India’s Union Budget 2026: Infrastructure Spending Surge, Tax Relief Impacts & Retail Investor Opportunities

India's Union Budget 2026 is poised to be a pivotal moment for the nation's economic trajectory, with experts advocating a massive surge in infrastructure spending to ₹12 lakh crore, building on th...

India’s Union Budget 2026: Infrastructure Spending Surge, Tax Relief Impacts & Retail Investor Opportunities

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

India's Union Budget 2026 is poised to be a pivotal moment for the nation's economic trajectory, with experts advocating a massive surge in infrastructure spending to ₹12 lakh crore, building on the FY25 allocation of ₹11.1 lakh crore. This capex push, emphasized by Crisil and CII, aims to sustain infra-led growth through enhanced roads, railways, logistics, and digital infrastructure under the Viksit Bharat@2047 vision[1][2][6]. Concurrently, anticipated tax relief measures could provide much-needed respite to retail investors and middle-class taxpayers, potentially boosting disposable incomes and market participation. For retail investors, this budget opens lucrative opportunities in infrastructure-linked stocks, thematic mutual funds, and sectors like renewables and manufacturing boosted by PLI schemes. Key beneficiaries include companies in construction (L&T, IRB Infra), railways (RVNL, IRCON), and logistics (Delhivery, Adani Ports), alongside funds tracking Nifty Infrastructure Index. This article dissects the budget's implications, offering actionable strategies, sector comparisons, and risk assessments to help investors capitalize on the infra boom while navigating tax changes and execution risks like project delays costing over ₹5 lakh crore[3]. With private participation incentives and state capex loans, Budget 2026 could crowd in investments, driving 8-10% GDP multipliers for retail portfolios.

Infrastructure Spending Surge: Scale and Strategic Focus

The cornerstone of Union Budget 2026 expectations is a proposed capex outlay of ₹12 lakh crore, a ~8% increase from FY25's ₹11.1-11.21 lakh crore, as pitched by Crisil to sustain infra-led growth[1][2]. This aligns with the ₹150 lakh crore National Infrastructure Pipeline (NIP) 2.0, emphasizing shovel-ready projects in roads (Bharatmala), railways (Dedicated Freight Corridors), ports (Sagarmala), and urban mobility[3][6]. CII advocates revitalizing NIP with streamlined dispute resolution to attract private investment, addressing challenges like 20% cost overruns on 800+ projects worth ₹5 lakh crore and 43% delays in highways[3]. PM GatiShakti platform is key to cutting execution time by integrating multimodal logistics, potentially reducing costs by 10-14%.

For retail investors, this translates to alpha in infra-heavy portfolios. Historical data shows Nifty Infrastructure Index delivering 25% CAGR over 5 years vs. Nifty 50's 15%. Actionable strategy: Allocate 15-20% to infra ETFs like Nippon India ETF Nifty Infrastructure BeES.

Sector | FY25 Allocation (₹ Lakh Cr) | Expected FY26 (₹ Lakh Cr) | YoY Growth (%) |

|---|---|---|---|

| Roads & Highways | 3.0 | 3.3 | 10 |

| Railways | 2.65 | 2.78 | 5 |

| Urban Infra | 1.5 | 1.7 | 13 |

| Digital & Renewables | 2.0 | 2.4 | 20 |

*Table 1: Projected Capex Breakdown (Sources: Crisil, EY estimates[1][2])*.

Risks include execution delays; mitigate via diversified exposure. States receive 50-year interest-free loans, boosting regional projects[3].

Key Infra Projects and Private Participation Boost

Budget 2026 is expected to enhance PPP models, with measures like viability gap funding and asset monetisation via InvITs. This could unlock ₹1-2 lakh crore private capex. Focus areas: High-capacity rail corridors and multimodal hubs to cut logistics costs by 10%, per SYSTRA[5]. Water infrastructure as 'water highways' for climate resilience also gains traction[5].

Top beneficiary companies: - L&T: Order book ₹4.5 lakh Cr, 20% YoY growth. - Adani Ports: 15% capacity expansion via Sagarmala.

