next new-economy wave: a Walmart-backed Flipkart IPO targeting a hea...

Coal India Stock Analysis 2025: Surprise Dividend Hike & Export Order Wins Fuel Small‑Cap Re‑rating

Coal India (NSE: COALINDIA / BSE: 533278) has been at the centre of market attention in 2025 after the company announced a surprise 2nd interim dividend of ₹10.

India’s Cryptocurrency Boom 2025: Regulatory Shifts and Retail Investment Strategies

India’s cryptocurrency landscape in 2025 is experiencing unprecedented growth, fueled by regulatory clarity and surging retail investor interest.

Freshworks 2025: SaaS Unicorn's Global Expansion and Path to $20B Valuation

Imagine a Chennai-born SaaS powerhouse, once a scrappy startup founded by two brothers in a modest apartment, now challenging global giants like Salesforce and ServiceNow on the NASDAQ stage.

Trent Stock Analysis 2025: Record Q3 Fashion Sales Surge & Zudio Expansion Ignite Multibagger Rally

Trent Limited (NSE: TRENT), the Tata Group's powerhouse in organized retail, has ignited investor excitement with its blockbuster Q3 FY25 results announced recently, showcasing a staggering 33% YoY...

India’s Mega IPO Boom 2025: ₹1.75 Lakh Crore Raised and Retail Investment Strategies

India's Initial Public Offering (IPO) market in 2025 has shattered all previous records, raising a staggering ₹1.

BYJU'S 2025 Revival: Edtech Unicorn's Debt Restructuring and Path to Profitability

Imagine a phoenix rising from the ashes of India's edtech boom – that's BYJU'S in 2025, the once $22 billion unicorn now charting a gritty path to revival through aggressive debt restructuring and ...

Bajaj Electricals Stock Analysis 2025: Q3 Earnings Beat & Promoter Stake Increase Sparks Rally

Bajaj Electricals Ltd (NSE: BAJAJELEC), a leading player in India's consumer durables and lighting sector, has captured investor attention with its Q3 FY25 earnings announcement on February 4, 2025...

India’s CBDC Wave 2025: How Digital Rupee Adoption Will Transform Retail Payments, Fees, and Cash Flows

India’s digital rupee (e₹) rollout in 2023–25 marks a structural shift in retail payments, fee economics, and cash-flow mechanics across households, merchants, banks, and government programs.

Dhan 2025: Fintech Trading Platform's Unicorn Leap and Path to IPO Profitability

Imagine turning ₹10 into a ₹450 crore empire in just four years – that's the jaw-dropping story of Dhan, India's newest fintech unicorn that has Wall Street whispering and Dalal Street buzzing.

IRCON International Stock Analysis 2025: Recent Dividend Declaration & Infra Order Wins Spark Rally

IRCON International Ltd.

India's Securities Markets Code 2025: How the Historic Capital Market Overhaul Will Reshape Retail Investor Opportunities

The Securities Markets Code, 2025, introduced in the Lok Sabha by Finance Minister Nirmala Sitharaman, marks a watershed moment for India's capital markets, consolidating the SEBI Act 1992, Securit...

Paytm 2025: Post-IPO Revival — Can India's Fintech Giant Reclaim Unicorn Glory?

Remember the frenzy of November 2021 when Paytm's IPO shattered records, raising ₹8,235 crore at a whopping ₹2,150 per share and minting India's largest fintech unicorn into a listed giant? Fast fo...

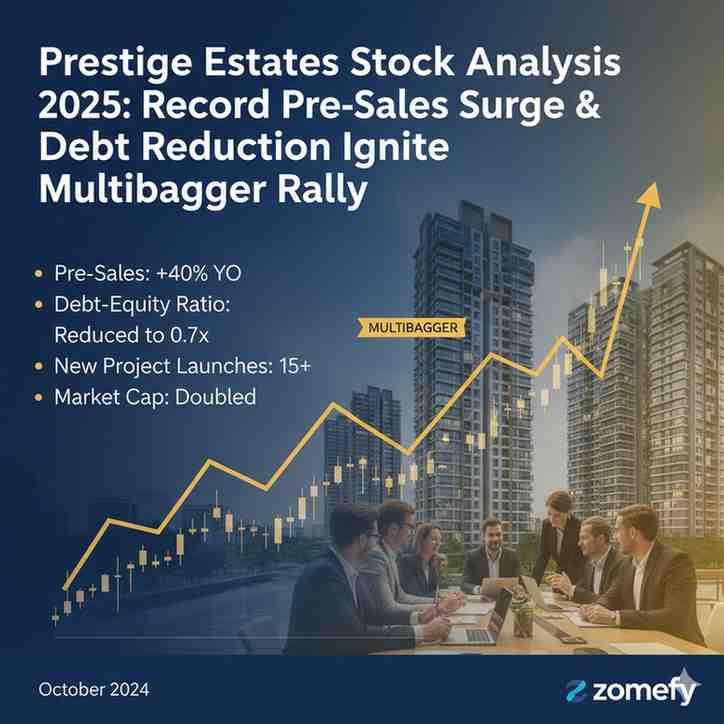

Prestige Estates Stock Analysis 2025: Record Pre-Sales Surge & Debt Reduction Ignite Multibagger Rally

Prestige Estates Projects Limited (PEPL) has emerged as India's leading real estate developer by pre-sales performance in FY26, delivering a record-breaking ₹18,143.

India's AI Exposure Gap 2025: Why Missing the Global Tech Rally Is Costing Retail Investors Billions

India's equity markets stand at a critical juncture in 2025, with the BSE Sensex projected to reach 94,000 by 2026 according to HSBC Global Research, yet retail investors are missing out on billion...

Bajel Projects Stock Analysis 2025: Recent IPO Listing Surge & Order Wins Ignite Multibagger Potential

Bajel Projects Limited (NSE: BAJEL), a prominent player in India's power transmission and infrastructure EPC sector, has emerged as a standout performer following its recent IPO listing and a landm...

India's Market Breadth Crisis 2025: Why Benchmark Gains Are Masking Widespread Stock Weakness for Retail Investors

India's stock market presents a paradoxical picture in 2025: while benchmark indices like the Sensex and Nifty50 have reached all-time highs, the underlying market structure reveals a deeply concer...

Meesho 2025: Reshaping E-commerce for Bharat with $5B Valuation and IPO Roadmap

Meesho's blockbuster IPO on December 10, 2025, marked a watershed moment for India's e-commerce sector, with shares surging approximately 95% in just over a week to add ₹47,000 crore in investor va...

Real Estate Sector Stock Analysis 2025: Interest Rate Decline Tailwinds & Defensive Property Valuations Drive 2026 Opportunity

The Indian real estate sector is poised for a transformative 2026, propelled by anticipated interest rate declines and defensive property valuations that create compelling investment opportunities.

India’s 2025 Pension Privatization Playbook: How New NPS Reforms and Foreign Pension Funds Will Transform Retirement Investing

India's 2025 pension landscape is undergoing a structural shift as sweeping NPS (National Pension System) reforms, a new Unified Pension Scheme (UPS) for select central employees, and increasing pa...

PhonePe 2025: Business Model Deep Dive and $15B Valuation Path to IPO

Imagine a world where a simple scan of a QR code powers over 270 million daily transactions, fueling India's $1.

Adani Ports Stock Analysis 2025: Record Cargo Volumes & Global Terminal Wins Fuel Multibagger Momentum

Adani Ports and Special Economic Zone Limited (APSEZ), India's largest private port operator, is riding high on record cargo volumes and strategic global terminal wins, positioning the stock for mu...

India’s Gold Rush 2025: Commodity Price Surges and Portfolio Hedging Strategies for Retail Investors

India's Gold Rush 2025 has been characterised by an extraordinary rally in both international and domestic gold prices, driven by a weaker US dollar, geopolitical uncertainty, and robust investment...

CRED 2025: From Rewards to Revenue — Can India's Credit-Centric Unicorn Build a Profitable Financial Services Stack?

