Silver’s Industrial Supercycle: EVs, Solar and India’s 2025 Price Boom

Why silver is surging in India in 2025: EVs, solar PV, tight supply, and rising investment demand. A practical guide to silver’s industrial supercycle and how to invest.

Silver’s Industrial Supercycle: EVs, Solar and India’s 2025 Price Boom

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

Silver has broken out to historic highs in 2025. Unlike gold—which is driven mostly by macro safety demand—silver’s rally is increasingly powered by real‑world industrial usage across EVs, solar PV, 5G, semiconductors, and medical devices. India’s own energy transition (500 GW renewable target by 2030) puts silver at the center of a once‑in‑a‑generation capex cycle. This insight explains the structural drivers, supply constraints, investment avenues, risks, and a pragmatic strategy for Indian investors.

Why Silver Is Surging in 2025

Silver is a unique hybrid asset: part precious metal, part essential industrial input. In 2025, multiple demand pillars aligned while supply lagged. Key catalysts:

EV & Storage

Silver demand per EV is structurally higher than ICE vehicles. As EV penetration climbs in India and globally, component‑level silver intensity—especially in power control systems—supports steady volume growth.

Solar PV

Despite ongoing thrifting, silver remains critical for cell efficiency and reliability. India’s National Solar Mission and rooftop PV adoption imply multi‑year silver intensity, with supply substitutions gradual, not instantaneous.

Electronics & 5G

Silver’s unmatched conductivity continues to anchor use in connectors, switches, and high‑frequency components across 5G/IoT ecosystems.

