Breakout Trading Strategy: Channel Breaks & Volume Confirmation

Master breakout trading with channel breaks, volume confirmation, and false breakout protection for Indian markets. Learn to trade breakouts using NSE and BSE stocks.

Breakout Trading Strategy: Channel Breaks & Volume Confirmation

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

Breakout trading is one of the most powerful strategies in technical analysis, capitalizing on price movements beyond key support and resistance levels. In Indian markets, where institutional activity and retail sentiment often create strong breakout moves, mastering this strategy can lead to significant profits. This comprehensive guide covers channel breakouts, volume confirmation, false breakout protection, and advanced breakout techniques specifically tailored for NSE and BSE markets.

Understanding Breakouts

Types of Breakouts

Breakout Characteristics

Channel Breakout Strategies

Horizontal Channel Breakouts

Ascending Channel Breakouts

Volume Confirmation Techniques

Volume Analysis Methods

Institutional Volume Confirmation

False Breakout Protection

Identifying False Breakouts

Protection Strategies

Breakout Trading Strategies

Immediate Entry Strategy

Pullback Entry Strategy

Advanced Breakout Techniques

Multi-Timeframe Breakouts

Pattern Confluence

Risk Management for Breakouts

Stop Loss Strategies

Target Setting Methods

Conclusion

Continue Your Investment Journey

Discover more insights that match your interests

ITC Stock Analysis 2025: Q3 Earnings Beat & Rural Market Expansion Fuel FMCG Growth Momentum

ITC Limited (NSE: ITC) continues to dominate the Indian FMCG and tobacco landscape, with its Q3 FY25 earnings report reinforcing its resilience amid challenging macroeconomic conditions.

India's Domestic Consumption Boom and Premiumization Trend: How Retail Investors Can Capitalize on the Consumer Discretionary Sector's 17% Growth Potential in 2025

India’s domestic consumption landscape is undergoing a transformative boom, driven by rising incomes, favorable demographics, and evolving consumer preferences.

Navigating India’s Rising Commodity Market Volatility in 2025: Strategic Insights on Gold, Crude Oil, and Agricultural Prices for Retail Investors

India’s commodity markets in 2025 are witnessing unprecedented volatility driven by a confluence of global supply chain realignments, geopolitical tensions, shifting demand patterns, and domestic p...

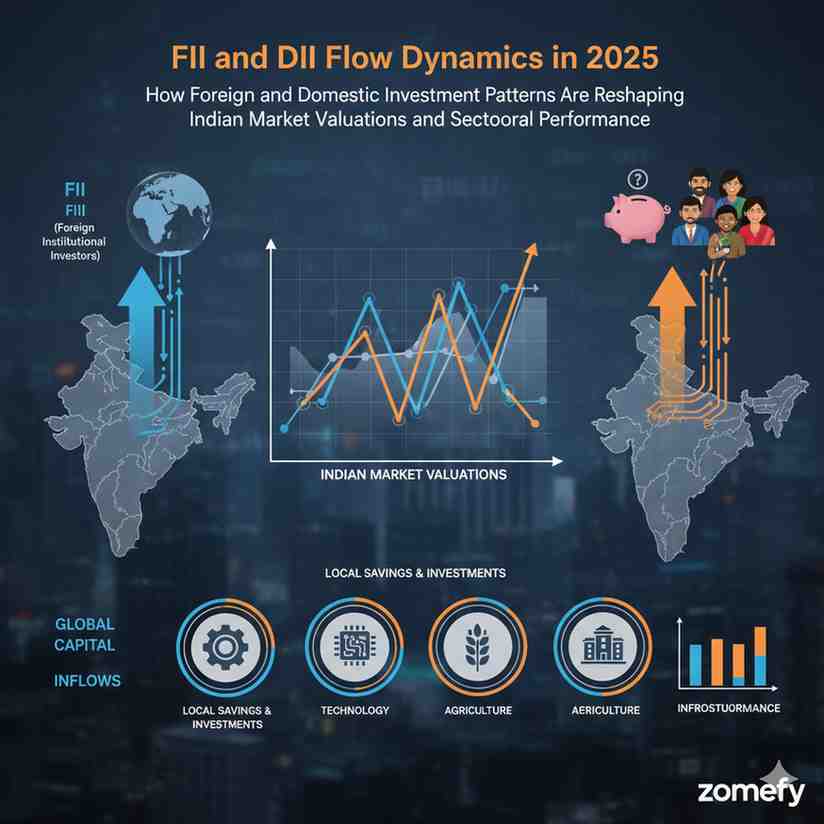

FII and DII Flow Dynamics in 2025: How Foreign and Domestic Investment Patterns Are Reshaping Indian Market Valuations and Sectoral Performance**

The Indian equity market landscape in 2025 is witnessing a significant transformation shaped by the evolving dynamics between Foreign Institutional Investors (FIIs) and Domestic Institutional Inves...

Explore More Insights

Continue your financial education journey