Unlocking Investment Potential in 2025: A Beginner's Guide to ETFs and Index Funds in India

As Indian retail investors increasingly seek efficient, cost-effective ways to build wealth, Exchange-Traded Funds (ETFs) and index funds have emerged as powerful tools to unlock investment potential in 2025.

Unlocking Investment Potential in 2025: A Beginner's Guide to ETFs and Index Funds in India

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

As Indian retail investors increasingly seek efficient, cost-effective ways to build wealth, Exchange-Traded Funds (ETFs) and index funds have emerged as powerful tools to unlock investment potential in 2025. These passive investment vehicles offer diversified exposure to key Indian market indices and sectors, combining transparency, liquidity, and low costs. With the Indian mutual fund industry witnessing rapid growth in ETF assets under management—reaching nearly ₹9 lakh crore and constituting 13% of total mutual fund AUM—both beginners and seasoned investors are recognizing their value amid heightened market volatility and evolving economic trends. This guide aims to demystify ETFs and index funds in the Indian context, providing actionable insights, data-driven examples, and practical strategies tailored for retail investors and financial professionals. By understanding their structures, benefits, and risks, investors can confidently integrate these instruments into their portfolios to capitalize on India's dynamic equity markets and government-backed sectors in 2025.

Understanding ETFs and Index Funds: The Foundations of Passive Investing

ETFs and index funds are both forms of passive investment vehicles designed to replicate the performance of specific market indices, such as the Nifty 50 or BSE Sensex. While they share the goal of providing diversified market exposure at low costs, their structures differ, leading to distinct investment experiences. ETFs are traded on stock exchanges like individual stocks throughout the trading day, offering liquidity and price transparency. In contrast, index funds are mutual funds bought or sold once a day at the net asset value (NAV), providing simplicity and ease of investing via systematic investment plans (SIPs).

In India, these products have gained traction due to their ability to offer broad market exposure without the need for active stock selection. As of March 2025, ETFs managed assets worth approximately ₹8.39 lakh crore, growing over fivefold in five years, reflecting strong investor confidence. Index funds complement this by enabling disciplined investing with low expense ratios, often below 0.2%, making them attractive for long-term wealth creation.

Key distinctions to consider:

Understanding these nuances helps investors choose the right vehicle based on their investment style, liquidity needs, and cost sensitivity.

The Indian Regulatory and Market Context

The Securities and Exchange Board of India (SEBI) regulates both ETFs and index funds, ensuring transparency, investor protection, and market integrity. Indian ETFs predominantly track domestic indices such as Nifty 50, Nifty Bank, Bharat 22, and sector-specific benchmarks like PSU banks. The government’s disinvestment initiatives have further popularized ETFs like Bharat 22 and CPSE, which provide exposure to public sector undertakings.

The NSE and BSE serve as primary trading platforms for ETFs, with over 260 schemes spanning equities, gold, silver, and bonds as of 2025. The Indian ETF market penetration is growing but still trails developed markets, indicating substantial room for expansion and innovation. Recent regulatory enhancements have facilitated ETF accessibility, including streamlined KYC norms and digital platforms integrating Demat accounts.

For index funds, leading asset management companies such as UTI, HDFC, and SBI offer products tracking major indices with low expense ratios and robust performance records. The growing investor appetite for passive funds is driven by increased awareness, cost-consciousness, and the desire for market-linked returns without active management risks.

Top ETFs and Index Funds to Consider in India for 2025

In 2025, Indian investors have a diverse range of ETFs and index funds to choose from, each catering to different risk profiles, sectors, and investment goals. The best ETFs combine strong historical returns with reasonable expense ratios and sectoral diversification. Notable ETFs include Mirae Asset NYSE FANG+ ETF with a remarkable 3-year return of 257.47%, Nippon India ETF PSU Bank BeES at 145.39%, and Bharat 22 ETF delivering 117.13%. These ETFs provide exposure to fast-growing sectors such as technology, PSU banks, and government enterprises.

Index funds tracking the Nifty 50, like UTI Nifty 50 Index Fund, HDFC Nifty 50 Index Fund, and SBI Nifty Index Fund, offer broad market exposure with returns typically ranging from 12% to 21% over three years. These funds are ideal for investors seeking steady growth with minimal active management risk.

Investment professionals recommend a balanced approach combining ETFs and index funds to harness liquidity and cost benefits while enabling systematic investment through SIPs. For example, an investor could allocate 60% to index funds for steady accumulation and 40% to sector-specific ETFs like Kotak Nifty PSU Bank ETF or gold ETFs such as Nippon India Silver ETF for tactical diversification.

Key considerations when selecting funds:

Sector-Specific ETFs: Opportunities and Risks

Sector-specific ETFs in India provide targeted exposure to industries such as banking, technology, and commodities. For instance, the Nippon India ETF Nifty Bank BeES and Kotak Nifty Bank ETF track the Nifty Bank Index, capturing India's robust banking sector, which significantly contributes to GDP growth. Similarly, Mirae Asset NYSE FANG+ ETF offers exposure to global technology giants, introducing international diversification to Indian portfolios.

