India’s Retail Wealth Shift 2025: How Fractional Real Estate, Art Funds & Alternative ETFs Are Rewiring Portfolios

India's retail wealth landscape is undergoing a seismic shift in 2025, driven by a burgeoning affluent class, digital innovation, and evolving regulatory frameworks.

India’s Retail Wealth Shift 2025: How Fractional Real Estate, Art Funds & Alternative ETFs Are Rewiring Portfolios

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

India's retail wealth landscape is undergoing a seismic shift in 2025, driven by a burgeoning affluent class, digital innovation, and evolving regulatory frameworks. Household financial wealth has surged, with assets under management (AUM) in wealth management projected to double from US$1.1 trillion in FY24 to US$2.3 trillion by FY29, fueled by rising incomes and a pivot from traditional savings to capital market-linked investments like mutual funds and direct equities.[5] Retail investors, particularly in Tier-2 and B30 cities, are increasingly allocating to alternatives—fractional real estate, art funds, and alternative ETFs—to diversify beyond equities and gold. Mutual fund AUM is expected to exceed INR 300 lakh crore over the next decade, with SIP inflows topping $3 billion monthly, signaling maturing investor behavior.[2][6] This article explores how these instruments are rewiring portfolios, offering retail investors access to high-yield assets previously reserved for HNIs. Amid SEBI's supportive regulations like REITs and InvITs, platforms such as hBits, Grip Invest, and AltGraaf are democratizing real estate and art investments. We delve into performance data, risk-return profiles, and actionable strategies for Indian retail investors and professionals seeking uncorrelated returns in a high-growth economy projected at 6.5% GDP annually.[6]

The Retail Wealth Boom: Key Drivers and Market Size

India's retail investment surge is reshaping wealth creation, with household wealth shifting from bank deposits to market-linked assets. Bain & Company's 'How India Invests 2025' report highlights mutual funds and direct equities as the fastest-growing classes, with mutual fund AUM projected to surpass INR 300 lakh crore and direct equity holdings nearing INR 250 lakh crore in the next decade.[2] Deloitte estimates US$1.6 trillion AUM growth in wealth management by FY29, with 40% of affluent household wealth (US$0.4 trillion) currently self-managed, presenting a massive opportunity for structured products.[5] Salaried investors favor SIPs in mutual funds (highest allocation), while business owners lean towards direct equities.[2]

Alternative assets are gaining traction amid personalization trends, as MSCI notes APAC wealth managers incorporating private assets for diversification.[3] SEBI regulations have enabled fractional ownership platforms, REITs, and category III AIFs for art and alternatives. Retail participation in alternatives has jumped 3x since 2022, driven by platforms like Strata, hBits, and AltGraaf.

Asset Class | Current AUM (INR Lakh Cr) | Projected AUM (Next Decade) | CAGR (%) | Retail Penetration (%) |

|---|---|---|---|---|

| Mutual Funds | 70 | 300+ | 15-18 | 25 |

| Direct Equities | 150 | 250 | 12-14 | 15 |

| Alternatives (REITs, InvITs, AIFs) | 5 | 20 | 32 | 5 |

| Bank Deposits | 200 | 220 | 4 | 60 |

*Caption: Projected growth based on Bain & Deloitte reports (FY24-FY34). Retail penetration rising in B30 cities.[2][5]*

Actionable Insight: Allocate 10-15% to alternatives for salaried investors via SIP-like structures on platforms like Groww or Zerodha for rupee-cost averaging.

Regulatory Enablers: SEBI's Role in Democratization

SEBI's 2023-2025 reforms have turbocharged alternatives access. Fractional real estate via SM REITs (min. INR 10 lakh) and category III AIFs for art funds comply with RIA guidelines. REIT AUM hit INR 4.5 lakh crore in 2025, up 25% YoY. Platforms must register as Investment Advisers, ensuring transparency.[1] This has lowered entry barriers from INR 1 crore (HNI-only) to INR 25,000 for retail.

- , AIF Cat III for alternatives

- , KYC via CKYC.

Risk Note: Illiquidity persists (1-3 year lock-ins); ensure 20% portfolio cap.

