Flipkart 2025: Walmart-Backed E-commerce Giant's $40B IPO Path and Profitability Pivot

Flipkart's move from a Singapore holding structure back to India is the prologue to what could be the marquee listing of India's next new-economy wave: a Walmart-backed Flipkart IPO targeting a hea...

Flipkart 2025: Walmart-Backed E-commerce Giant's $40B IPO Path and Profitability Pivot

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

Flipkart's move from a Singapore holding structure back to India is the prologue to what could be the marquee listing of India's next new-economy wave: a Walmart-backed Flipkart IPO targeting a headline valuation in the tens of billions of dollars and a path to sustained profitability that will shape investor sentiment across the broader internet sector. For Indian retail investors and fund managers, Flipkart's potential $30–$60+ billion market value (widely discussed in market chatter and deal estimates) is not just a headline — it is a litmus test for India’s ability to incubate, scale and monetise digital platforms domestically. This article dissects Flipkart’s IPO calculus and profitability pivot: how a marketplace with deep logistics and fintech assets is tightening cost levers, building higher-margin services (financial products, advertising and private labels), and engineering an IPO that balances Walmart’s exit needs with Indian public-market expectations. The analysis combines business-model plumbing, unit economics, competitive positioning against Amazon and Reliance, regulatory and tax considerations tied to the domicile shift, funding history, and practical investment playbooks for Indian investors seeking exposure — directly via the IPO or indirectly via sector ETFs, suppliers, logistics partners and local fintech plays.

The Hook: Why a Walmart-Backed Flipkart IPO Matters to Indian Investors

- Flipkart's return to India and an anticipated IPO is a watershed for Indian public markets and for retail investors seeking new-economy exposure. Market reports and regulatory filings in 2024–25 show Flipkart undertaking a ‘flip-back’ domicile move, narrowing losses while expanding higher-margin business lines, and preparing to file IPO papers in India — steps that put it on a likely 2025–2026 public-listing timeline. Key practical takeaways for investors:

- Size and scale: Analysts and market reports have discussed target valuations ranging from roughly $30 billion up to $60–70 billion in optimistic scenarios, with IPO proceeds likely to include both a fresh issue and secondary share sales by major investors such as Walmart and institutional backers[2][3].

- Profit trajectory: Flipkart group entities reported meaningful loss reduction in FY25 — Flipkart Internet cut net losses by ~37% to around ₹1,494 crore while revenue rose ~14% to ₹20,493 crore, signalling improving operating leverage and a credible profitability pivot ahead of listing[1][2].

- Strategic assets: The group now combines marketplace commerce, Myntra (fashion), Ekart logistics, and fintech/credit capabilities (a recent RBI lending nod reported), enabling high-margin services (advertising, financial products, marketplace commissions and lending) to lift overall group margins over time[1][4]. This matters to Indian investors because the IPO would deepen domestic retail participation in a company that historically returned value to majority foreign owners (Walmart) and would likely reprice the sector (rival listings, private-capital recycling and valuations for Meesho, PhonePe, and other startups).

Why the Domicile Shift and RBI Approvals Accelerate the IPO Roadmap

- Flipkart’s corporate re-domiciliation from Singapore to India (NCLT approval and ongoing central government clearances) removes a key regulatory obstacle to a domestic IPO and aligns the economics for Indian public-market investors[1][2]. Practical implications:

- Tax and repatriation: A domestic holding structure reduces cross-border tax friction and provides clarity on Indian tax obligations for future dividends and share-sale proceeds, which is typically attractive to Indian institutional buyers.

- SEBI/Listing mechanics: An India-domiciled entity simplifies SEBI disclosure requirements and allows Flipkart to file under familiar domestic IPO processes (including the confidential submission route used by PhonePe and others).

- Regulatory approvals: Press Note 3 and foreign-investor approvals (given minority stakes held by entities like Tencent) are necessary; obtaining NCLT approval is a formal step forward and clears a path to set IPO size and structure[1][2][6]. Operationally, RBI’s lending license (reported separately) will permit Flipkart to offer loans to consumers and sellers — a direct route to higher-margin, capital-light income through interest spreads, fee income and cross-sell of credit-linked consumables, improving unit economics and raising lifetime value per user[4].