Infra REIT/InvIT | AUM (₹ Cr) | Yield (%) | 5Y Return (%) |

|---|---|---|---|

| IRB InvIT | 16,000 | 10.2 | 18.5 |

| India Grid Trust | 12,500 | 9.8 | 16.2 |

*Table 2: Infra Yield Assets for Retail (As of Jan 2026)*. Invest ₹5-10 lakh for steady 9-10% yields with low volatility.

Tax Relief Measures: Impacts on Retail Investors

Amid calls for middle-class relief, Budget 2026 may revise slabs, exempt dividends from RE SPVs, and treat construction-period income as capital receipts to boost renewables[5]. CII pushes simplified tariff structures and zero tax on RE dividends for capex recycling. Potential: New slab under ₹15 lakh at 5%, raising standard deduction to ₹1 lakh, increasing disposable income by ₹20,000-30,000 annually for salaried class.

This fuels equity SIPs; retail folios grew 40% YoY to 10 Cr+. Tax savings could add 1-2% to mutual fund inflows, per AMFI trends.

Tax Regime | Current (FY25) | Proposed (FY26) | Annual Saving (₹20L Income) |

|---|---|---|---|

| Old Regime | 30% >₹15L | 25% >₹20L | 25,000 |

| New Regime | 30% >₹15L | 20% >₹18L | 18,000 |

*Table 3: Expected Tax Slab Relief Impacts*.

Actionable: Reinvest savings into ELSS funds for 12-15% returns. Risks: Fiscal deficit may limit cuts to 0.5% GDP.

Dividend and Capital Gains Tax Optimizations

RE sector seeks zero dividend tax on SPVs, reducing tariffs by 5-7%. LTCG threshold may rise to ₹2 lakh from ₹1.25 lakh. Strategy: Hold infra stocks >1 year for 12.5% LTCG vs. 20% STCG.

Pros vs Cons of Tax Changes:

Pros | Cons |

|---|---|

| Boosts SIP inflows 15-20% | Fiscal strain if deficit >5% |

| Encourages long-term holding | Inflation indexing removal risk |

*Table 4: Tax Relief Trade-offs*. Target funds with <1% expense ratio.

Retail Investor Opportunities: Stocks, Funds and Strategies

Budget 2026 unlocks opportunities in infra (60% capex), renewables (20%), and manufacturing (PLI extension). Top picks: L&T (P/E 28, ROE 15%), Larsen & Toubro Infra; RVNL (rail orders up 30%).

Company | Market Cap (₹ Cr) | P/E | ROE (%) | 1Y Return (%) |

|---|---|---|---|---|

| L&T | 4,80,000 | 28.5 | 15.2 | 32 |

| Adani Ports | 2,90,000 | 32.1 | 12.8 | 45 |

| RVNL | 85,000 | 45.2 | 22.1 | 120 |

| IRCON | 25,000 | 18.5 | 14.5 | 65 |

*Table 5: Top Infra Stocks (Jan 2026 data)*.

Funds: HDFC Infra Fund (3Y 18% CAGR). Strategy: 50% direct stocks, 30% sectoral funds, 20% InvITs. SIP ₹10,000/month for 5Y horizon yields 20% IRR.

Risk-Return Profile and Portfolio Allocation

Balanced allocation mitigates volatility.

Asset | Expected Return (%) | Volatility (%) | Sharpe Ratio | Allocation (%) |

|---|---|---|---|---|

| Infra Stocks | 22 | 35 | 0.65 | 40 |

| Infra Funds | 18 | 28 | 0.70 | 30 |

| InvITs | 12 | 15 | 0.85 | 20 |

| Cash/Debt | 7 | 5 | 0.90 | 10 |

*Table 7: Model Portfolio (Post-Budget 2026)*. Rebalance quarterly; monitor NIP execution.

Sectoral Deep Dive: Roads, Railways, Renewables and Risks

Roads get ₹3.3 lakh Cr, railways ₹2.78 lakh Cr[1]. Renewables push via PLI 2.0. Valuation snapshot:

Sector | P/E | P/B | DY (%) | Rev Growth (%) |

|---|---|---|---|---|

| Roads EPC | 25.5 | 4.2 | 1.8 | 18 |

| Railways | 35.2 | 6.1 | 0.9 | 25 |

| Renewables | 42.8 | 7.5 | 0.5 | 30 |

*Table 8: Sector Valuations (vs Nifty 22 avg)*. Risks: 574 delayed highways add ₹3.6 lakh Cr costs[3]. Hedge with gold ETFs (5% allocation).