Imagine paying your credit card bill and not just avoiding late fees, but earning exclusive rewards that feel like a luxury getaway— that's the magic Kunal Shah conjured with CRED in 2018.

Indigo Paints Stock Analysis 2025: Sudden Promoter Buyback & Block Deal Sparks Mid‑Cap Rally

Indigo Paints Ltd (NSE: INDIGOPNTS), a leading player in India's decorative paints sector, has sparked a mid-cap rally following a sudden promoter buyback announcement and a high-profile block deal...

Swiggy 2025: IPO Valuation Breakdown and Path to Beating Zomato's Post-Listing Returns

Imagine missing Zomato's explosive post-IPO journey: from a listing pop to over 400% returns in under two years, turning ₹1 lakh into ₹5 lakhs for early believers.

India’s Sovereign Green Bonds 2025: How India’s New Climate-Linked Debt Could Reshape Retail Portfolios

India’s Sovereign Green Bonds (SGBs) represent a transformative step in the nation’s journey towards sustainable finance, directly linking public debt to climate action.

Zomato 2025: Profitability Pivot — How Foodtech's Marketplace is Reinventing Unit Economics for Investors

Imagine a startup that started as a humble restaurant directory in 2008, battled through years of cash burn and skepticism, and emerged in 2025 as Eternal (formerly Zomato) – a ₹2.

Zomato Stock Analysis 2025: Record Q3 Profit Surge & Quick Commerce Expansion Driving Delivery Dominance

Zomato's Q3FY25 results and management commentary mark a critical inflection point in the company's multi-year growth playbook: aggressive quick-commerce (Blinkit) expansion alongside recovery in c...

RBI’s 2025 Rate Pivot: How Repo Cuts, Liquidity Tools, and Inflation Signals Will Reshape Indian Portfolios

The Reserve Bank of India’s (RBI) 2025 pivot toward easing monetary policy — signalled by a cumulative 125 basis points (bps) of repo-rate cuts during the year and the December 2025 repo rate at 5.

Razorpay 2025: How Embedded Banking and BNPL Could Turn India's Payments Unicorn into a Financial Services Giant

Razorpay sits at a pivotal crossroads: born as a payments gateway in 2014, the company has built a full-stack fintech platform serving 8-10+ million merchants and processing north of ₹1.

Dixon Technologies Stock Analysis 2025: Q3 Earnings Beat & Mobile Manufacturing Ramp-Up Driving Multibagger Potential

Dixon Technologies has been in the headlines following its Q3 FY2025 results and a rapid operational ramp-up in mobile manufacturing that together are being viewed by many market participants as po...

India’s FDI Surge 2025: Capital Inflows, Trade Deals, and Opportunities for Retail Investors

India’s FDI surge in 2025 represents a meaningful inflection point for domestic capital markets and retail investors as policy, trade deals and targeted incentives have combined to lift gross inflo...

Zepto's 2025 Quick Commerce Boom: Unit Economics and Path to $10B Valuation

Imagine ordering your evening groceries and having them at your doorstep in just 10 minutes – that's the magic Zepto has woven into the lives of millions of urban Indians.

Suzlon Energy Stock Analysis 2025: Record Order Wins & Wind Capacity Ramp-Up Driving Turnaround Momentum

Suzlon Energy Limited, a pioneer in India's wind energy sector, is witnessing a remarkable turnaround in 2025, fueled by record order wins exceeding 6 gigawatts (GW) and a significant ramp-up in wi...

India’s ESG Investing Surge 2025: Green Bonds and Sustainable Wealth Strategies for Retail Investors

India's ESG investing landscape is experiencing an unprecedented surge in 2025, driven by government commitments to net-zero by 2070, SEBI's stringent BRSR disclosures, and a burgeoning demand from...

Lenskart's 2025 Valuation Leap: $7.5B Path to IPO Profitability?

Lenskart’s 2025 IPO and its advertised valuation near USD 7.

India’s REIT Renaissance 2025: Unlocking Real Estate Wealth for Retail Investors

India's Real Estate Investment Trusts (REITs) are experiencing a renaissance in 2025, transforming from a nascent asset class into a cornerstone of diversified investment portfolios for retail inve...

Ola Electric's 2025 Surge: From Losses to EV Unicorn Profitability?

Ola Electric's 2025 story reads like a startup thriller: rapid scale, headline-grabbing valuation, operational stumbles, regulatory scrutiny — and now an intense question for investors and the mark...

Varun Beverages Stock Analysis 2025: Record Q3 Volume Growth & International Expansion Catalyzing Earnings Surge

Varun Beverages Ltd (VBL), the second-largest PepsiCo bottler globally and a powerhouse in India's FMCG sector, has once again captured investor attention with its stellar Q3 CY2025 results announc...

India’s Banking AI Revolution 2025: GenAI, Open Banking, and Wealth Tech Opportunities for Retail Investors

India’s banking sector is at the cusp of a structural transformation driven by Generative AI (GenAI), Open Banking frameworks (Account Aggregator and consented data flows), and a fast-maturing Weal...

Startup Unicorns 2025: Inside Groww's Rural Fintech Surge and Path to Multi-Billion Valuation

In the dynamic landscape of India's fintech sector, Groww stands out as a beacon of innovation, particularly with its aggressive push into rural markets, positioning it for a multi-billion dollar v...

Infosys Stock Analysis 2025: AI Contract Wins & Margin Recovery Driving Growth Momentum

Infosys Limited (NSE: INFY), a cornerstone of India's IT services sector, is poised for robust growth in 2025, fueled by major AI contract wins and a strong margin recovery trajectory.

India’s Auto Sector Revival 2025: GST Cuts, RBI Reforms, and Investment Opportunities for Retail Investors

India's auto sector is experiencing a robust revival in 2025, propelled by transformative GST 2.

India Unicorns 2025: The Rise of Semiconductor & Chip Design Startups Fueling India’s Hardware Renaissance

India's semiconductor and chip-design startups are rapidly maturing into a strategic industry cluster that can transform the country's technology stack and industrial capability.

Bajaj Finance Stock Analysis 2025: Post-Policy Rate Cut Loan Growth, SME Portfolio Resilience & NPA Stress Test

Bajaj Finance Limited (NSE: BAJFINANCE), one of India's leading non-banking financial companies (NBFCs), continues to dominate headlines in 2025 amid RBI's recent policy rate cuts, robust loan grow...

India’s SIP Revolution 2025: Driving Retail Shift to Long-Term Mutual Fund Wealth Building

India's Systematic Investment Plan (SIP) landscape is undergoing a profound transformation in 2025, marking a seismic shift in retail investor behavior towards disciplined, long-term wealth buildin...

Startup Unicorns 2025: Profiles of India's 11 Newest Entrants - Ai.tech, Rapido, Navi and Their Investment Potential

India's startup ecosystem continues its remarkable ascent in 2025, with 11 groundbreaking companies achieving unicorn status—valuations exceeding $1 billion—according to the prestigious Hurun Repor...