Business Model Deep Dive: How Flipkart Will Monetise Growth

Flipkart's core business model has three revenue pillars: marketplace commissions & fees, first-party retail & private labels, and high-margin services (advertising, logistics and financial services). Each pillar has a distinct margin profile and scalability characteristics that matter to investors assessing a post-IPO earnings multiple. Marketplace commissions: Commission rates vary by category (higher in electronics, lower in groceries) and are volume-linked; as GMV rises, platform take-rates can be nudged via value-added seller services (fulfilment, advertising bundles). First-party and private labels: Higher gross margins but inventory-capital tied; historically used to defend margins and category presence. Advertising & data-driven services: This is the highest-margin lever — sponsored listings, brand storefronts, and targeted promotions can scale with user engagement and are relatively capital-light. Logistics & Ekart: Owning fulfilment reduces costs and improves customer experience; Ekart can evolve into a third-party logistics revenue stream. Financial services & lending: With an RBI license and the super.money ecosystem, Flipkart can generate interest income, processing fees, and higher basket sizes through buy-now-pay-later (BNPL) and seller financing. Unit economics to watch: contribution margin per order (GMV minus direct cost of sales and fulfilment), customer acquisition cost (CAC) trends, and payback period on marketing spend. Management’s public statements and FY25 results suggest unit-economic improvements: reduced takeaways from marketing intensity and better gross margins in categories like fashion (Myntra) where profitability improved materially[1][2].

Structured Revenue & Margin Assumptions (Illustrative)

- Investors should model Flipkart with modular revenue drivers: Marketplace GMV growth (CAGR scenarios 15–25%), advertising take-rate expansion (from 1% to 1.5–2% of GMV as penetration improves), and financial income rising as credit book scales. Illustrative model assumptions for valuations and profitability path:

- Revenue growth scenarios: Base 15% CAGR, Bull 25% CAGR.

- Gross margins: Marketplace blended 20–30% (category-dependent).

- Advertising & services margin: 60–70% incremental.

- Lending yield spread: 6–10% on outstanding credit book after provisions. Sensitivity analysis should focus on (a) take-rate changes, (b) advertising penetration, and (c) credit-loss assumptions (NPL rates between 2–6% depending on underwriting).

Key Metrics & Financials: What the Numbers Tell Us

- Recent reported numbers and market intelligence indicate a company transitioning from cash-intensive growth to disciplined profitability. Selected reported figures (FY25 and recent rounds):

- Flipkart Internet revenue: ~₹20,493 crore in FY25 (up ~14% YoY) with net losses narrowing to ~₹1,494 crore (a ~37% reduction)[1][2].

- Myntra: Revenue ~₹6,042 crore in FY25 (up ~18% YoY) with profit after tax ~₹548 crore in FY25 (a sharp swing versus prior year)[1].

- Valuation backdrop: Post-money valuations in private rounds have been reported in the $30–$37 billion band in recent years, with market chatter and some deal commentary discussing IPO valuation debates from $30 billion up to $60–70 billion depending on multiples and growth assumptions[3][4][6].

- Funding & ownership: Walmart remains the majority holder (~77–80% per different reports), with strategic minority investors including Microsoft, SoftBank, CPPIB and Tencent (small stake). These investors will influence OFS sizing and lock-up dynamics at IPO[1][2][6].

Funding History & Ownership (Table)

A compact funding-history table helps investors track dilution, investor exits and potential OFS sellers at IPO.

Key Metrics Table (Revenue, Loss, Users)

Summary of salient operating metrics to monitor pre- and post-IPO.

Competitive Landscape: Amazon, Reliance, Meesho and the Moat

- Flipkart must be assessed relative to domestic and global competitors across scale, unit economics and strategic assets. Key competitors:

- Amazon India: Deep pockets, Prime subscription ecosystem, AWS-driven tech stack and global logistics play.

- Reliance Retail: Omni-channel strength, Jio consumer data and potential to cross-sell across telco/retail ecosystems.