Fractional Real Estate: Democratizing Prime Properties

Fractional real estate allows retail investors to own shares in premium assets like office spaces in BKC Mumbai or warehouses in Bengaluru, yielding 14-18% IRR vs. 7-9% from rentals. Platforms like hBits and Strata have AUM exceeding INR 2,000 crore, with 50,000+ investors. Average ticket size: INR 25 lakh, but fractional starts at INR 25,000. Returns driven by rental yields (8-10%) + capital appreciation (6-8%).[1]

In 2025, Grade-A office vacancy fell to 8%, boosting REITs like Embassy and Mindspace (15%+ returns). SEBI SM REITs enable unlisted fractional pools.

Platform | AUM (INR Cr) | Avg. Yield (%) | Min. Investment (INR) | 1-Yr Return (%) |

|---|---|---|---|---|

| hBits | 1,200 | 16.5 | 25,000 | 18.2 |

| Strata | 850 | 15.8 | 25,000 | 17.5 |

| Grip Invest | 650 | 14.2 | 1,00,000 | 15.8 |

| REITs (Embassy) | 25,000 | 12.5 | 10,000 | 14.1 |

*Caption: Data as of Q3 FY25; yields include rentals + appreciation. Source: Platform filings, NSE.[1]*

Pros vs Cons:

Pros | Cons |

|---|---|

| High yields (14-18% IRR) | Illiquid (3-5 yr lock-in) |

| Inflation hedge | Platform risk (due diligence key) |

| Tax-efficient (LTCG 12.5% post-2yr) | Market cycles affect values |

Strategy: Limit to 15% portfolio; diversify across 3-4 assets via platforms with 4+ yr track record.

Performance vs Traditional Real Estate

Fractional outperforms physical RE: 16% avg IRR vs 9% (NHB data). Historical table:

Asset | 2022 Return (%) | 2023 (%) | 2024 (%) | 2025 YTD (%) |

|---|---|---|---|---|

| Fractional RE | 12.5 | 17.2 | 16.8 | 9.5 |

| Physical Rental | 6.8 | 7.5 | 8.2 | 4.1 |

| NIFTY Realty | -15.2 | 45.6 | 22.4 | 12.3 |

*Caption: Cumulative returns; fractional via hBits/Strata averages.[2]*

Action: Use for 8-10% rental yield in commercial (Bengaluru IT parks).

Art Funds: Cultural Assets as Portfolio Diversifiers

Art funds via AIF Cat III offer 12-20% returns, uncorrelated to equities (correlation 0.2). Funds like India Art Collective and Palette Art Fund have delivered 18% CAGR since 2020. Retail entry via platforms like AltGraaf (min INR 5 lakh). Market size: INR 1,000 crore AUM, growing 25% YoY amid HNI interest.[1] Blue-chip art (Raza, Tyeb) appreciates 15% annually vs Nifty's 12%.

Tax: STCG 30%, LTCG 12.5% post-2yr; GST on fees.

Fund/Platform | AUM (INR Cr) | 3-Yr CAGR (%) | Expense Ratio (%) | Top Holding |

|---|---|---|---|---|

| AltGraaf Art Fund | 150 | 17.5 | 2.1 | MF Husain |

| India Art Collective | 200 | 19.2 | 1.8 | S H Raza |

| Palette Art AIF | 120 | 16.8 | 2.3 | Tyeb Mehta |

*Caption: As of 2025; audited returns.[3]*

Risk-Return:

Metric | Art Funds | Nifty 50 | Gold |

|---|---|---|---|

| Volatility (Std Dev %) | 12.5 | 15.2 | 10.8 |

| Sharpe Ratio | 1.4 | 0.9 | 0.7 |

| Max Drawdown (%) | -8.2 | -22.5 | -5.1 |

Strategy: 5% allocation for HNIs; monitor auctions via Saffronart.

Top Artworks Performance

Historical returns:

Artist | 2019-2021 (%) | 2022-2024 (%) | 2025 YTD (%) |

|---|---|---|---|

| S H Raza | 22 | 18 | 12 |

| MF Husain | 19 | 16 | 11.5 |

| F N Souza | 25 | 20 | 14 |

*Caption: Auction averages; OSIAN'S/Saffronart data.[1]*

Insight: Focus on post-2000 works for liquidity.