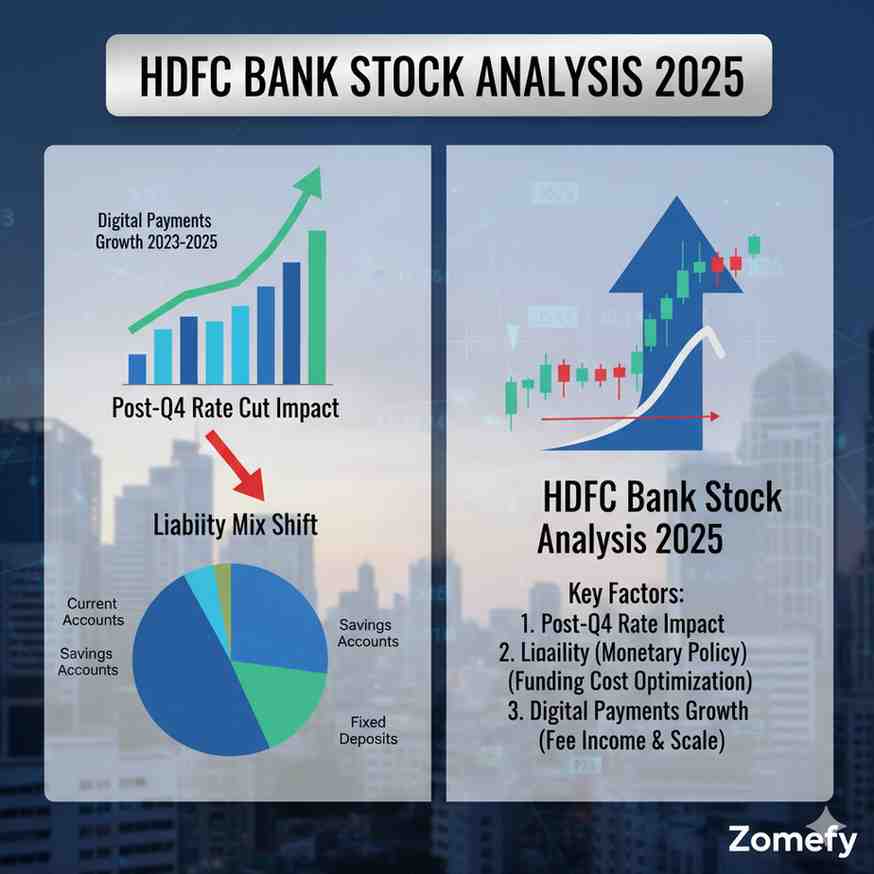

HDFC Bank Stock Analysis 2025: Post-Q4 Rate Cut Impact, Liability Mix Shift & Digital Payments Growth

HDFC Bank, India's largest private sector bank by market capitalization at ₹15.

India’s Private Credit Explosion 2025: High-Yield Opportunities in AIFs for Retail Investors

India's private credit market is experiencing an unprecedented explosion in 2025, emerging as a high-yield powerhouse for retail investors seeking superior returns amid traditional fixed-income lim...

Startup Unicorns 2025: Vertical Farming and Agtech Innovators Driving India's Food Security Revolution

India's food security challenge and rising urbanisation have accelerated investment in agtech and vertical farming, creating a fertile environment for startups to scale into unicorns by 2025.

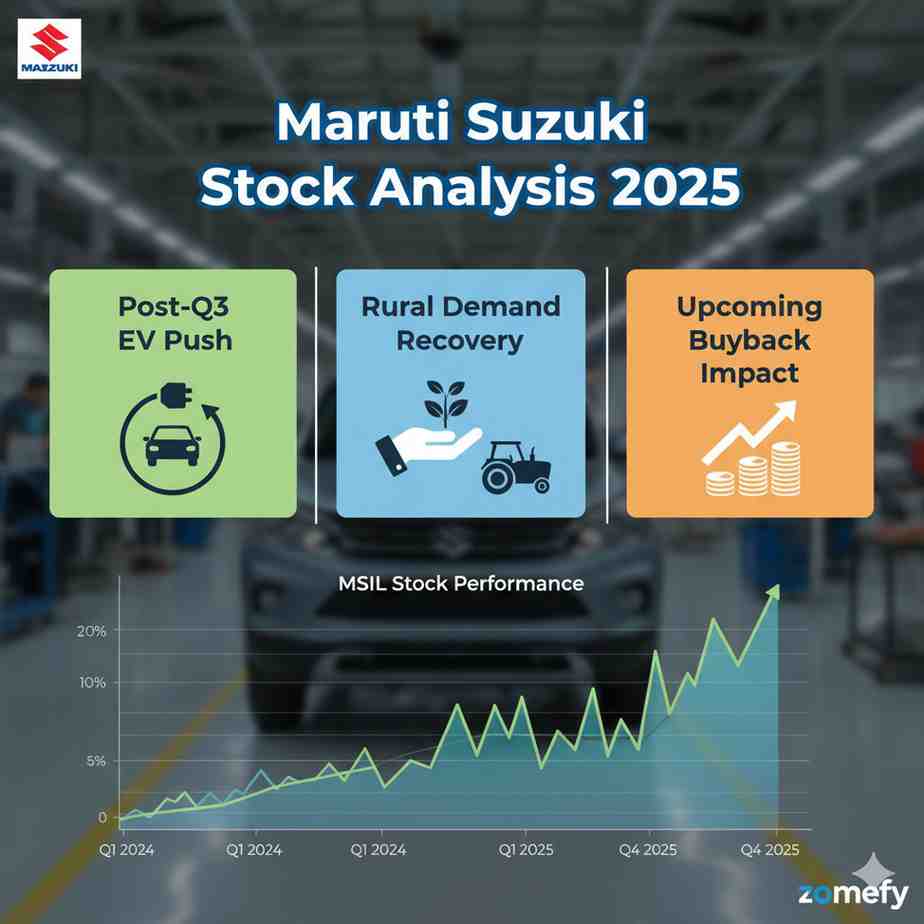

Maruti Suzuki Stock Analysis 2025: Post-Q3 EV Push, Rural Demand Recovery & Upcoming Buyback Impact

Maruti Suzuki India Limited (NSE: MARUTI), India's largest passenger vehicle manufacturer, has once again demonstrated its market dominance with stellar Q3 FY25 results announced on January 29, 2025.

India’s 2025 Economic Outlook: How GDP Growth, Employment Trends, and Inflation Dynamics Shape Retail Investment Strategies

India's economic trajectory heading into 2025 presents a compelling landscape for retail investors and financial professionals alike.

Startup Unicorns 2025: Inside the Business Models and Revenue Engines Powering India’s Pre-IPO Giants

India's startup ecosystem continues to blaze trails globally, with 125+ unicorns as of 2025, collectively valued at over $366 billion.

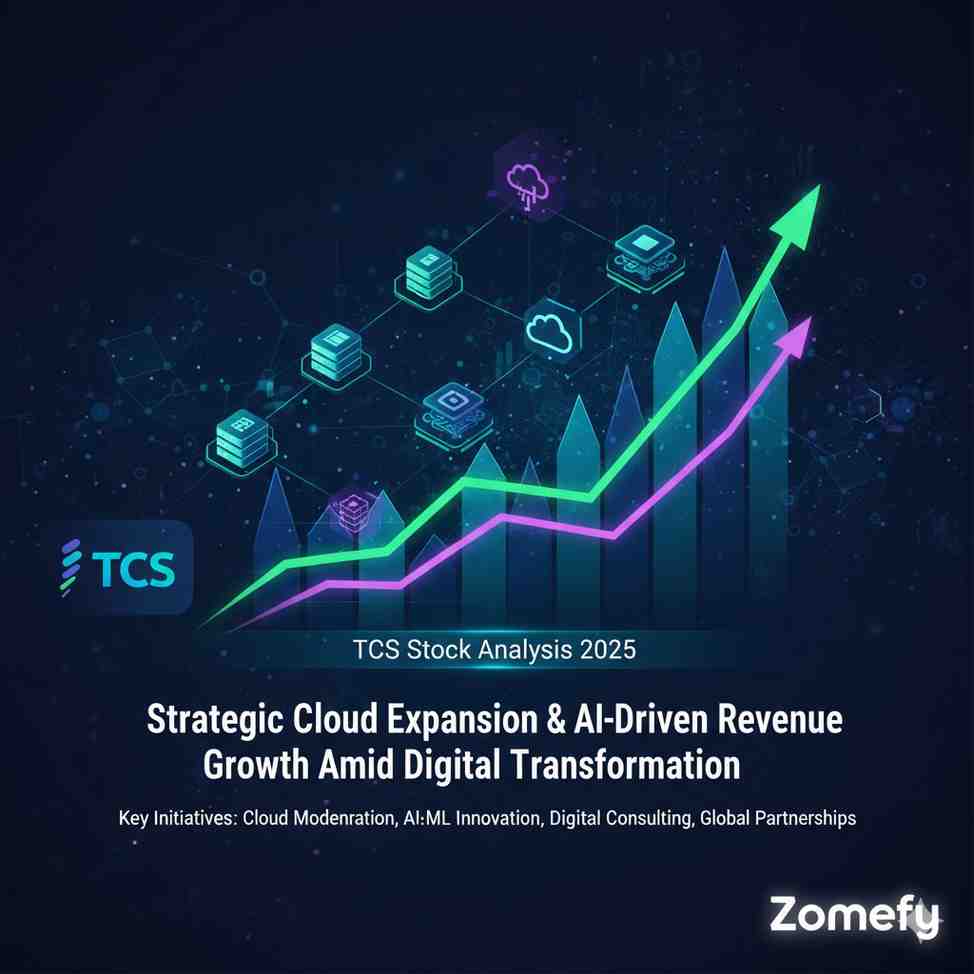

TCS Stock Analysis 2025: Strategic Cloud Expansion & AI-Driven Revenue Growth Amid Digital Transformation

Tata Consultancy Services (TCS), India's largest IT services company and a bellwether for the Indian IT sector, is strategically navigating the evolving digital landscape through aggressive cloud e...