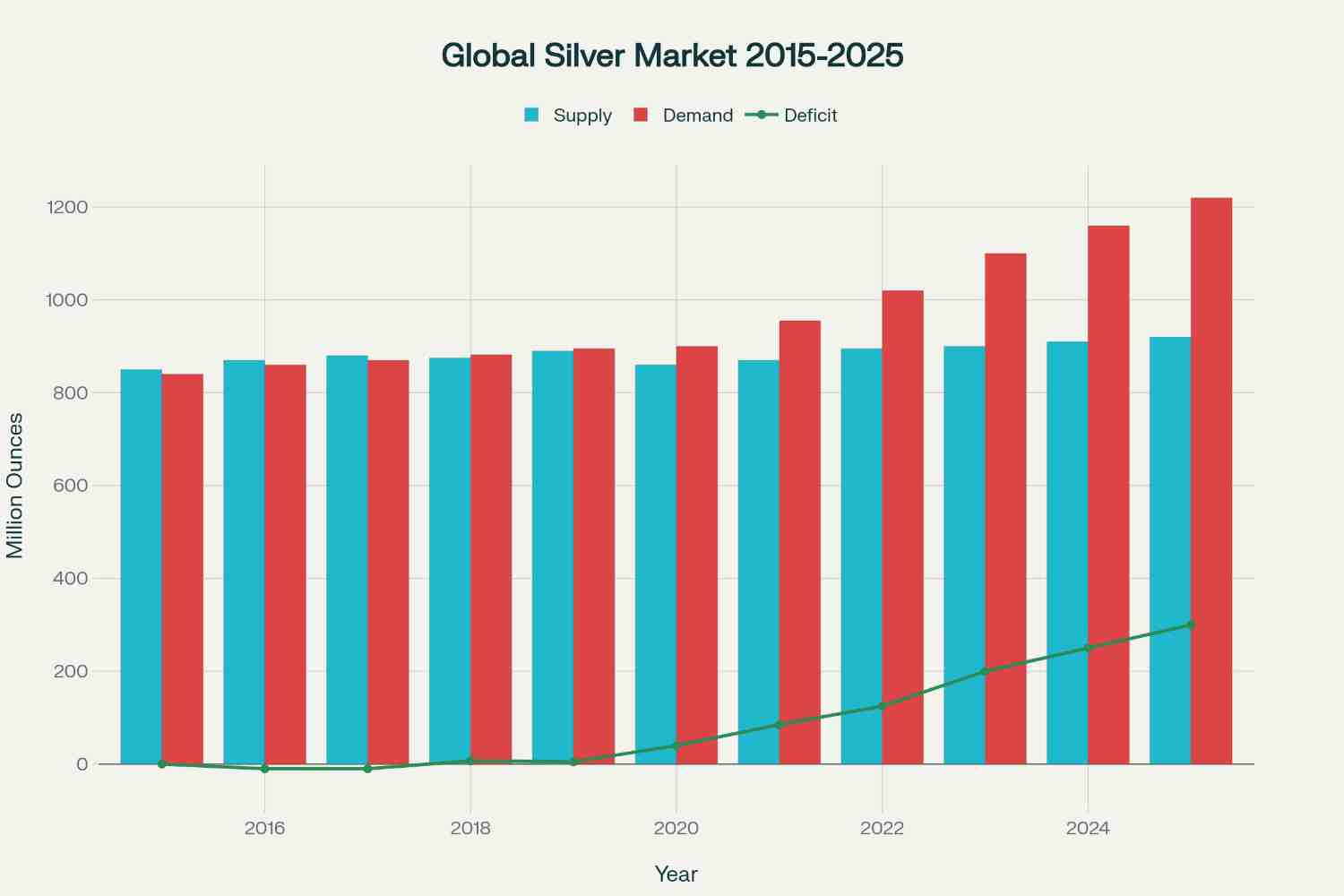

Supply Picture: Tight, Cyclical, and By‑Product Constrained

Global mine supply has struggled to keep pace, in part because ~70% of silver is produced as a by‑product of lead/zinc/copper mining. When base‑metal capex slows or specific mines shut, silver output also drops—even if silver prices are strong. Recycling helps but isn’t fully elastic. Net: structural deficits can persist through cycles, amplifying price spikes during demand surges.

By‑Product Dependence

Silver supply hinges on base‑metal cycles. If copper/zinc capex lags, silver output under‑responds to price—prolonging deficits.

Recycling Limits

Recovery improves with price, but availability, collection friction, and technical yields cap near‑term upside.

Gold vs Silver: 2025 Investment Lens

Gold remains the premier reserve/safe‑haven asset with central‑bank sponsorship. Silver is smaller, more volatile, and more cyclically tied to industry, but can outperform in growth cycles. Summary:

Quick Comparison

Aspect | Gold | Silver |

|---|---|---|

| Primary Driver | Reserve/safe haven | Industrial + investment |

| 2025 Price Move | ~60% up (est.) | ~75% up (est.) |

| Volatility | Lower | Higher |

| Central Banks | Active buyers | Limited/incipient interest |

| India Demand | Jewelry, bars, SGB | Jewelry, bars, industrial |

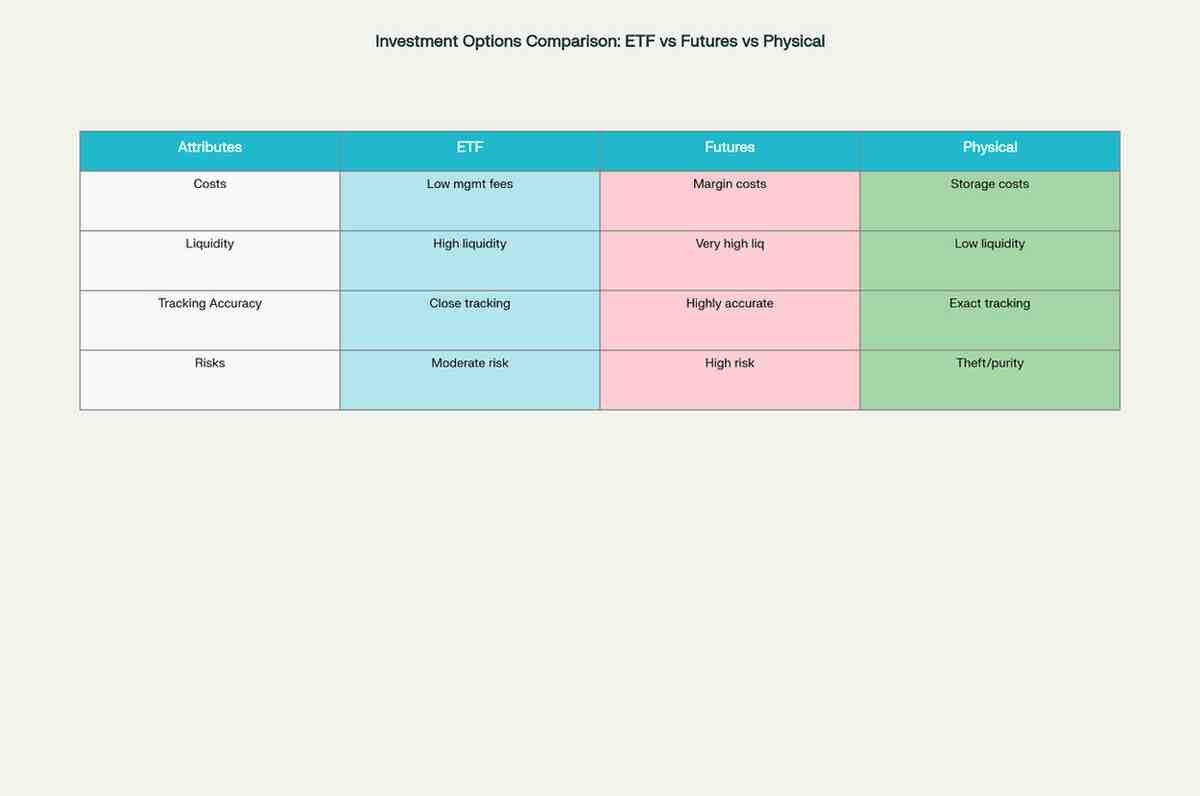

How to Invest in Silver (India)

Indian investors can access silver via multiple routes. Choose based on costs, liquidity, tracking accuracy, and holding period.

1) Silver ETFs / Fund of Funds

Demat‑based, convenient, low spread; tracks domestic silver price (inclusive of duties). Good for SIPs and tactical allocation (5‑15%).

2) MCX Silver Futures

Leverage, liquidity, and margin efficiency—but requires risk management (roll costs, volatility). Suitable for advanced traders only.

3) Physical (Bars/Coins)

Tangible, but involves making charges, purity checks, and storage. Works for long‑term holders; ensure BIS‑hallmarked purity.

Risks & What Could Go Wrong

2025‑2030 Outlook: The Case for a Silver Allocation

Base case: India’s renewables and EV programs keep silver demand structurally supported; supply stays tight; volatility persists. A core 5‑10% portfolio allocation (via ETF/FOF) plus opportunistic adds on corrections can balance growth upside with risk control. For traders, futures can express tactical views; for long‑term savers, SIP in ETFs smooths drawdowns.

Conclusion

Silver’s 2025 breakout is underpinned by durable industrial demand (EVs, solar, electronics) layered on cultural and investment flows in India. Supply is inelastic, deficits recur, and volatility is high—but that’s exactly why disciplined, phased exposure can pay. Gold remains the core hedge; silver is the growth‑sensitive kicker poised to benefit from India’s green capex decade.

Frequently Asked Questions

Is silver just a cheaper version of gold?

No. Silver’s investment story overlaps with gold, but ~50%+ end‑use is industrial. That duality drives different cycles and higher volatility—often stronger upside in growth phases, sharper drawdowns in slowdowns.

What’s a sensible silver allocation?

For diversified portfolios, 5‑10% via ETFs/FOFs is a practical starting range. Tactical traders may use MCX futures with strict risk controls; long‑term savers should prefer SIP in ETFs to average volatility.

Could solar thrifting kill silver demand?

Thrifting is real but gradual; efficiency and reliability needs constrain rapid substitution at scale. Meanwhile, absolute PV volumes are rising fast, keeping total silver demand resilient.

References

- [1] Gold/silver rate outlook (India media trackers) - Times of India / 5Paisa / Moneycontrol / BusinessLine. View Source ↗(Accessed: 2025-10-14)

- [2] Silver shortage and investment demand - Economic Times Wealth / Indian Express / Forbes. View Source ↗(Accessed: 2025-10-14)

- [3] India’s National Solar Mission (500 GW target) - Government/Policy summaries. View Source ↗(Accessed: 2025-10-14)

Continue Your Investment Journey

Discover more insights that match your interests

India’s Commodity Crunch 2025: Decoding Gold, Crude, and Agri Price Trends for Strategic Portfolios

India’s commodity markets are at a pivotal juncture in 2025, shaped by global economic shifts, domestic policy dynamics, and evolving investor behavior.

Titan Multibagger Story: How a Watch Company Became a 100-Bagger

Complete analysis of Titan's transformation from a watch company to a 100-bagger multibagger stock. Learn investment lessons from Titan's success story and business model evolution.

Tata Consultancy Services (TCS) Stock Analysis 2025: Q3 Earnings Beat & Strategic AI Expansion Driving Growth

Tata Consultancy Services (TCS), India’s largest IT services company and a bellwether of the Indian IT sector, has once again showcased its resilience and growth potential in its Q3 FY2025 earnings...

RBI’s 2025 Monetary Policy Unpacked: Impact of Repo Rate Cuts and Liquidity Measures on Indian Markets and Investments

The Reserve Bank of India’s (RBI) monetary policy decisions in 2025 have been pivotal for Indian markets, shaping liquidity conditions, interest rates, and growth trajectories in a year marked by g...

Explore More Insights

Continue your financial education journey