Pharma Sector Valuation 2025: Patent Cliff Risks & Opportunities

Comprehensive pharma sector valuation analysis for 2025 with patent cliff risks and opportunities. Analyze Sun Pharma, Dr. Reddy's, Cipla, Lupin performance and investment opportunities in Indian pharma sector.

Pharma Sector Valuation 2025: Patent Cliff Risks & Opportunities

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

The Indian pharma sector is at a critical juncture, with major patent expirations creating both risks and opportunities. As we enter 2025, understanding the patent cliff dynamics and their impact on valuations becomes crucial for investors. This comprehensive analysis examines the pharma sector's valuation metrics, patent cliff opportunities, and investment strategies.

Pharma Sector Overview 2025

Sector Characteristics

2025 Growth Outlook

Patent Cliff Analysis

Patent Expiration Timeline

Generic Drug Opportunities

Company-Specific Analysis

Sun Pharma - The Market Leader

Dr. Reddy's - The Generic Leader

Cipla - The Respiratory Leader

Lupin - The US Generic Leader

Valuation Framework & Metrics

Valuation Metrics

Patent Cliff Valuation

Investment Recommendations

Top Picks by Category

Risk Management

Conclusion

Frequently Asked Questions

What is the patent cliff and how does it impact pharma sector?

Patent cliff refers to the expiration of patents on blockbuster drugs, creating opportunities for generic drug manufacturers. $200+ billion worth of drugs are going off-patent by 2030, creating significant opportunities for Indian pharma companies. This is expected to boost generic drug market by 15-20% annually.

What are the key growth drivers for pharma sector in 2025?

Key growth drivers include patent expirations creating generic opportunities, rising healthcare spending and insurance penetration, strong demand from international markets, government support for healthcare sector, and growing R&D investment in new drug development. Generic drug market is expected to grow 15-20% annually.

How to evaluate pharma sector companies for investment?

Evaluate companies based on generic drug capabilities and market share, R&D investment and pipeline, regulatory compliance and approvals, manufacturing capabilities and efficiency, financial health and margins, and ESG practices and sustainability focus. Consider both fundamental analysis and technical analysis for better decision making.

What are the key risks in pharma sector investments?

Key risks include intense competition in generic drug market, regulatory challenges and compliance costs, patent cliff competition and pricing pressure, currency sensitivity and export dependence, supply chain disruptions and raw material costs, and technology disruption and innovation risks. Diversification and risk management are crucial.

How to value pharma sector companies?

Use multiple valuation methods: P/E ratios (12-25x range), P/B ratios (1.5-4x range), EV/EBITDA (6-18x range), and DCF analysis considering growth prospects. Consider patent cliff opportunities, generic drug capabilities, and competitive advantages. Focus on companies with strong fundamentals and growth prospects.

Disclaimer: This analysis is for educational purposes only and should not be considered as investment advice. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making investment decisions. Pharma sector investments are subject to market risks and regulatory challenges.

Continue Your Investment Journey

Discover more insights that match your interests

Banking Sector Valuation 2025: Complete Framework

Comprehensive banking sector analysis with valuation frameworks, key metrics, and investment opportunities in 2025.

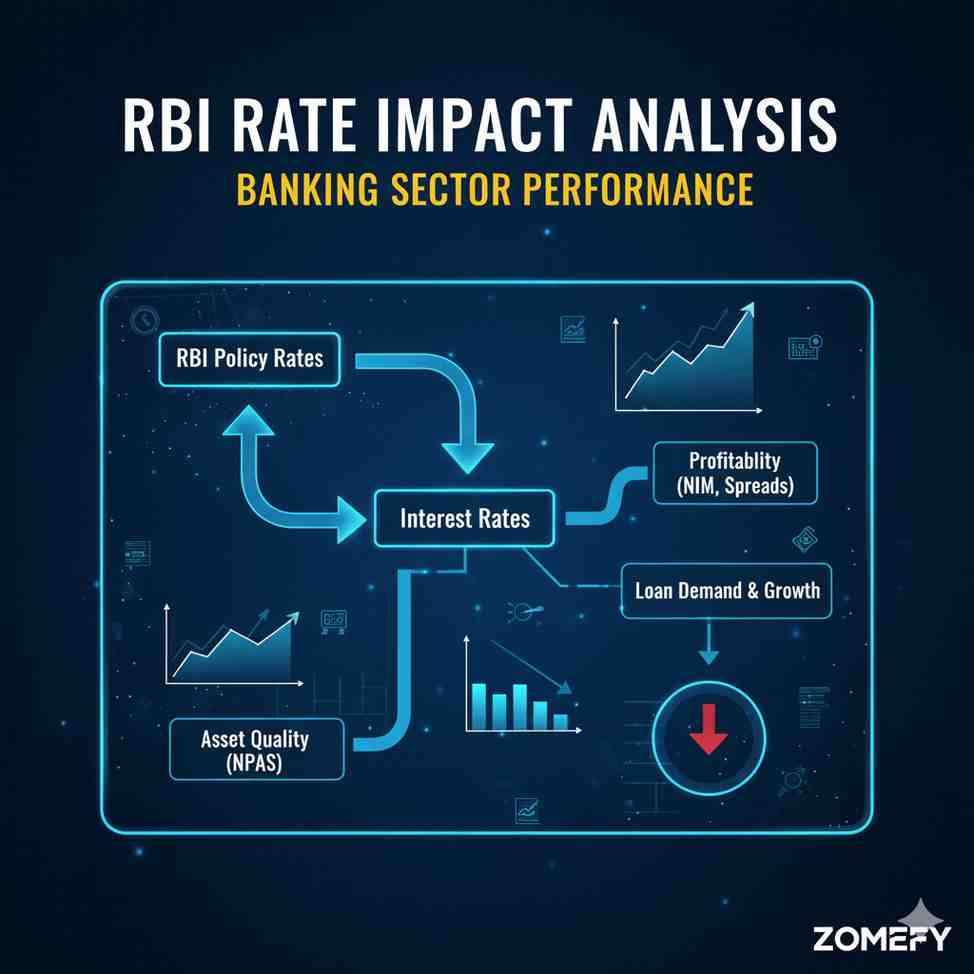

RBI Rate Impact Analysis: Banking Sector Performance

Comprehensive analysis of how RBI rate changes impact banking sector performance with historical data and future outlook.

Cement Sector Valuation 2025: Regional vs Pan-India Players

Comprehensive cement sector valuation analysis for 2025 with regional vs pan-India players framework. Analyze UltraTech, Shree Cement, Dalmia Bharat performance and investment opportunities in Indian cement sector.

IT Sector Outlook 2025: Navigating AI Adoption, Cloud Migration, and Margin Pressures for Sustainable Growth

India’s IT sector is at a pivotal juncture in 2025, shaped by rapid AI adoption, accelerating cloud migration, and persistent margin pressures.

Explore More Insights

Continue your financial education journey