India’s 2025 Private Equity Secondaries Surge: Unlocking New Investment Pathways for Retail Investors

India's private equity (PE) secondaries market is undergoing a remarkable transformation in 2025, emerging as a vital liquidity and investment pathway for retail investors and financial professiona...

Startup Unicorns 2025: Unveiling the Profitability Playbooks of India’s Leading SaaS and Edtech Giants

India’s startup ecosystem has witnessed phenomenal growth with the emergence of unicorns—startups valued at over $1 billion—especially in the SaaS (Software as a Service) and EdTech sectors.

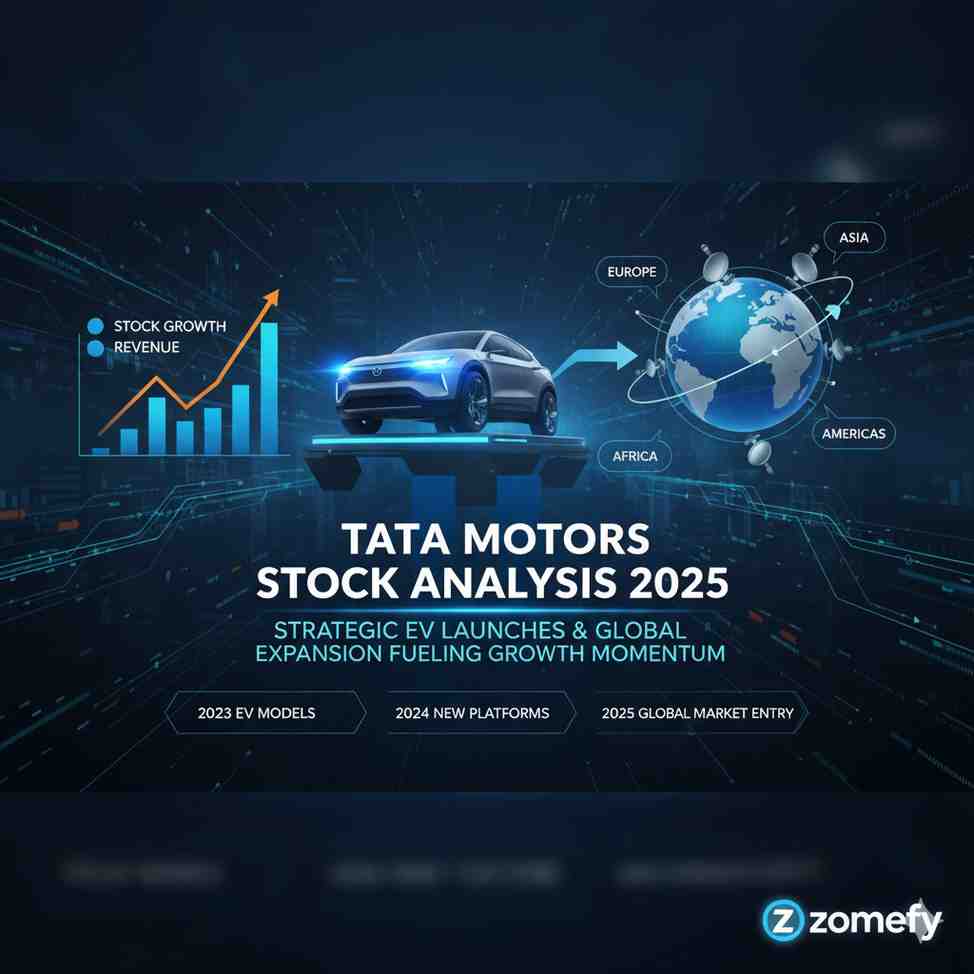

Tata Motors Stock Analysis 2025: Strategic EV Launches & Global Expansion Fueling Growth Momentum

Tata Motors, a flagship company of the Tata Group, remains a pivotal player in the Indian automobile industry, especially in the electric vehicle (EV) and commercial vehicle segments.

Navigating India’s Emerging High-Yield Debt Market in 2025: Opportunities and Risks for Retail Investors

India's high-yield debt market is emerging as a dynamic and increasingly attractive segment for retail investors in 2025, driven by evolving macroeconomic conditions, regulatory reforms, and a grow...

Startup Unicorns 2025: How India's Regulatory Changes Are Shaping Pre-IPO Valuations and Investor Strategies

India's startup ecosystem has witnessed unprecedented growth, with 2025 marking a pivotal year as regulatory changes reshape pre-IPO valuations and investor strategies.

Titan Company Stock Analysis 2025: Post-Diwali Sales Surge & Jewellery Segment Expansion Driving Revenue Growth

Titan Company Limited, a flagship entity in India's consumer discretionary sector, has demonstrated robust growth momentum entering 2025-26, fueled by a strong post-Diwali sales surge and strategic...

India’s 2025 Fintech Revolution: Exploring the Rise of Embedded Lending and UPI-Driven Financial Inclusion for Retail Investors

India's fintech sector is entering a transformative phase as we approach 2025, characterized by the rapid rise of embedded lending and the deepening impact of UPI-driven financial inclusion.

Startup Unicorns 2025: How Indian D2C Brands Are Redefining Profitability and Investor Returns

The Indian startup ecosystem has witnessed a transformative evolution, particularly in the direct-to-consumer (D2C) space, which is reshaping traditional business models and investor expectations.

ICICI Bank Stock Analysis 2025: Post-Q3 Credit Growth Surge & Digital Innovation Accelerating Retail Banking Expansion

ICICI Bank, India's second-largest private sector bank, has demonstrated robust performance in Q3 FY2025, marked by a 15% rise in net profit to ₹11,792 crore, driven by strong credit growth and dig...

India’s 2025 Retail Investment Surge: Navigating the Impact of Rising Inflation and Currency Volatility on Wealth Preservation

India's retail investment landscape in 2025 is witnessing an unprecedented surge, fueled by robust domestic consumption, digital penetration, and evolving consumer preferences.

India's Unicorns 2025: How Climate-Tech Startups Are Defining the Next Wave of Sustainable Investment Opportunities

India's dynamic startup ecosystem is undergoing a transformative shift as climate-tech startups emerge as powerful drivers of sustainable innovation and investment.

Reliance Industries Stock Analysis 2025: Strategic Bet on Digital Assets & FinTech Expansion Driving Next-Gen Growth

Reliance Industries Limited (RIL), India's largest conglomerate, is at a pivotal juncture in 2025 as it strategically shifts focus towards digital assets and fintech expansion to fuel its next-gene...

India’s Digital Lending Boom 2025: Opportunities, Risks, and Regulatory Outlook for Retail Investors

India's digital lending sector is experiencing a transformative boom, driven by rapid technological adoption, expanding fintech ecosystems, and progressive regulatory frameworks.

Startup Unicorns 2025: The Rise of Sustainable and Impact-Driven Business Models in India’s New Investment Era

India’s startup ecosystem is undergoing a profound transformation, moving beyond the traditional playbook of rapid growth at all costs to embrace sustainable and impact-driven business models.

