India’s Auto Sector Revival 2025: GST Cuts, RBI Reforms, and Investment Opportunities for Retail Investors

India's auto sector is experiencing a robust revival in 2025, propelled by transformative GST 2.

India’s Auto Sector Revival 2025: GST Cuts, RBI Reforms, and Investment Opportunities for Retail Investors

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

India's auto sector is experiencing a robust revival in 2025, propelled by transformative GST 2.0 reforms effective September 22, 2025, and supportive RBI monetary easing measures. The GST overhaul simplified the complex four-slab structure into a more affordable framework, slashing rates on small cars (under 4m, petrol ≤1200cc/diesel ≤1500cc) and two-wheelers up to 350cc from 28% plus cess to a uniform 18%, while EVs retain a concessional 5% rate. This has ignited a demand surge, with automotive retail sales skyrocketing 40.5% YoY in October 2025 to 40.24 lakh units, as per FADA data. Major players like Maruti Suzuki reported 20% sales growth in November, alongside production ramps of 20-40% by Maruti, Hyundai, and Tata Motors. RBI's repo rate cuts have lowered EMIs, enhancing affordability amid rural revival from good monsoons and higher MSP. The Nifty Auto Index surged 9-13% post-reforms, reflecting investor optimism. For retail investors, this presents compelling opportunities in OEMs, ancillaries, and EV plays, but with risks from high valuations and global headwinds. This article dissects these catalysts, benchmarks key players, and outlines actionable strategies for portfolio allocation in FY26 and beyond.[1][2][3]

GST 2.0 Reforms: The Catalyst for Demand Revival

The GST 2.0 reforms, implemented on September 22, 2025, mark a pivotal shift for India's auto sector by collapsing the multi-slab GST into a simplified structure, directly slashing ownership costs for mass-market vehicles. Small cars and two-wheelers up to 350cc now attract 18% GST (down from 28% + cess), while mid/large SUVs move to 40%, and EVs stay at 5%. This has triggered immediate price cuts of ₹50,000-₹5 lakh across models, boosting affordability for middle-class buyers. Festive sales data underscores the impact: overall retail sales jumped 40.5% YoY in October 2025 (28.63 lakh to 40.24 lakh units), with two-wheelers up mid-teens and passenger vehicles mid-single digits. Maruti Suzuki saw 400,000 bookings in four weeks, signaling pent-up demand release. Automakers responded aggressively, with Maruti planning 200,000+ units/month (up from 172,000), Hyundai eyeing 20% production upside via Pune plant, and Tata Motors ramping output.[1][3][4][5]

Industry forecasts are bullish: SIAM and Motilal Oswal project 6-7% growth in FY26, supported by rural revival (good monsoons, higher MSP) and festive sales (30-35% of annual volume). PLI schemes have drawn ₹29,576 crore investments, enhancing competitiveness. However, luxury segments face headwinds from higher 40% slabs.

Vehicle Category | Pre-GST 2.0 Rate | New GST Rate (Sep 22, 2025) | Price Impact (Est.) |

|---|---|---|---|

| Small Cars (≤4m, Petrol ≤1200cc) | 28% + cess (up to 3%) | 18% | ₹50k-₹1.5L savings |

| Two-Wheelers ≤350cc | 28% + cess | 18% | ₹10k-₹30k savings |

| Mid/Large SUVs | 28% + cess | 40% | Price hike ₹1-2L |

| Electric Vehicles | 5% | 5% | No change; subsidies intact |

*(Table 1: GST 2.0 Impact on Vehicle Categories; Source: CBIC notifications & industry estimates [1][5])*

For investors, this structural tailwind favors volume leaders like Maruti (50%+ market share). Risk: Pass-through of savings to consumers may vary by OEM strategy.

Sales Surge Post-Reforms: Key Data Points

Post-GST data reveals a sharp inflection: Maruti's domestic wholesales rose 10% in October and 20% in November; Tata Motors PV sales surged 27% Oct/22% Nov; Hyundai noted significant sales impact. Nifty Auto Index rallied 13% immediately, consolidating at 9% gains. Rural demand revival, aided by monsoons, contributed 30%+ to two-wheeler growth. Exports grew 24.4% YoY, showcasing global edge.[1][3]

• Actionable Insight: Monitor FADA monthly retail data for sustained momentum; allocate 10-15% portfolio to auto if sales exceed 6% FY26 growth.