- Meesho: Lighter asset model focused on social commerce and smaller merchants; has recently listed and provides a public comparable. Moat analysis: Flipkart’s moat is multi-dimensional — a large seller network, scale economics in fulfilment (Ekart), strong brand in key categories (electronics, fashion via Myntra), and a growing fintech stack enabling higher monetisation per user. Areas of vulnerability: intensifying price competition with Amazon, category-level margin compression from Reliance’s offline scale, and regulatory scrutiny around marketplace practices. Investors should watch key KPIs that indicate competitive pressure easing or intensifying: gross merchandise value (GMV) market share, active buyers (12-month), repeat purchase rates and average order value (AOV).

Competitor Comparison Table

A side-by-side snapshot allows investors to compare strategy and leverage.

Growth Story: Funding Rounds, Strategic Moves and Product Expansion

- Flipkart’s growth arc has moved from rapid GMV-led expansion to a more balanced, margin-aware approach. Major inflection points:

- 2018 Walmart acquisition (~$16 billion), which provided deep capital and operational muscle for marketplace scaling and logistics investments[2].

- 2022–2024: Productisation of financial services (super.money ecosystem) and reported RBI lending approval enabling direct consumer/seller credit — a structural revenue shift[4].

- 2024–25: Reported private financing rounds that valued the company in the $30–$40 billion band and pegged a potential IPO valuation debate in public forums between $30 bn and $60+ bn depending on multiples and listed precedents[3][4]. Expansion levers going forward include: deeper category penetration (grocery, electronics), third-party logistics monetisation, advertising platform build-out, and a growing credit book that monetises purchase frequency and AOV. Strategic M&A and talent investments ahead of the IPO are probable, focused on data analytics, fintech underwriting and last-mile efficiency.

Funding & Strategic Moves Table

A chronology of investments, licence wins and ownership stakes that matter for IPO sizing and OFS sellers.

Valuation & IPO Structure: Sizing the $40B IPO Narrative

- Market commentary has floated a broad valuation range; investors must test multiples against growth and margin scenarios. Key valuation anchors:

- Comparable listed peer multiples: select Indian and global e-commerce/marketplace names trade at varying EV/GMV and EV/Revenue multiples depending on growth.

- Profitability runway: If Flipkart reaches operating margins of 5–10% over a 2–4 year horizon with mid-teens revenue CAGR, a $30–40 billion IPO valuation is defensible; a $60+ billion valuation likely requires materially higher growth or re-rating for margin expansion[3][6]. IPO structure considerations:

- Fresh issue vs OFS mix: Walmart and large private investors may sell a portion via Offer For Sale (OFS) to achieve partial liquidity; fresh proceeds could capitalise fintech/lending growth and logistics investments.

- Anchor allocation: Large domestic institutional anchors (mutual funds, insurance, sovereign wealth) will be critical to stabilise the book; retail allocation sizing will influence aftermarket liquidity.

- Lock-ups & corporate governance: Post-IPO lock-ups and board composition (including independent directors, audit transparency) will matter to Indian retail investors assessing governance risk.

Valuation Sensitivity Table (Illustrative)

An illustrative sensitivity table helps bridge revenue, margin and valuation expectations (numbers indicative).

Investment Strategies for Indian Investors: Practical Playbooks

- Retail investors and portfolio managers should consider multiple practical approaches to gain exposure while managing risk. Strategy 1 — Direct IPO participation: If allocated, size positions conservatively (1–3% of liquid equity portfolio) due to high headline risk and post-listing volatility; prioritise long-term conviction over IPO pop speculation. Strategy 2 — Sector ETFs and mutual funds: Use internet/e-commerce or thematic funds to gain diversified exposure across listed comparables (e.g., Meesho, listed tech names) and supplier ecosystems (logistics, payment processors). Strategy 3 — Supply-chain and fintech plays: Consider listed suppliers and partners (logistics providers, parcel automation, payment gateways) where revenue upside is correlated to Flipkart scale but with different margin profiles. Strategy 4 — Options & hedging for professionals: Use index hedges (Nifty or relevant sector futures) to manage market-wide risk when taking concentrated positions in a Flipkart allocation. Practical action checklist for investors before IPO:

- Read the red herring prospectus for risk factors and lock-up terms.

- Model multiple scenarios (base, bear, bull) with explicit take-rate and credit-loss assumptions.