Tata Consumer Products Stock Analysis 2025: Impact of Recent Global Supply Chain Innovations on Earnings Growth

Tata Consumer Products Limited (TCPL), a leading FMCG player and the flagship food and beverage arm of the Tata Group, has been in the spotlight in recent weeks due to a combination of strong analy...

Crypto Payroll in India 2025: The Future of Salary Payments and Tax Implications for Retail Investors

Cryptocurrency payroll systems represent a transformative shift in how Indian companies compensate employees, particularly in the tech and fintech sectors.

Startup Unicorns 2025: Navigating New SEBI Regulations and Their Impact on Indian Startup Valuations and Fundraising

The Indian startup ecosystem has witnessed phenomenal growth over the past decade, with the number of startups soaring from approximately 20,000 in 2015 to over 1,59,000 by early 2025.

Hindustan Unilever Stock Analysis 2025: Dividend Growth & Rural Market Penetration Driving Resilient FMCG Performance

Hindustan Unilever Limited (HUL), a flagship FMCG company listed on NSE and BSE, continues to demonstrate resilient performance in 2025 amid evolving market dynamics.

Risk-Off Sentiment and Market Rotation in 2025: How Indian Investors Should Navigate Global Volatility and Sector Shifts

The Indian equity markets have entered a critical phase in 2025, characterized by persistent foreign portfolio investor (FPI) outflows, elevated valuations, and heightened global uncertainty.

Indian Startup IPOs 2025: Decoding Valuation Trends, Grey Market Premiums, and Listing Performances for Unicorns

The Indian startup ecosystem has entered a transformative phase in 2025, marked by a surge in Initial Public Offerings (IPOs) from unicorns and high-growth companies.

Wipro Stock Analysis 2025: Strategic Cloud Expansion & AI Integration Driving Next-Gen IT Services Growth

Wipro Limited, a stalwart in India's IT services sector, is poised for transformative growth in 2025 driven by strategic expansion in cloud computing and aggressive integration of artificial intell...

Federal Bitcoin Reserve 2025: Implications for Indian Investors

The Federal Bitcoin Reserve (FBR) initiative, anticipated to be operational by 2025 following recent U.

Healthcare AI Unicorns 2025: How Medical AI Startups Are Disrupting Valuations and Clinical Outcomes

The healthcare sector in India is undergoing a transformative phase driven by the integration of artificial intelligence (AI) technologies.

Adani Green Energy Stock Analysis 2025: Impact of Recent SEBI Regulatory Updates and Renewable Capacity Expansion

Adani Green Energy Limited (ADANIGREEN) stands as India's largest renewable energy company, commanding a pivotal position in the nation's energy transition.

Kalshi Prediction Markets 2025: New Frontiers for Retail Investors

Kalshi, a US-based prediction market platform valued at approximately $5 billion, represents a transformative opportunity for Indian retail investors seeking exposure to event-based trading and fin...

Deeptech Unicorns 2025: How Defence, Robotics, and Energy Startups Are Reshaping Investment Valuations

India's startup ecosystem is undergoing a profound transformation, with deep tech—encompassing defence, robotics, and energy—emerging as a key driver of innovation and investment.

Tata Steel Stock Analysis 2025: Q3 Earnings Beat & Green Steel Initiatives Position Company for Sustainable Growth

Tata Steel, one of India's largest and most respected steel producers, has once again captured investor attention with its Q3 FY25 earnings results.

ESG Investing in India 2025: Emerging Trends, Green Bonds, and Sustainable Wealth Creation Strategies for Retail Investors

ESG (Environmental, Social, and Governance) investing in India is rapidly evolving as a mainstream strategy for wealth creation, driven by increasing awareness, regulatory mandates, and global sust...

Fintech Unicorn Economics 2025: How PhonePe, Razorpay, and CRED Are Building Sustainable Revenue Models

The Indian fintech landscape in 2025 is defined by rapid innovation, aggressive expansion, and a relentless focus on building sustainable revenue models.

Asian Paints Stock Analysis 2025: Q3 Earnings Beat & Strategic Price Hike Impact on Margin Expansion

Asian Paints Limited, India's leading paint manufacturer, has once again grabbed the spotlight with its Q3FY25 earnings announcement.

Fei USD and the Rise of Algorithmic Stablecoins: 2025 Investment Implications

Algorithmic stablecoins have emerged as a significant innovation in the cryptocurrency space by offering decentralized, scalable alternatives to traditional fiat-backed stablecoins.

Geographic Expansion 2025: How Emerging Unicorn Hubs Are Reshaping Global Startup Valuations

The global startup ecosystem in 2025 is witnessing a transformative phase driven by geographic expansion beyond traditional hubs like Silicon Valley, New York, and Beijing.

ITC Stock Analysis 2025: Q3 Earnings Beat & Rural Market Expansion Fuel FMCG Growth Momentum

ITC Limited (NSE: ITC) continues to dominate the Indian FMCG and tobacco landscape, with its Q3 FY25 earnings report reinforcing its resilience amid challenging macroeconomic conditions.

RBI’s 2025 Monetary Policy Impact: How Repo Rate Adjustments and Liquidity Measures Are Shaping India’s Investment Landscape

The Reserve Bank of India's (RBI) monetary policy in 2025 is a pivotal force shaping India's economic and investment landscape.

CEE Unicorns 2025: How Physical Tech and Deeptech Are Reshaping Europe’s Startup Landscape

Central and Eastern Europe (CEE) has emerged as one of Europe's most dynamic startup ecosystems, fundamentally reshaping the continent's innovation landscape.

Infosys Stock Analysis 2025: Q3 Earnings Beat & AI-Driven Margin Expansion

Infosys Limited, one of India's premier IT services companies listed on NSE and BSE, has once again demonstrated robust financial and operational performance in its Q3 FY2025 earnings, exceeding ma...

India’s Emerging Real Estate Investment Trust (REIT) Market in 2025: Unlocking New Avenues for Retail Investors

India's Real Estate Investment Trust (REIT) market has emerged as one of the most dynamic segments of the Indian capital markets, representing a paradigm shift in how retail investors can access in...

AI-Powered Unicorns 2025: Why Generative AI Startups Are Reshaping Valuations

The Indian startup ecosystem is witnessing a seismic shift, driven by the rapid rise of generative artificial intelligence (AI) startups.

International Market Rotation 2025: Why Global Diversification Beyond US Mega-Caps Is Reshaping Portfolio Strategy

The global equity landscape in 2025 is undergoing a profound transformation, marked by a significant sector and market rotation away from the dominance of US mega-cap technology stocks.

India's Auto Sector Recovery in 2025: GST Cuts, RBI Support, and Investment Opportunities for Retail Investors

India's automobile sector is experiencing a significant recovery in 2025, marked by transformative policy interventions and macroeconomic stimulus measures.

Bajaj Finance Stock Analysis 2025: Q3 Earnings Beat & Digital Lending Surge Drive Investor Momentum

Bajaj Finance Limited, one of India's leading non-banking financial companies (NBFCs), has demonstrated robust financial performance in Q3 FY25, surpassing market expectations and driving significa...

