India's Economic Transformation 2025: Unpacking GST Revisions and Their Impact on Auto and Consumer Sectors

India’s economic landscape is undergoing a profound transformation in 2025, driven by landmark reforms to the Goods and Services Tax (GST) regime.

India's Economic Transformation 2025: Unpacking GST Revisions and Their Impact on Auto and Consumer Sectors

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

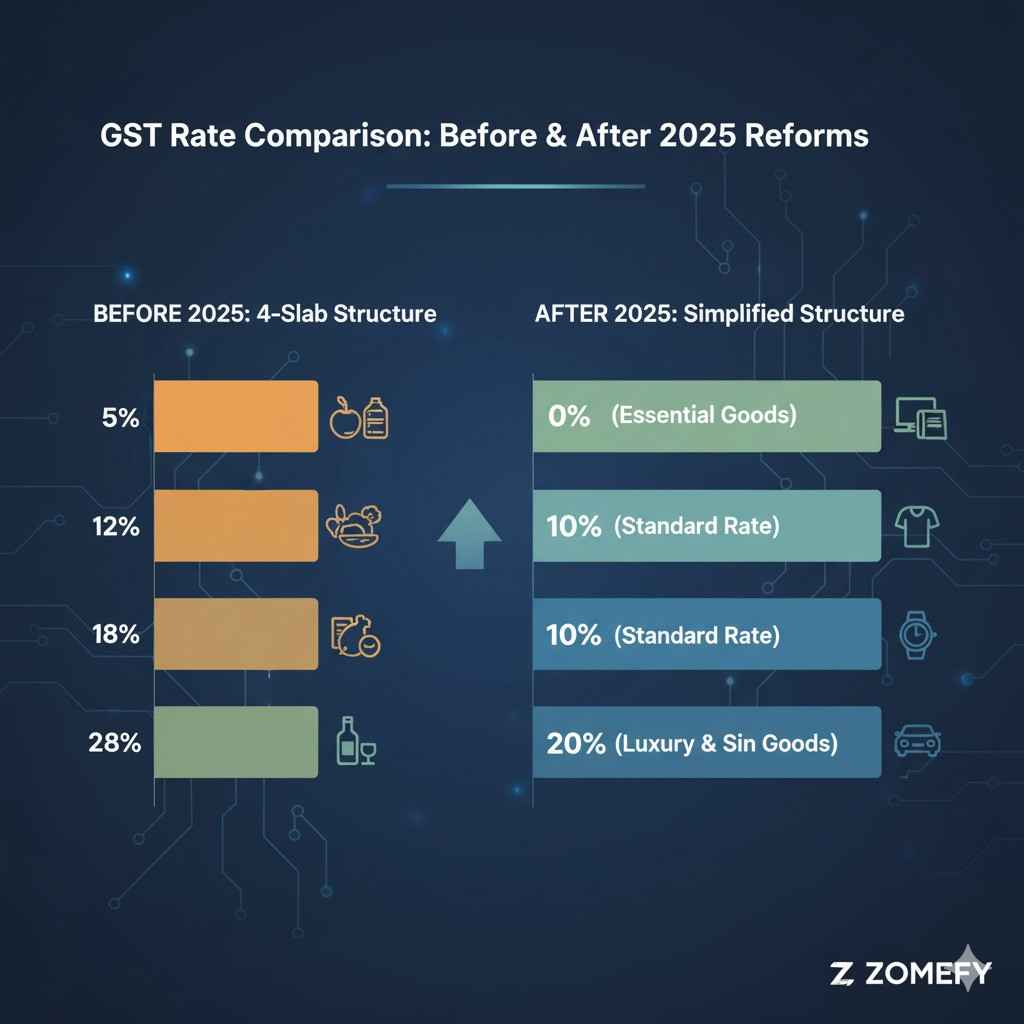

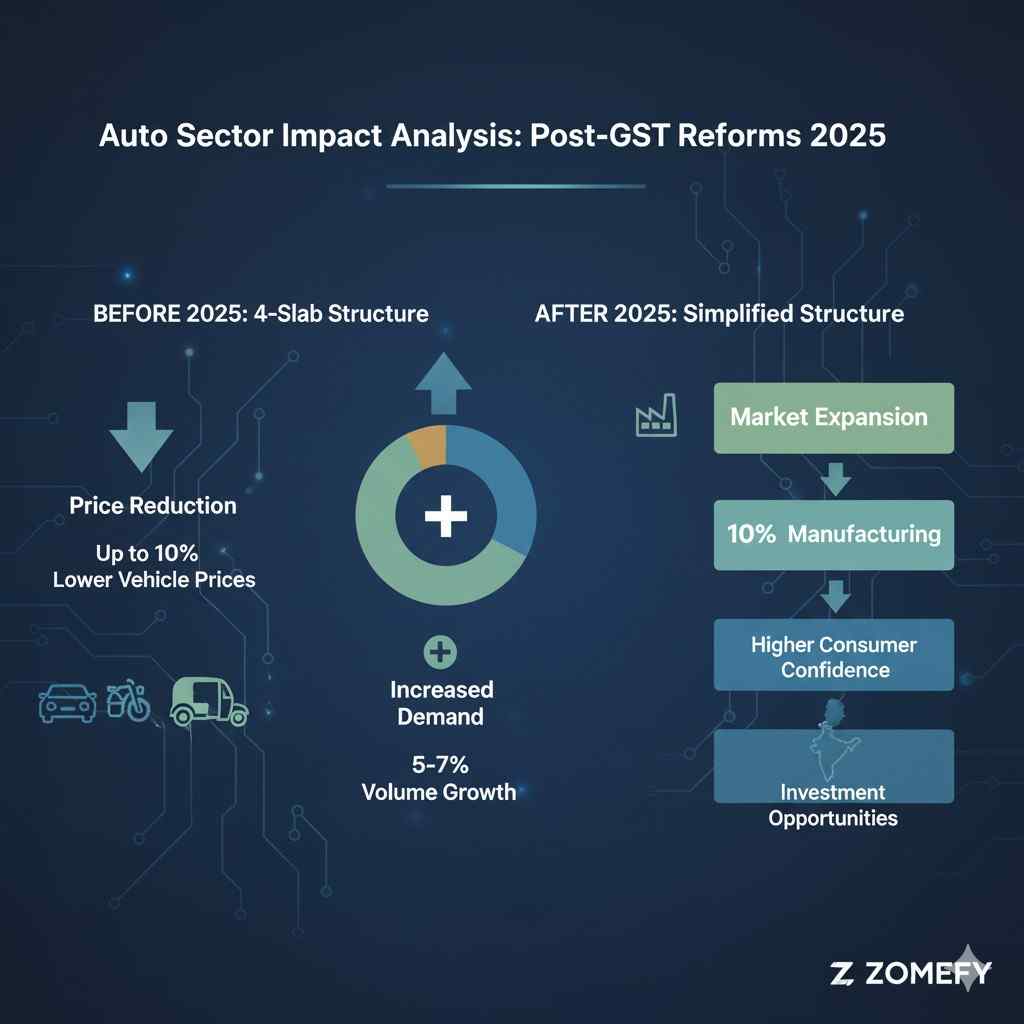

India’s economic landscape is undergoing a profound transformation in 2025, driven by landmark reforms to the Goods and Services Tax (GST) regime. The GST Council’s 56th meeting in September 2025 has ushered in a new era of tax rationalization, particularly for the automobile and consumer sectors—two of the economy’s most dynamic growth engines. With the implementation of ‘GST 2.0’ from September 22, 2025, the government has collapsed the previous four-slab structure into a simplified two-slab system (5% and 18%), while introducing a 40% ‘de-merit’ slab for select luxury and environmentally unfriendly goods[2][4]. For the auto sector, this means mass-market vehicles and components now attract an 18% GST rate (down from 28–31%), electric vehicles (EVs) remain at 5%, and luxury cars/SUVs move to 40% with the abolition of the compensation cess[1][4][6]. These changes are expected to reduce prices for small cars, two-wheelers, and commercial vehicles by over 10%, directly boosting affordability and consumer demand[1][5]. For investors and financial professionals, understanding the nuances of these reforms—how they impact company valuations, sectoral growth, and consumer behavior—is critical to identifying opportunities and managing risks in a rapidly evolving market. This article unpacks the GST revisions, quantifies their impact, and offers actionable strategies for navigating India’s economic transformation in 2025.