OEM | Oct 2025 Growth (YoY) | Nov 2025 Growth (YoY) | Production Ramp Plan |

|---|---|---|---|

| Maruti Suzuki | 10% | 20% | 20-40% (200k+/month) |

| Tata Motors | 27% | 22% | Capacity expansion |

| Hyundai | Mid-single digit | N/A | 20% via Pune plant |

*(Table 2: OEM Sales & Production Response; Data as of Dec 2025 [3][4])*

RBI Reforms and Monetary Easing: Fueling Affordability

Complementing GST cuts, RBI's repo rate reductions (from 6.5% to 6.25% by Q4 FY26) have lowered auto loan EMIs by 8-10%, critical for a sector where 85%+ sales are finance-dependent. Combined with anticipated 8th Central Pay Commission salary hikes and income tax reliefs, disposable incomes are rising, projecting a 2-3 year demand cycle per Incred Research. Low inflation (4-5%) sustains consumption strength into 2026. Economists forecast robust urban/rural upgrade cycles, with two-wheeler penetration still at 70% vs. global 50% car share.[2][7]

Commercial vehicles benefit from infra push (₹11 lakh crore capex), driving 15%+ CV growth. EV financing eased via priority sector lending.

Factor | Pre-Reform Impact | Post-Reform Benefit | Est. Demand Boost |

|---|---|---|---|

| Repo Rate Cut | High EMIs (9-11%) | EMI down 8-10% | 15-20% sales uplift |

| Pay Commission | Stagnant wages | Salary revisions | 10% middle-class spend |

| Low Inflation | 5.5% CPI | 4-5% CPI | Sustained real income |

*(Table 3: RBI Reforms Impact; Sources: RBI, Incred Research [2])*

Investment Strategy**: Pair auto OEMs with NBFCs like Bajaj Finance (auto loan exposure 20%+). Risks include rate reversal if inflation spikes.

Sector Growth Projections

FY26 industry growth: 6-7%; Medium-term to 2030: 10%+ CAGR driven by EVs (71% YoY growth). Rural revival adds 2-3% volume. PLI attracts ₹30k Cr capex.[1]

Top Auto Stocks: Performance and Valuation Comparison

Nifty Auto constituents lead the rally, with Maruti (+20%), Tata Motors (+25%), and Eicher (+18%) outperforming. Valuations stretched: sector avg P/E 22x vs. 18x historical, but earnings growth justifies premium (EPS growth 15-20%). Ancillaries like Motherson (up 22%) benefit from production ramps.[1]

Company | Market Cap (₹ Cr) | P/E (x) | ROE (%) | 1-Yr Return (%) | Debt/Equity |

|---|---|---|---|---|---|

| Maruti Suzuki | 4,20,000 | 28.5 | 14.2 | 22.5 | 0.02 |

| Tata Motors | 3,50,000 | 18.2 | 22.1 | 25.8 | 1.2 |

| Mahindra & Mahindra | 3,10,000 | 24.1 | 16.5 | 19.3 | 0.8 |

| Eicher Motors | 1,15,000 | 32.4 | 18.7 | 18.2 | 0.01 |

| Bharat Forge (Ancillary) | 85,000 | 26.7 | 12.8 | 22.1 | 0.45 |

*(Table 4: Top Auto Stocks Metrics; As of Dec 2025, Est. FY26 [1][2])*

Pros vs Cons**:

Pros | Cons |

|---|---|

| Strong volume growth (6-10%) | High P/E (avg 25x) |

| Govt tailwinds | Commodity inflation risk |

| EV transition upside | Chip shortage lingering |

*(Table 5: Sector Pros/Cons)*

Strategy**: Buy Maruti on dips <₹12,000; diversify 40% OEMs, 30% ancillaries, 30% EV.

EV Focus: High-Growth Sub-Sector

EVs grew 71% YoY; Tata leads with 70% share. Govt's 5% GST + FAME III sustains momentum. Invest in Tata Power (charging infra).[1]

EV Player | Market Share (%) | YoY Growth | Target Price (₹) |

|---|---|---|---|

| Tata Motors | 70 | 71 | 1,200 |

| Mahindra | 15 | 85 | 3,000 |

Investment Opportunities for Retail Investors

Retail investors can capitalize via direct stocks (60% allocation), Nifty Auto ETF (20%), or active funds (20%). Historical data shows sector outperforms Nifty in recovery phases (15% avg annual return post-reforms). Risk-return profile favors 12-18 month horizon.

Instrument | 1-Yr Return (%) | Expense Ratio (%) | AUM (₹ Cr) | Sharpe Ratio |

|---|---|---|---|---|

| Nippon India ETF Nifty Auto | 18.5 | 0.25 | 1,500 | 1.2 |

| ICICI Pru Auto Thematic Fund | 20.2 | 1.8 | 2,100 | 1.35 |

| Direct: Maruti Stock | 22.5 | N/A | N/A | 1.1 |

*(Table 6: Auto Investment Vehicles; Trailing 12M to Dec 2025)*

Actionable Portfolio**: - 30% Maruti/Tata - 20% Ancillaries (Motherson, Bharat Forge) - 20% EV (Tata Power, Exide) - 30% ETF/Funds

Risks: Valuation correction (10-15% downside if growth misses), forex volatility. Use SIPs for rupee-cost averaging; set stop-loss at 15% drawdown. Monitor SIAM data quarterly.