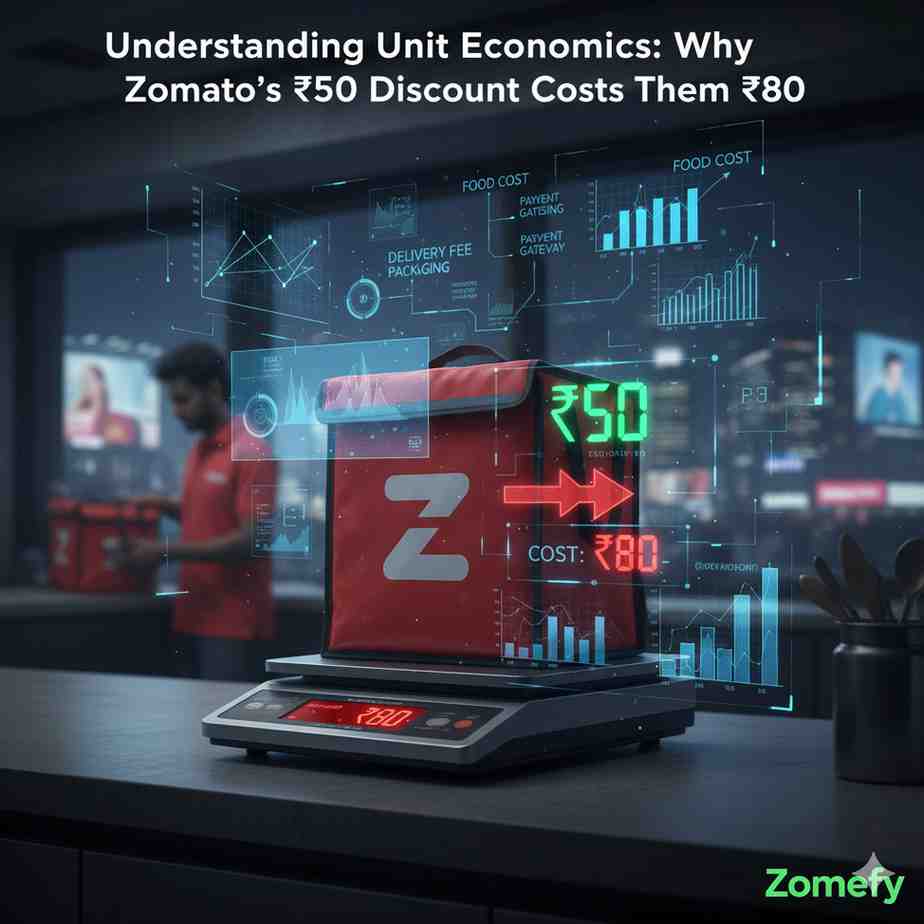

Understanding Unit Economics: Why Zomato's ₹50 Discount Costs Them ₹80

Deep dive into Zomato's unit economics revealing how a ₹50 customer discount actually costs ₹80. Learn about CAC, LTV, contribution margins, and what it means for startup investing.

Quick Commerce Wars: Zepto vs Blinkit vs Instamart - Who Wins?

Comprehensive analysis of India's quick commerce battle between Zepto, Blinkit, and Swiggy Instamart. Compare business models, unit economics, dark store strategies, and investment potential.

5 Metrics to Evaluate Loss-Making Tech Stocks

Learn the 5 essential metrics to evaluate loss-making tech stocks like Zomato, Paytm, and Nykaa. Master EV/Revenue, burn rate, CAC payback, and unit economics for startup investing.

BYJU'S Downfall: Lessons for Startup Investors

Analyze BYJU'S spectacular collapse from $22 billion valuation to near-zero. Learn critical lessons about startup investing, governance red flags, and how to avoid similar disasters.

India's SaaS Unicorns: The Next Infosys Generation?

Explore India's booming SaaS sector with analysis of Freshworks, Zoho, Chargebee, and emerging unicorns. Can Indian SaaS companies replicate Infosys's global success?

How to Read a Startup's DRHP: Key Red Flags to Watch

Master the art of reading startup DRHPs (Draft Red Herring Prospectus). Learn to identify red flags in IPO filings for Zomato, Paytm, Nykaa, and future startup IPOs.

From Unicorn to Zombie: When Startups Lose Their Magic

Analysis of failed Indian unicorns and 'zombie' startups. Learn warning signs when high-growth companies stall, case studies of Paytm, BYJU'S, Dunzo, and how to protect your portfolio.

AI-Driven Portfolio Rebalancing: 2025 Strategies for Indian Investors

In 2025, Indian investors are navigating a dynamic financial landscape shaped by rapid technological advancements, evolving regulatory frameworks, and heightened market volatility.

HDFC Bank Stock Analysis 2025: Digital Lending Surge & Q3 Profit Beat Drive Investor Focus

HDFC Bank, India's largest private sector lender, continues to command investor attention in 2025 amid a dynamic financial landscape marked by digital transformation and evolving credit demand.

India’s Macro-Economic Outlook 2025: Decoding GDP Growth, Inflation Trends, and Employment Dynamics for Strategic Investment Decisions

India's macroeconomic landscape entering 2025 presents a complex yet promising canvas for retail investors and financial professionals alike.

Reliance Industries Stock Analysis 2025: Q3 Earnings Beat & Green Energy Push Drive Investor Interest

Reliance Industries Limited (RIL) continues to be a pivotal force in the Indian corporate landscape, demonstrating resilience and strategic agility in its Q3 FY2025 earnings.

India’s 2025 Financial Literacy Revolution: Empowering Retail Investors Through Digital Education and Community-Driven Wealth Building

India stands at a pivotal moment in its economic journey, where the convergence of digital transformation, regulatory reforms, and a young, aspirational population is reshaping the landscape of ret...

TCS Stock Analysis 2025: Q3 Earnings Beat, Cloud Expansion & AI-Driven Digital Transformation Catalyzing Growth Trajectory

Tata Consultancy Services (TCS), India’s largest IT services company, continues to demonstrate robust growth and resilience in a dynamic global technology landscape.

Navigating India’s Rising Commodity Market Volatility in 2025: Strategic Insights on Gold, Crude Oil, and Agricultural Prices for Retail Investors

India’s commodity markets in 2025 are witnessing unprecedented volatility driven by a confluence of global supply chain realignments, geopolitical tensions, shifting demand patterns, and domestic p...

Tata Motors Stock Analysis 2025: Record JLR Sales & EV Push Drive Momentum Amid Auto Sector Regulatory Shifts

Tata Motors, a flagship company of the Tata Group, remains a focal point in the Indian auto sector as it navigates a transformative phase marked by record sales from its Jaguar Land Rover (JLR) uni...

India's Domestic Consumption Boom and Premiumization Trend: How Retail Investors Can Capitalize on the Consumer Discretionary Sector's 17% Growth Potential in 2025

India’s domestic consumption landscape is undergoing a transformative boom, driven by rising incomes, favorable demographics, and evolving consumer preferences.

ICICI Bank Stock Analysis 2025: Q3 Earnings Beat & Digital Banking Expansion Driving Market Optimism

ICICI Bank, one of India’s leading private sector banks, continues to capture investor attention with its robust Q3 2025 earnings and aggressive push into digital banking.

India’s 2025 Wealth Planning Revolution: Navigating Post-PF Reforms, NPS Updates, and Tax-Efficient Retirement Strategies for Retail Investors

India’s wealth planning landscape is undergoing a transformation in 2025, driven by sweeping regulatory reforms, evolving retirement frameworks, and the urgent need for tax-efficient strategies.

Navigating India’s Growing Private Credit Market in 2025: Risks, Regulatory Changes, and Strategic Opportunities for Retail Investors

India’s private credit market is rapidly evolving into a vital component of the country’s financial ecosystem, driven by robust economic growth, structural reforms, and a burgeoning demand for alte...

Value Stock Resurgence 2025: Why Defensive Sectors & Undervalued Equities Are Outperforming Growth Giants—A Tactical Shift in Market Leadership

India's stock market in 2025 presents a compelling paradox that has caught seasoned investors off guard.

Navigating India's Emerging Digital Currency Ecosystem: Opportunities and Risks for Investors in 2025

India's digital currency ecosystem is rapidly evolving, driven by technological innovation, regulatory reforms, and increasing retail and institutional interest.

Geopolitical Fragmentation & Infrastructure Boom 2025: How Indian Midcap Infrastructure Stocks Are Positioned to Capitalize on Deglobalization & Domestic Capex Acceleration

India’s midcap infrastructure sector is at a pivotal juncture, shaped by two powerful forces: geopolitical fragmentation and a domestic capex boom.