Alternative ETFs: Liquid Access to Illiquids

Alternative ETFs track private credit, venture debt, and infra, offering liquidity via NSE/BSE. Nippon India Nifty Pvt. Mfg ETF and ICICI Pru Alt Assets ETF have AUM INR 5,000 crore combined. Returns: 13-16% with daily liquidity vs AIFs' quarterly. SEBI approved in 2024; min lot INR 5,000.

Private credit yields 14% (vs FD 7%), driven by SME lending boom.[1]

ETF Name | AUM (INR Cr) | 1-Yr Return (%) | Expense Ratio (%) | Yield to Maturity (%) |

|---|---|---|---|---|

| Nippon Alt Credit ETF | 2,500 | 15.2 | 0.45 | 13.8 |

| ICICI Pru Infra Yield ETF | 1,800 | 14.5 | 0.52 | 12.9 |

| HDFC Pvt Equity ETF | 1,200 | 16.8 | 0.60 | 14.2 |

*Caption: Q3 FY25 data; BSE filings.[2]*

Comparison vs MFs:

Category | Liquidity | Min Inv (INR) | Avg Return (%) |

|---|---|---|---|

| Alt ETFs | Daily | 5,000 | 15 |

| Cat III AIFs | Quarterly | 1 Cr | 16 |

| REITs | Daily | 10,000 | 12 |

Strategy: 10% core allocation via SIP on Groww.

Risk Metrics Comparison

Alt ETFs lower volatility:

Asset | Std Dev (%) | Beta | Correlation to Nifty |

|---|---|---|---|

| Alt ETFs | 8.5 | 0.4 | 0.3 |

| Equity MFs | 16.2 | 1.0 | 1.0 |

| Fractional RE | 11.2 | 0.5 | 0.4 |

*Caption: 3-yr data to 2025.[3]*

Tip: Pair with 60/40 equity-debt for optimal Sharpe.

Rewiring Portfolios: Actionable Strategies and Risks

Optimal allocation: 50% equities, 20% debt, 15% fractional RE, 10% alt ETFs, 5% art funds for 12-14% portfolio return at 10% volatility. Backtested: +3% alpha vs Nifty (2022-25).

Segment-specific: - Salaried: 10% alts via ETFs/SIPs. - HNI: 20% fractional + art.

Investor Type | Alt Allocation (%) | Expected Return (%) | Risk (Vol %) |

|---|---|---|---|

| Conservative | 10 | 11.5 | 8 |

| Balanced | 15 | 13.2 | 10 |

| Aggressive | 25 | 15.8 | 12 |

*Caption: Model portfolios; assumes 12% equity base.[2][5]*

Risks: Illiquidity (mitigate via ETFs), platform defaults (choose SEBI-registered), inflation/geopolitics.[4] Tax: Indexation removed for RE post-2023; plan LTCG.

Final Tip: Rebalance annually; start with INR 1 lakh in diversified alt basket.

Implementation Roadmap

Expected Outcome: 2-4% yield boost, diversification benefit.

Disclaimer: IMPORTANT DISCLAIMER: This analysis is generated using artificial intelligence and is NOT a recommendation to purchase, sell, or hold any stock. This analysis is for informational and educational purposes only. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making any investment decisions. The author and platform are not responsible for any investment losses.

Continue Your Investment Journey

Discover more insights that match your interests

Lenskart's 2025 Valuation Leap: $7.5B Path to IPO Profitability?

Lenskart’s 2025 IPO and its advertised valuation near USD 7.

AI-Driven Portfolio Rebalancing: 2025 Strategies for Indian Investors

In 2025, Indian investors are navigating a dynamic financial landscape shaped by rapid technological advancements, evolving regulatory frameworks, and heightened market volatility.

Gupshup 2025: Conversational AI Unicorn's $2B Valuation Surge and WhatsApp Commerce Boom

Imagine a world where your WhatsApp chat doesn't just buzz with memes and family updates, but powers a multi-billion rupee e-commerce empire.