While these ETFs offer potential for high returns, they carry sector concentration risks. Banking ETFs may be sensitive to interest rate changes, regulatory shifts, or non-performing asset (NPA) trends. Technology-focused ETFs can be volatile due to global market dynamics and innovation cycles. Commodity ETFs like gold and silver serve as hedges against inflation and currency depreciation but may underperform during bull equity markets.

Investors should assess their risk appetite and investment horizon before allocating to sector ETFs and consider blending them with broad-market index funds to mitigate volatility. Regular portfolio rebalancing and monitoring economic indicators such as RBI policy decisions and global trade developments are essential to managing these risks effectively.

Practical Strategies for Investing in ETFs and Index Funds in India

To capitalize on the benefits of ETFs and index funds, Indian investors should adopt practical, disciplined strategies tailored to their financial goals and risk profiles. Here are actionable steps to unlock investment potential in 2025:

Risk considerations include market volatility, liquidity constraints for less popular ETFs, and sector-specific risks. Staying informed about SEBI regulations, tax implications (capital gains tax on ETFs and index funds), and market trends is crucial. Investors should also be aware that ETFs may incur brokerage and bid-ask spreads, while index funds typically have higher minimum investment flexibility.

Financial professionals should guide clients on blending passive funds with active strategies to optimize portfolio risk-adjusted returns, considering Indian market idiosyncrasies and macroeconomic factors.

Taxation and Regulatory Considerations for Indian Investors

Understanding the tax treatment of ETFs and index funds is vital for maximizing after-tax returns. In India, equity-oriented ETFs and index funds (with over 65% equity exposure) are subject to capital gains tax as follows:

Debt-oriented ETFs and index funds have different holding periods and tax rates, with LTCG taxed at 20% with indexation after 36 months.

SEBI regulations mandate transparency in portfolio disclosures and expense ratios, ensuring investor protection. Recent regulatory changes have simplified KYC processes and enabled digital onboarding, enhancing accessibility.

Investors should consult tax advisors to optimize asset allocation and consider implications of dividend distribution tax and Securities Transaction Tax (STT) on trading ETFs. Awareness of the Liberalised Remittance Scheme (LRS) also allows Indian residents to invest in international ETFs, expanding diversification opportunities.

Continue Your Investment Journey

Discover more insights that match your interests

Reliance Industries Stock Analysis 2025: Strategic Bet on Digital Assets & FinTech Expansion Driving Next-Gen Growth

Reliance Industries Limited (RIL), India's largest conglomerate, is at a pivotal juncture in 2025 as it strategically shifts focus towards digital assets and fintech expansion to fuel its next-gene...

Support and Resistance Trading: Complete Strategy Guide for Indian Markets

Master support and resistance trading with horizontal levels, trendlines, and volume confirmation strategies for Indian markets.

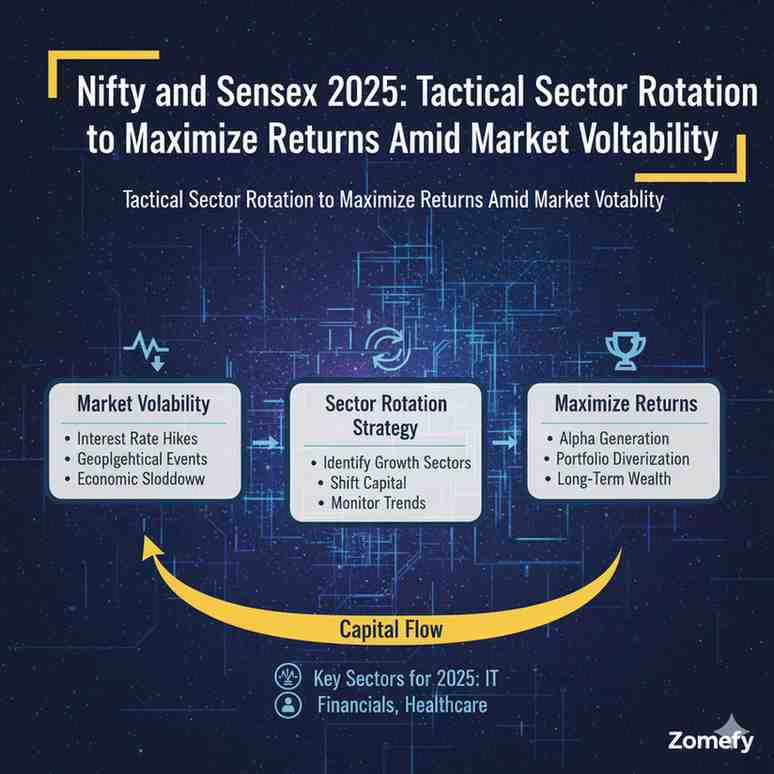

Nifty and Sensex 2025: Tactical Sector Rotation to Maximize Returns Amid Market Volatility

As we advance into 2025, the Indian equity markets represented by the Nifty 50 and BSE Sensex continue to navigate a complex environment marked by heightened volatility, geopolitical tensions, and ...

Moving Average Crossover Strategies 2025: Mastering SMA & EMA for Reliable Trend Following in Indian Markets

In the dynamic landscape of Indian financial markets, mastering technical tools for reliable trend identification is crucial for retail investors and financial professionals alike.

Explore More Insights

Continue your financial education journey