FII and DII Flow Dynamics in 2025: How Foreign and Domestic Investment Patterns Are Reshaping Indian Market Valuations and Sectoral Performance**

The Indian equity market landscape in 2025 is witnessing a significant transformation shaped by the evolving dynamics between Foreign Institutional Investors (FIIs) and Domestic Institutional Inves...

Navigating India’s Surge in Financial Sector M&A and Foreign Investments: Strategic Insights for Retail Investors in 2025

India’s financial sector is undergoing a transformative phase in 2025, marked by a surge in mergers and acquisitions (M&A) and a notable influx of foreign investments.

Adani Enterprises Stock Analysis 2025: Strategic Diversification Play & Q3 Earnings Beat Amid Infrastructure Push

Adani Enterprises Limited (NSE: ADANIENT) has emerged as a compelling diversification play within India's infrastructure and emerging technology sectors, despite reporting a sharp 96.

Intangible Assets & Valuation Paradigm Shift 2025: How India's Top 500 Companies Are Redefining Market Value Beyond Traditional Metrics—A Deep Dive into Equity Research for Modern Investors

In the rapidly evolving Indian corporate landscape, intangible assets have emerged as pivotal drivers of value creation, fundamentally altering traditional valuation paradigms.

Unlocking the Potential of Generative AI in Personalized Wealth Management: Financial Insights for India 2025

The advent of Generative Artificial Intelligence (GenAI) is poised to revolutionize personalized wealth management in India by 2025.

AI Integration in Equity Research 2025: How 70% of Global Asset Managers Are Transforming Investment Analysis & What Indian Investors Need to Know

In 2025, artificial intelligence (AI) is reshaping equity research globally, with approximately 70% of asset managers adopting AI-driven tools to enhance investment analysis.

Navigating Embedded Lending in India 2025: Unlocking New Opportunities in Digital Credit and Consumer Finance

The embedded lending landscape in India is undergoing a transformative shift, driven by rapid digitalization, evolving consumer behavior, and supportive regulatory frameworks.

ESG Investing in India 2025: How Green Bonds and Climate Finance Are Reshaping Retail Investment Strategies

ESG (Environmental, Social, and Governance) investing has emerged as a transformative force in the Indian financial landscape, reshaping how retail investors and financial professionals approach po...

Small-Cap Momentum Stocks 2025: Russell 2000 Rally & Valuation Discount Opportunity—Which Indian Mid-Caps Offer Similar Upside Potential?

The momentum rally seen in the Russell 2000 Index, a key benchmark for U.

Navigating the Impact of RBI’s New Liquidity Framework and Repo Rate Adjustments on Indian Markets in 2025

The Reserve Bank of India (RBI) has ushered in a new era for Indian financial markets with its revised Liquidity Management Framework (LMF) and a recent adjustment to the policy repo rate in 2025.

Adani Ports Stock Analysis 2025: Record Cargo Volumes & Regulatory Clarity Spark Investor Interest

Adani Ports and Special Economic Zone Ltd (Adani Ports) has emerged as a pivotal player in India's logistics and port infrastructure sector, demonstrating robust growth and resilience amidst evolvi...

Navigating India's Green Bond Surge: Investment Strategies and Market Outlook for 2025

India's green bond market has witnessed an unprecedented surge over recent years, emerging as a pivotal vehicle in financing the country's ambitious transition to a low-carbon and sustainable economy.

Adani Green Energy Stock Analysis 2025: Q3 Earnings Surge & Renewable Expansion Amid India's Clean Energy Push

Adani Green Energy Limited (AGEL) has emerged as a pivotal player in India’s renewable energy sector, capturing investor attention with its robust Q3 FY25 earnings and aggressive expansion plans.

ESG Investing in India 2025: Unlocking Growth Opportunities Through Green Bonds and Sustainable Finance Innovations

ESG investing—focusing on Environmental, Social, and Governance criteria—has rapidly emerged as a key investment theme in India, driven by increasing regulatory mandates, growing retail investor aw...

Infosys Stock Analysis 2025: AI-Led Margin Expansion & Large Order Wins Fueling 10% Stock Surge—What’s Next for India’s Tech Titan?

Infosys Ltd, India’s second-largest IT services company, has been in the spotlight over the past week as its stock surged over 10% in early November 2025, outperforming the broader Nifty IT index.

Deglobalization & the New Investment Playbook: Navigating the Multipolar World of 2025

As we approach 2025, the global economic landscape is undergoing a profound transformation marked by deglobalization—the gradual retreat from the hyper-connected global trade and investment network...

Coal India Stock Analysis 2025: Surging on Delivery Volumes & Power Demand Revival Amid Crude-Led Inflation Relief

Coal India Limited (CIL), the world’s largest coal producer and a Maharatna PSU under the Ministry of Coal, remains a cornerstone of India’s energy infrastructure.

RBI’s 2025 Monetary Policy Unpacked: Impact of Repo Rate Cuts and Liquidity Measures on Indian Markets and Investments

The Reserve Bank of India’s (RBI) monetary policy decisions in 2025 have been pivotal for Indian markets, shaping liquidity conditions, interest rates, and growth trajectories in a year marked by g...

Trent Ltd. Stock Analysis 2025: FII Exit Amid Festive Boom & Shifting Consumer Sentiment—What’s Next for India’s Retail Giant?

Trent Ltd.

RBI Monetary Policy 2025: Decoding Repo Rate Changes and Their Impact on Indian Markets and Inflation Dynamics

The Reserve Bank of India’s (RBI) monetary policy decisions, particularly changes in the repo rate, wield significant influence over the Indian economy, markets, and inflation dynamics.

Bajaj Finance Stock Analysis 2025: Q3 Earnings Beat & Record AUM Growth Amid Rising Retail Credit Demand

Bajaj Finance Limited, a flagship non-banking financial company (NBFC) under the Bajaj Finserv umbrella, continues to capture investor attention with its robust Q3 FY25 earnings and record Assets U...

HDFC Bank Stock Analysis 2025: Q3 Earnings Beat & Credit Growth Momentum Amid Regulatory Clarity

HDFC Bank, India’s largest private sector lender, has once again grabbed headlines with its Q3 FY25 earnings, reporting a net profit of ₹16,736 crore—a 2.

Deglobalization and the New Multipolar World: Investment Strategies for Indian Markets in 2025

The global economic landscape in 2025 is witnessing a marked shift from decades of hyper-globalization to a phase often described as deglobalization, accompanied by the rise of a new multipolar wor...

Nifty50 Equity Research 2025: Analyzing the November Market Dip Amid Global Headwinds & India-US Trade Deal Speculation

The Indian equity market, represented by the Nifty50 index, has entered November 2025 on a cautious note.

Tata Consultancy Services (TCS) Stock Analysis 2025: Q3 Earnings Beat & Strategic AI Expansion Driving Growth

Tata Consultancy Services (TCS), India’s largest IT services company and a bellwether of the Indian IT sector, has once again showcased its resilience and growth potential in its Q3 FY2025 earnings...

From Blackouts to Breakthroughs: How India’s AI-Driven Energy Crunch Is Reshaping Power Investments in 2025

India’s energy sector is undergoing a transformative phase in 2025, driven by the twin forces of an escalating energy crunch and innovative artificial intelligence (AI) applications.

Reliance Industries Stock Analysis 2025: Trending News & Fundamental Review

Reliance Industries Limited (RIL) has emerged as one of the most discussed stocks in November 2025, driven by a combination of exceptional financial performance, strategic partnerships, and ambitious expansion plans across multiple business segments.

RBI Monetary Policy 2025: Navigating Neutral Repo Rates Amid Downward Inflation and Upgraded GDP Forecasts for Strategic Investing

The Reserve Bank of India (RBI) has maintained a neutral stance on monetary policy in 2025, holding the repo rate steady at 5.

Nifty and Sensex Performance 2025: Leveraging Sectoral Rotation and Global Market Influences for Strategic Gains

The year 2025 marks a pivotal phase for Indian equity markets, with the Nifty 50 and BSE Sensex navigating through complex dynamics shaped by sectoral rotations and global market influences.