GST 2.0: What Changed and Why It Matters

The GST Council's September 2025 overhaul represents the most significant tax rationalization since the original GST rollout in 2017. The new structure simplifies compliance, resolves classification disputes, and aims to stimulate growth in key sectors[3][4]. Here's what changed:

Key Data Points and Market Examples

The GST 2.0 reforms have immediate, measurable impacts on vehicle pricing and sector dynamics:

Sectoral Impact: Auto, Ancillaries, and Consumer Durables

The GST revisions have far-reaching implications beyond the auto OEMs, touching ancillaries, consumer durables, and the broader economy.

Case Study: Maruti Suzuki and the Mass Market

Maruti Suzuki, India’s largest carmaker, is a prime beneficiary of GST 2.0. With over 50% market share in passenger vehicles, the company’s volume-driven model aligns perfectly with the new tax regime. Models like the Alto, Swift, Wagon R, and Baleno—all falling under the 18% GST slab—could see a 10%+ reduction in ex-showroom prices, making them even more accessible to first-time buyers and upgraders[1][4].

Maruti’s extensive rural and semi-urban dealership network positions it to capture incremental demand from price-sensitive segments. Furthermore, the company’s partnership with Toyota for hybrid technology and its investments in CNG variants provide additional growth levers in a market prioritizing affordability and cleaner fuels.

Luxury, Premium, and EV Segments: A Mixed Bag

The GST revisions have differentiated impacts across vehicle segments:

Investment Strategies for the Luxury and EV Space

For investors eyeing the luxury and EV segments, consider the following:

Practical Implications for Retail Investors and Financial Professionals

The GST 2.0 reforms present both opportunities and challenges for investors. Here’s how to navigate them:

Regulatory and Tax Compliance Considerations

Financial professionals must guide clients through the transition:

Conclusion and Forward Look

India’s GST 2.0 reforms mark a decisive shift toward a simpler, more growth-oriented tax regime. For the auto and consumer sectors, the changes are transformative—reducing prices, boosting volumes, and supporting job creation across the value chain[1][5]. Retail investors and financial professionals must stay attuned to pricing actions, volume trends, and regulatory updates to capitalize on this new phase of economic transformation.

- Mass-market autos and components are clear winners, with 10%+ price reductions driving volume growth and market expansion. - Luxury vehicles see a net tax reduction due to cess abolition, but effective communication of pricing benefits is essential. - EVs retain their concessional 5% rate, supporting India’s clean mobility goals and benefiting companies with credible EV strategies. - Ancillaries and MSMEs stand to gain from simplified compliance and higher demand, with positive spillovers into employment and credit growth[5]. - Risks remain from global supply chains, commodity prices, and state-level charges, requiring active portfolio management.

Continue Your Investment Journey

Discover more insights that match your interests

Zepto's 2025 Quick Commerce Boom: Unit Economics and Path to $10B Valuation

Imagine ordering your evening groceries and having them at your doorstep in just 10 minutes – that's the magic Zepto has woven into the lives of millions of urban Indians.

RBI’s 2025 Monetary Policy Impact: How Repo Rate Adjustments and Liquidity Measures Are Shaping India’s Investment Landscape

The Reserve Bank of India's (RBI) monetary policy in 2025 is a pivotal force shaping India's economic and investment landscape.

Federal Bitcoin Reserve 2025: Implications for Indian Investors

The Federal Bitcoin Reserve (FBR) initiative, anticipated to be operational by 2025 following recent U.

India's Domestic Consumption Boom and Premiumization Trend: How Retail Investors Can Capitalize on the Consumer Discretionary Sector's 17% Growth Potential in 2025

India’s domestic consumption landscape is undergoing a transformative boom, driven by rising incomes, favorable demographics, and evolving consumer preferences.

Explore More Insights

Continue your financial education journey