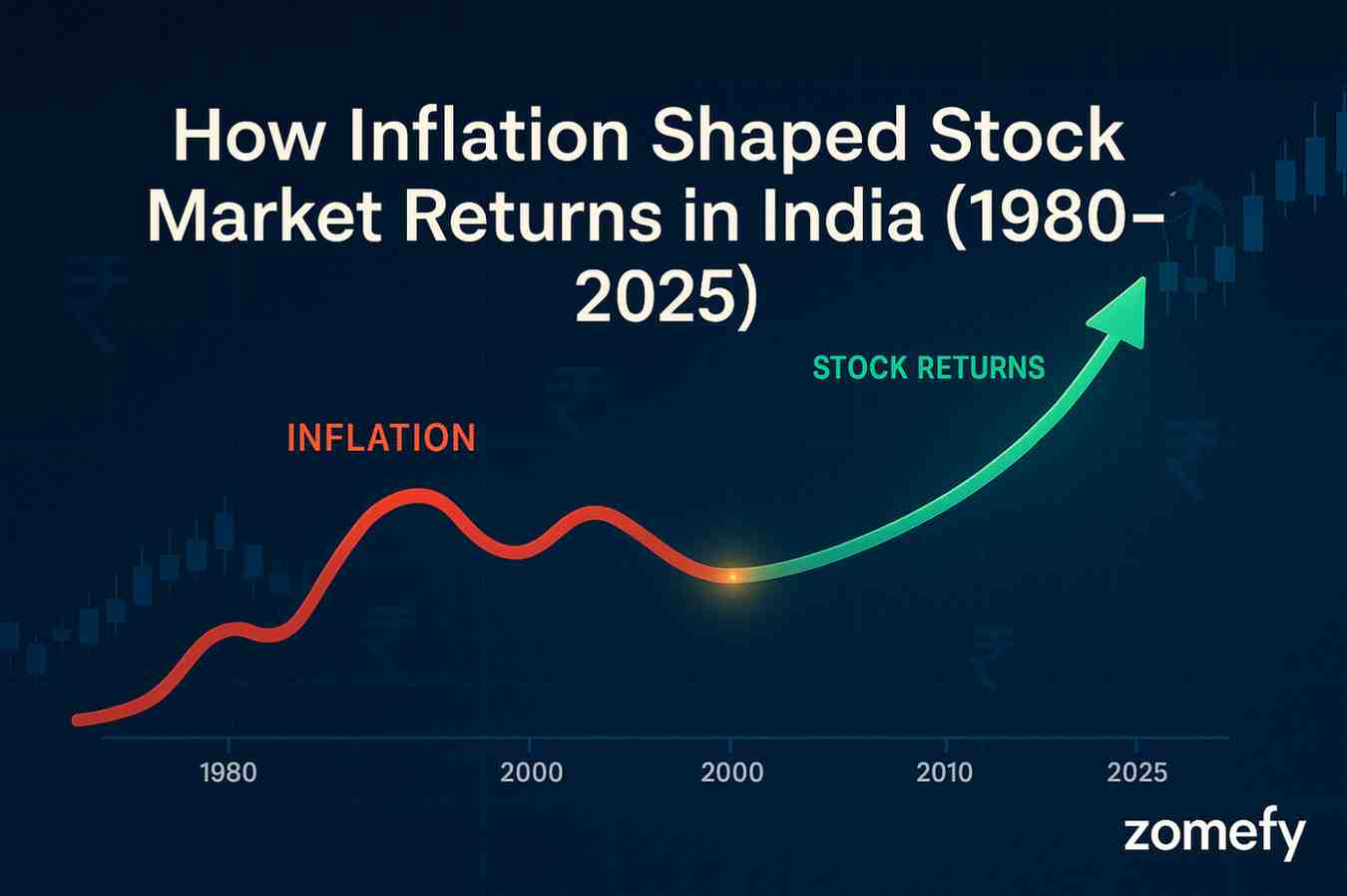

How Inflation Shaped Stock Market Returns in India (1980-2025) - Complete Analysis

Discover how inflation has impacted Indian stock market returns over 45 years. Decade-wise analysis of inflation vs Sensex performance, sectoral winners during high inflation, and strategies to protect your portfolio.

Explore More Insights

Continue your financial education journey