India's Economic Pulse 2025: Unraveling GDP Growth, Inflation, and Employment Trends for Informed Investment Decisions

India's economy in 2025 stands at a pivotal juncture, characterized by robust GDP growth, moderated inflation, and evolving employment trends that collectively shape the investment landscape.

Nifty and Sensex 2025: Tactical Sector Rotation to Maximize Returns Amid Market Volatility

As we advance into 2025, the Indian equity markets represented by the Nifty 50 and BSE Sensex continue to navigate a complex environment marked by heightened volatility, geopolitical tensions, and ...

Tax-Smart ELSS Funds 2025: Section 80C Champions with 10-Year Return Comparisons for Indian Investors

Equity-Linked Savings Schemes (ELSS) have long been a cornerstone of tax planning for Indian investors seeking to optimize their tax liability under Section 80C of the Income Tax Act.

IT Sector Outlook 2025: Navigating AI Adoption, Cloud Migration, and Margin Pressures for Sustainable Growth

India’s IT sector is at a pivotal juncture in 2025, shaped by rapid AI adoption, accelerating cloud migration, and persistent margin pressures.

Moving Average Crossover Strategies 2025: Mastering SMA & EMA for Reliable Trend Following in Indian Markets

In the dynamic landscape of Indian financial markets, mastering technical tools for reliable trend identification is crucial for retail investors and financial professionals alike.

Banking Sector Trends 2025: Credit Growth Challenges and NPA Management Strategies

The Indian banking sector in 2025 stands at a critical juncture characterized by evolving credit growth dynamics, asset quality challenges, and strategic shifts in non-performing asset (NPA) manage...

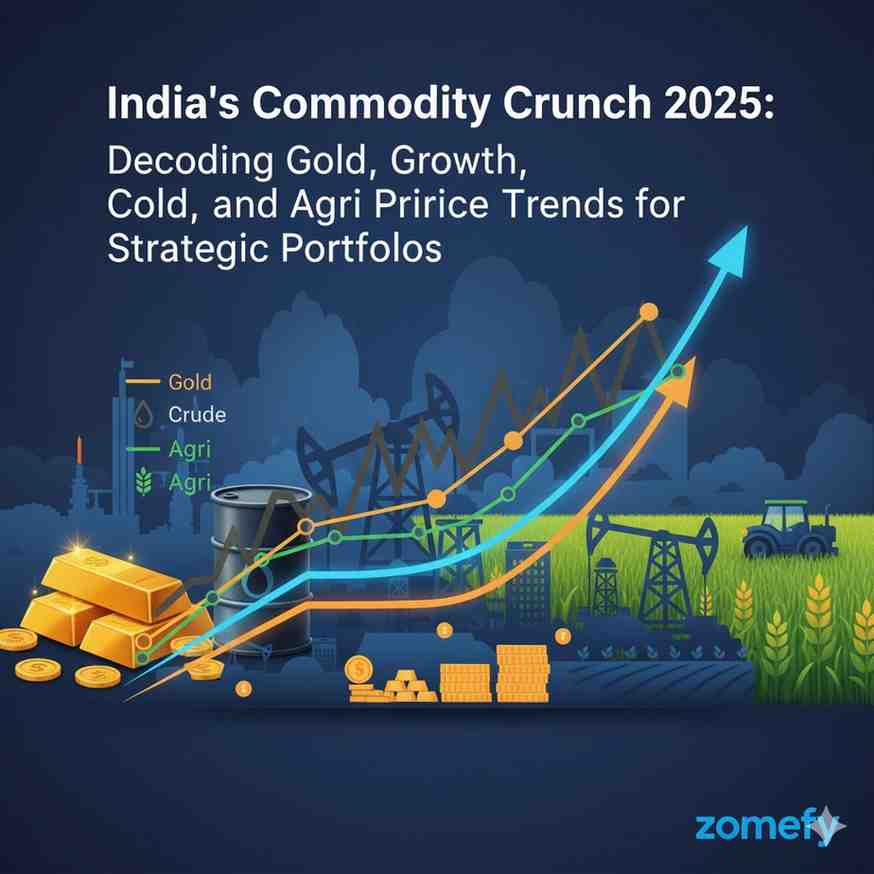

India’s Commodity Crunch 2025: Decoding Gold, Crude, and Agri Price Trends for Strategic Portfolios

India’s commodity markets are at a pivotal juncture in 2025, shaped by global economic shifts, domestic policy dynamics, and evolving investor behavior.

Mid Cap Momentum 2025: Identifying High-Growth, Risk-Adjusted Mutual Funds for Indian Investors

In the evolving landscape of Indian equity markets, mid-cap mutual funds have emerged as a compelling investment avenue for retail investors and financial professionals alike.

India's Economic Transformation 2025: Unpacking GST Revisions and Their Impact on Auto and Consumer Sectors

India’s economic landscape is undergoing a profound transformation in 2025, driven by landmark reforms to the Goods and Services Tax (GST) regime.

Large Cap Leaders 2025: Decoding the 10-Year Consistency of India’s Top Bluechip Funds

Indian retail investors and financial professionals often seek stable and consistent returns from their investments, particularly in the large-cap segment.

Sectoral Rotation Strategies for Indian Markets 2025: Capitalizing on IT, Pharma, and Infrastructure Cycles

In 2025, Indian markets are poised at a pivotal juncture characterized by evolving economic cycles, robust policy support, and heightened retail participation.

India's Economic Resilience in 2025: Unpacking GDP Growth, Inflation, and Employment Trends

India’s economic landscape in 2025 reflects a complex interplay of resilience and challenges amid a shifting global and domestic environment.

RBI Monetary Policy 2025: How Repo Rate Decisions Will Shape Inflation and Liquidity in India

In October 2025, the Reserve Bank of India (RBI) maintained its key repo rate at 5.

Nifty and Sensex Outlook 2025: Navigating Sectoral Rotation Strategies Amidst Market Volatility

The Indian equity markets, represented by the Nifty 50 and the BSE Sensex, have demonstrated remarkable resilience and dynamism amidst a backdrop of global uncertainties and domestic economic reforms.

Unlocking Investment Potential in 2025: A Beginner's Guide to ETFs and Index Funds in India

As Indian retail investors increasingly seek efficient, cost-effective ways to build wealth, Exchange-Traded Funds (ETFs) and index funds have emerged as powerful tools to unlock investment potenti...

Silver’s Industrial Supercycle: EVs, Solar and India’s 2025 Price Boom

Why silver is surging to record highs in 2025: India’s EV and solar buildout, global supply deficits, and rising investment demand are driving a potential multi‑year supercycle.

Harnessing AI for Growth: Opportunities and Risks in Financial Services 2025

Explore how AI-driven technologies are reshaping risk management, customer service, and compliance across the financial sector, highlighting both innovations and regulatory safeguards.

The Rise of Digital-Only Banking: How Fintechs are Changing Consumer Finance

Detail the rapid shift toward branchless, digital banking institutions, focusing on benefits, security innovations, and the future of retail banking.

Tokenized Assets: Democratizing Investment and Wealth Creation

Explore how asset tokenization is making fractional ownership possible for real estate, art, and private equity, transforming access for a broader range of investors.

Real-Time Payments: The 5G Revolution in Financial Transactions

Detail how 5G technology is turbocharging peer-to-peer, cross-border, and in-store payments, making financial exchanges instant, seamless, and more secure.

RegTech's Rise: Automating Compliance and Fighting Financial Crime

Examine the adoption of regulatory technology by financial companies to simplify compliance, reduce risks, and respond to global regulatory demands faster and smarter.

Challenger Banks: Expanding Beyond Borders and Products

Assess how digital-first challenger banks are broadening their product lines and launching in new markets despite regulatory and competitive hurdles.

Quantum Computing: The Next Frontier for Financial Security and Analytics

Discuss how emerging quantum technology may revolutionize risk modeling, transaction security, and investment strategies in global financial markets.

Risk Management for Technical Traders: Position Sizing & Stop-Loss Strategies