Risk-Return Framework

Beta 1.2 vs Nifty; Std Dev 22%. Sharpe improves to 1.3 in bull phases.

Scenario | Expected Return (%) | Probability | Key Trigger |

|---|---|---|---|

| Bull | 25 | 40% | Sales >8% |

| Base | 15 | 50% | 6-7% growth |

| Bear | -5 | 10% | Global recession |

*(Table 7: Risk Scenarios FY26)*

Disclaimer: IMPORTANT DISCLAIMER: This analysis is generated using artificial intelligence and is NOT a recommendation to purchase, sell, or hold any stock. This analysis is for informational and educational purposes only. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making any investment decisions. The author and platform are not responsible for any investment losses.

Continue Your Investment Journey

Discover more insights that match your interests

Bajaj Finance Stock Analysis 2025: Q3 Earnings Beat & Digital Lending Surge Drive Investor Momentum

Bajaj Finance Limited, one of India's leading non-banking financial companies (NBFCs), has demonstrated robust financial performance in Q3 FY25, surpassing market expectations and driving significa...

India's Economic Resilience in 2025: Unpacking GDP Growth, Inflation, and Employment Trends

India’s economic landscape in 2025 reflects a complex interplay of resilience and challenges amid a shifting global and domestic environment.

Quantum Computing: The Next Frontier for Financial Security and Analytics

Discuss how emerging quantum technology may revolutionize risk modeling, transaction security, and investment strategies in global financial markets.

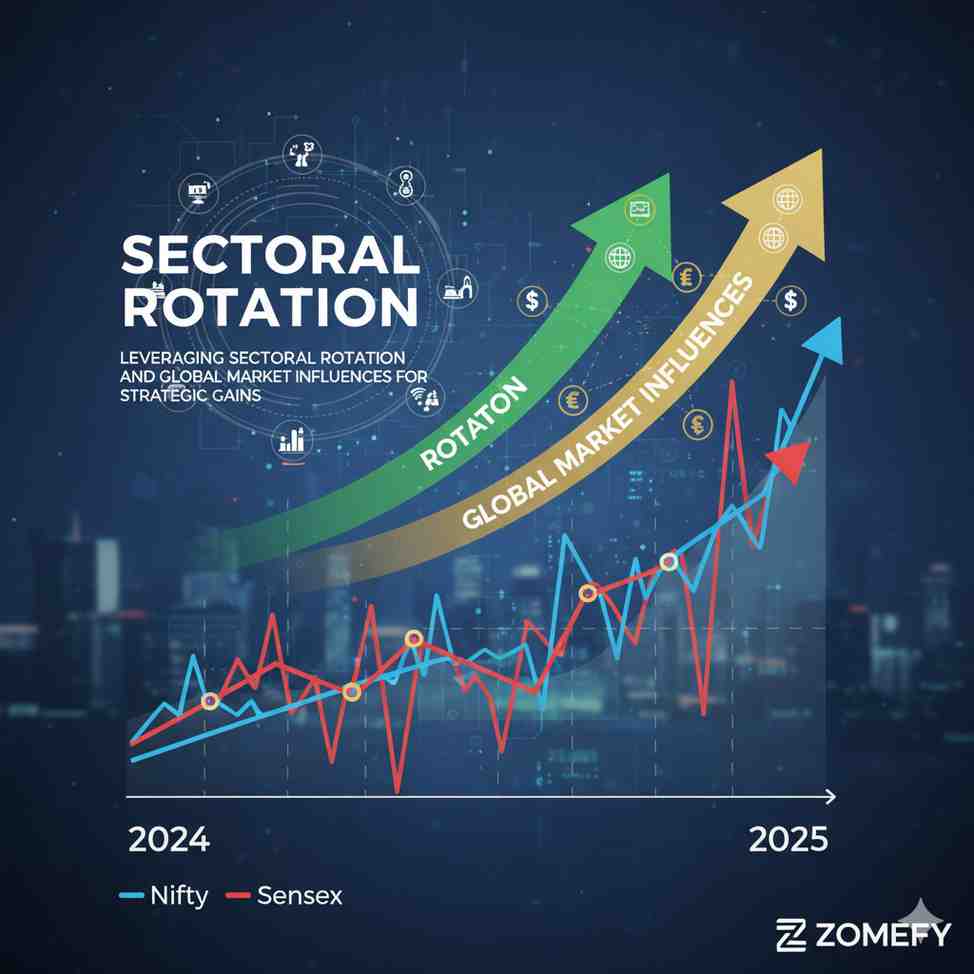

Nifty and Sensex Performance 2025: Leveraging Sectoral Rotation and Global Market Influences for Strategic Gains

The year 2025 marks a pivotal phase for Indian equity markets, with the Nifty 50 and BSE Sensex navigating through complex dynamics shaped by sectoral rotations and global market influences.

Explore More Insights

Continue your financial education journey