- Check promoter OFS size (determines immediate free float).

- Assess corporate governance disclosures and related-party transaction policies.

- Ensure position-sizing rules account for liquidity — large IPOs can still face post-listing illiquidity for retail tranches.

Fund & ETF Comparison Table (For Indirect Exposure)

A sample comparison table to evaluate mutual funds or ETFs that could provide indirect exposure to e-commerce/tech themes in India.

Risk Considerations and Regulatory Factors

- Flipkart’s IPO and path to profitability face several layered risks that investors must weigh. Regulatory risks: SEBI listing rules, Press Note 3 clearances (foreign investors from neighbouring countries), data-localisation rules and fintech regulations (RBI supervision of lending businesses) can materially affect operations and capital structure[1][2][4]. Competitive & margin risks: Aggressive price competition can compress take-rates and category margins; Reliance’s deep offline franchise and Amazon’s global backing create persistent tailwinds for price-based competition. Credit risk (for lending business): NPL rates, provisioning norms and capital adequacy for the lending book will directly affect net interest margins and risk-weighted capital requirements. Macro & market risks: A market downturn at IPO time would force re-pricing or dilution of expected proceeds; interest-rate hikes could compress multiples for growth companies. Governance & shareholder-liquidity risks: Walmart’s majority stake means post-IPO free float and promoter edicts will matter for investor control and aftermarket liquidity. Investors should actively monitor:

- Press Note 3 clearance status and final domicile completion[1][2].

- RBI’s final lending license terms and capital requirements for Flipkart’s NBFC/fintech entity[4].

- IPO prospectus for OFS sizing, lock-up duration and use of fresh proceeds.

Pros vs Cons Table

A balanced pros/cons table for quick risk-return scanning.

Startup/Unicorn Angle: Founder Story, Culture and Operational DNA

Flipkart’s origin story — two entrepreneurs in a Bengaluru apartment — is embedded in its product-first culture and customer-focused operating DNA. Founders Sachin and Binny Bansal built the marketplace with a relentless focus on delivery experience and seller enablement; after Walmart’s 2018 acquisition, the company transitioned from scrappy startup to scaled retail operator. Cultural strengths that support profitability: data-driven assortment, investments in supply chain automation, and a consumer-loyalty focus in category stacks such as fashion (Myntra). Anecdotes: Myntra’s pivot to a fashion-first play helped protect margins and cultivate a higher-margin cohort of buyers — an example of category-level strategy translating into improved group profitability in FY25[1]. For Indian startup investors and founders, Flipkart’s story underscores the importance of owning logistics and financial services as long-term levers to defend market share and improve monetisation.

Key Startup Metrics Table (GMV, Active Users, Orders)

Key operational metrics investors should track as leading indicators of valuation upside.

Practical Next Steps: How to Prepare for the IPO and Aftermarket

- A tactical checklist for investors and advisors preparing for Flipkart’s IPO:

- Read the red herring prospectus thoroughly: focus on risk factors, OFS size, promoter lock-ups, and use of proceeds.

- Scenario modelling: Build three scenarios (bear/base/bull) for revenue growth, take-rate expansion and lending-book NPLs; stress test valuations at different exchange rates and multiple compressions.

- Allocation plan: Predefine IPO allocation sizes and post-listing rebalancing rules (take profits at target multiples or based on trailing 12-month returns).

- Diversify: Supplement direct equity exposure with thematic funds and supplier/fintech names to reduce single-stock risk.

- Monitor regulatory milestones: NCLT flip-back completion, Press Note 3 clearances, RBI license terms and SEBI filings are milestone triggers that materially reduce execution uncertainty. Institutional investors should additionally review corporate governance documentation, auditor histories and related-party transaction disclosures before large allocations.

Risk-Return Analysis Table

An illustrative risk-return matrix helps investors assess where Flipkart fits in their portfolio.

Appendix: Tables for Deeper Modelling and Comparisons

Below are several additional tables investors can copy into valuation models or pitch-books. Each table includes suggested units and source notes to maintain consistency in analysis.