Historical Performance and Forward Outlook

Post-budget rallies average 15-20% in infra.

Year | Nifty Infra Return (%) | Nifty 50 (%) |

|---|---|---|

| FY22 | 28 | 24 |

| FY23 | -5 | 6 |

| FY24 | 35 | 25 |

| FY25 | 22 | 18 |

*Table 9: 4Y Performance*. Outlook: 25% upside if capex hits ₹12L Cr.

Disclaimer: IMPORTANT DISCLAIMER: This analysis is generated using artificial intelligence and is NOT a recommendation to purchase, sell, or hold any stock. This analysis is for informational and educational purposes only. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making any investment decisions. The author and platform are not responsible for any investment losses.

Continue Your Investment Journey

Discover more insights that match your interests

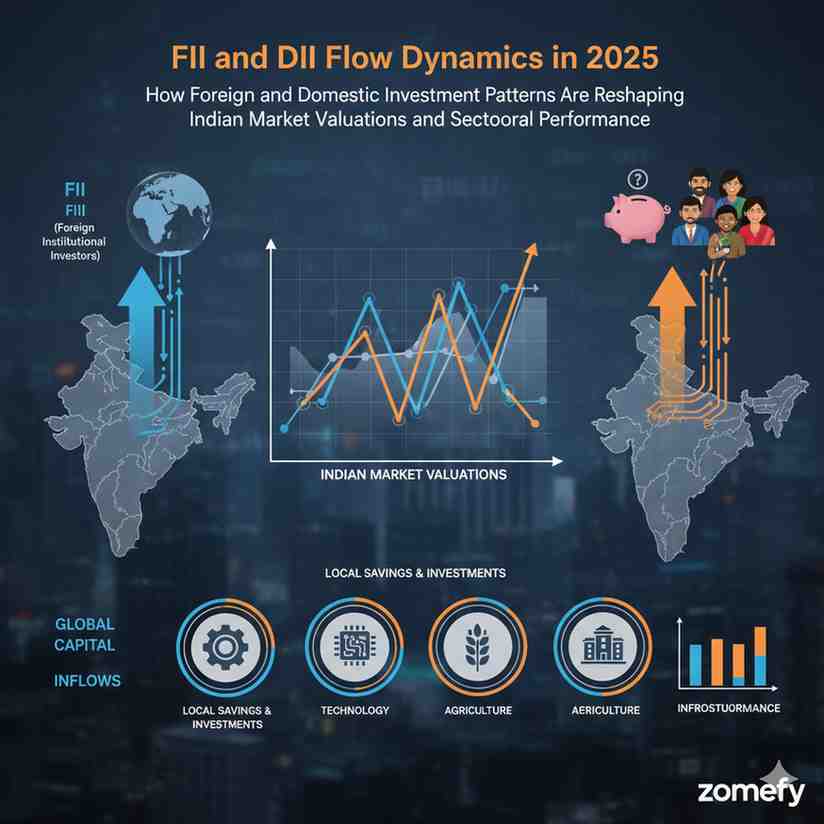

FII and DII Flow Dynamics in 2025: How Foreign and Domestic Investment Patterns Are Reshaping Indian Market Valuations and Sectoral Performance**

The Indian equity market landscape in 2025 is witnessing a significant transformation shaped by the evolving dynamics between Foreign Institutional Investors (FIIs) and Domestic Institutional Inves...

India's AI Exposure Gap 2025: Why Missing the Global Tech Rally Is Costing Retail Investors Billions

India's equity markets stand at a critical juncture in 2025, with the BSE Sensex projected to reach 94,000 by 2026 according to HSBC Global Research, yet retail investors are missing out on billion...

Support and Resistance Trading: Complete Strategy Guide for Indian Markets

Master support and resistance trading with horizontal levels, trendlines, and volume confirmation strategies for Indian markets.

Small-Cap Momentum Stocks 2025: Russell 2000 Rally & Valuation Discount Opportunity—Which Indian Mid-Caps Offer Similar Upside Potential?

The momentum rally seen in the Russell 2000 Index, a key benchmark for U.

Explore More Insights

Continue your financial education journey