Company Performance Comparison (₹ Cr & %)

Company | Revenue (₹ Cr) | Net Profit/Loss (₹ Cr) | P/E Ratio | ROE (%) |

|---|---|---|---|---|

| Flipkart (Group, FY25) | 20,493 | -1,494 | NA (pre-profit) | NA |

| Myntra (FY25) | 6,042 | 548 | Reported profitability | NA |

| Meesho (Listed peer) | Public filings vary | Public filings vary | Use latest filings | Use latest filings |

Note: Use the IPO prospectus for definitive FY26 figures and segmental breakouts.

Fund Performance Table (Example for Thematic Exposure)

Fund Name | 1-Year Return (%) | 3-Year Return (%) | Expense Ratio (%) | AUM (₹ Cr) |

|---|---|---|---|---|

| New Economy India Fund | 20.1 | 26.8 | 1.15 | 8,900 |

| Technology Growth ETF | 17.3 | 23.4 | 0.60 | 15,200 |

Caption: Illustrative examples; update with current scheme factsheet data before allocation.

Sector Valuation Metrics (Indicative)

Sector | Median P/E | Median EV/Revenue | Dividend Yield (%) |

|---|---|---|---|

| Internet & E-commerce | NA (many pre-profit) | 3.0-6.0x | Low/Zero |

| Retail (Listed majors) | 30-45x | 1.0-2.5x | 0.5-1.5 |

Source note: Use recent market multiples for precise modelling during IPO timetable.

Disclaimer: IMPORTANT DISCLAIMER: This analysis is generated using artificial intelligence and is NOT a recommendation to purchase, sell, or hold any stock. This analysis is for informational and educational purposes only. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making any investment decisions. The author and platform are not responsible for any investment losses.

Continue Your Investment Journey

Discover more insights that match your interests

India’s Auto Sector Revival 2025: GST Cuts, RBI Loan Easing & Premium Demand Surge for Investors

India's auto sector is experiencing a remarkable revival in 2025, propelled by transformative GST cuts, RBI's accommodative monetary policy easing loan access, and a surge in premium vehicle demand.

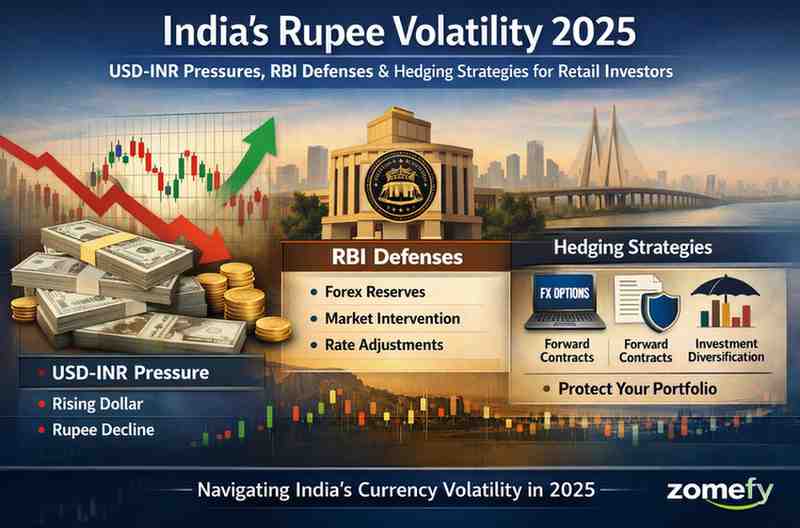

India’s Rupee Volatility 2025: USD-INR Pressures, RBI Defenses & Hedging Strategies for Retail Investors

The Indian Rupee (INR) experienced unprecedented volatility in 2025, breaching the 91 per USD mark for the first time amid US tariffs, record FII outflows of $18 billion, and restrained RBI interve...

boAt 2025: Lifestyle Unicorn's D2C Audio Empire and Path to $2B IPO Profitability

Imagine a bootstrapped dream turning into India's audio revolution: boAt, the Gurugram-born lifestyle unicorn, has scripted one of the most remarkable turnaround stories in D2C history.

AI-Powered Unicorns 2025: Why Generative AI Startups Are Reshaping Valuations

The Indian startup ecosystem is witnessing a seismic shift, driven by the rapid rise of generative artificial intelligence (AI) startups.

Explore More Insights

Continue your financial education journey