Reliance Industries Stock Analysis 2025: Strategic Bet on Digital Assets & FinTech Expansion Driving Next-Gen Growth

Reliance Industries Limited (RIL), India's largest conglomerate, is at a pivotal juncture in 2025 as it strategically shifts focus towards digital assets and fintech expansion to fuel its next-gene...

Reliance Industries Stock Analysis 2025: Strategic Bet on Digital Assets & FinTech Expansion Driving Next-Gen Growth

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

Reliance Industries Limited (RIL), India's largest conglomerate, is at a pivotal juncture in 2025 as it strategically shifts focus towards digital assets and fintech expansion to fuel its next-generation growth. After a subdued 2024, RIL's stock has surged by 25% in 2025, reflecting renewed investor confidence driven by strong earnings, robust cash flows, and aggressive capital allocation towards digital and consumer-facing businesses. With a market capitalization exceeding ₹20 lakh crore and a diversified portfolio spanning refining, petrochemicals, retail, telecom, and new energy, Reliance is leveraging its dominant position in digital services through Jio Platforms and expanding fintech offerings to capture India's rapidly growing digital economy. This article delves into RIL's recent financial performance, strategic initiatives in digital assets and fintech, competitive positioning compared to peers, and actionable insights for Indian retail investors and financial professionals. We also provide comprehensive data tables, risk considerations, and valuation metrics to assess RIL's investment potential in the evolving Indian market context.

Reliance Industries: Financial Performance and Market Position in 2025

Reliance Industries has demonstrated strong financial momentum in 2025, rebounding from a muted 2024. The company's net profit jumped 78.32% year-on-year to ₹26,994 crore in Q1 FY26, with revenue growing 7% to ₹2,43,632 crore, driven by robust performance in digital services, retail, and refining segments. The market capitalization stands at approximately ₹20.12 lakh crore, making RIL the most valuable Indian company by market cap. The company’s P/E ratio is 24.15 with a dividend yield of 0.37%, reflecting a growth-focused profile with moderate shareholder returns. Debt levels remain manageable with a debt-to-EBITDA ratio below 2x, supported by strong cash flows from consumer-facing businesses. S&P Global recently upgraded Reliance’s credit rating to 'A-' citing improved cash flow stability and earnings quality, further validating the company’s financial strength. Reliance’s refining capacity of 1.4 million barrels per day and its status as the world's largest single-site refinery complex continue to anchor its oil-to-chemicals business, which contributes 40% of operating cash flow. The remaining 60% is driven by retail and digital services, highlighting the strategic shift towards less cyclical, consumer-focused segments.

Key Financial Metrics Q1 FY26 vs. Q1 FY25

Metric | Q1 FY26 | Q1 FY25 | YoY Change (%) |

|---|---|---|---|

| Revenue | 2,43,632 | 2,27,500 | 7.1 |

| Net Profit | 26,994 | 15,150 | 78.32 |

| EBITDA | 42,400 | 34,500 | 22.9 |

| Debt to EBITDA | 1.9 | 2.4 | - |

Reliance’s strong revenue growth is fueled by Jio’s 5G subscriber base reaching 191 million and retail expansion, while refining margins have stabilized despite global volatility. The company’s focus on digital and consumer businesses is reflected in the improved profitability and cash flow metrics. Investor confidence is buoyed by the stable promoter holding at 49.11%, and consistent capital expenditure plans aimed at further expansion in digital and new energy sectors.

Strategic Bet on Digital Assets and FinTech Expansion

Reliance's decisive pivot towards digital assets and fintech is central to its growth strategy for 2025 and beyond. Jio Platforms, the digital arm, has aggressively expanded its 5G network, achieving a subscriber base of 191 million True 5G users by March 2025. This infrastructure underpins Reliance’s digital ecosystem, including fintech services such as Jio Payments Bank, JioMoney, and partnerships with global fintech innovators. The recent alliance with SpaceX to integrate Starlink satellite broadband services enhances connectivity in underserved regions, further expanding Reliance’s digital footprint. Reliance plans to raise ₹25,000 crore via debt in 2025 to fund expansion in digital services, fintech, retail, and new energy, reflecting confidence in long-term growth opportunities. The fintech expansion focuses on digital payments, lending, and wealth management products tailored for India's growing digital consumer base. This diversification reduces Reliance’s dependence on cyclical oil-to-chemicals segments and aligns with India's broader regulatory push for digital financial inclusion.

Digital & FinTech Revenue Contribution and Growth

Segment | Revenue (₹ Crore) | % of Total Revenue | Growth YoY (%) |

|---|---|---|---|

| Digital Services (Jio Platforms) | 1,20,000 | 13% | 25 |

| Retail & Consumer Services | 3,50,000 | 38% | 15 |

| Oil-to-Chemicals | 4,50,000 | 49% | 5 |

Reliance’s digital and retail segments now jointly contribute over 50% of operating cash flow, indicating a significant transformation from traditional energy-centric revenues. The fintech vertical is expected to grow at a CAGR of 30%-35% over the next five years, leveraging India's expanding digital economy and government initiatives like Digital India and UPI. Actionable insights for investors include monitoring Jio’s subscriber growth, fintech product adoption rates, and regulatory developments impacting digital financial services.

Investment Perspective: Valuation, Risks, and Recommendations

Reliance Industries currently trades at a P/E ratio of 24.15, reflecting a premium valuation justified by its dominant market position, diversified business model, and growth prospects in digital and fintech sectors. The company’s dividend yield stands at 0.37%, indicating reinvestment into growth initiatives rather than high payout. Key risks include regulatory challenges in telecom and fintech, aggressive capital expenditure potentially impacting leverage, and commodity price volatility affecting refining margins. However, the recent S&P Global upgrade to 'A-' credit rating underscores strong financial discipline and cash flow stability. For Indian retail investors, Reliance offers a compelling strategic play on India’s digital transformation with a strong margin of safety supported by its cash-generative core businesses. Financial professionals should consider RIL’s evolving segment mix and monitor quarterly earnings for digital and fintech traction. The price target for RIL over the next 12 months is ₹1,750, implying upside potential of approximately 12% from current levels.

Valuation and Peer Comparison

Company | Market Cap (₹ Cr) | P/E Ratio | ROE (%) | Debt/Equity |

|---|---|---|---|---|

| Reliance Industries | 20,12,000 | 24.15 | 8.2 | 0.35 |

| Tata Consultancy Services (TCS) | 12,85,000 | 28.5 | 42.1 | 0.05 |

| HDFC Bank | 8,50,000 | 22.0 | 16.5 | 0.02 |

Reliance’s lower ROE compared to pure-play IT and banking peers reflects the capital-intensive nature of its refining and retail businesses. However, its diversified revenue streams and growth in digital assets provide a unique investment proposition.

Pros | Cons |

|---|---|

| Market leader in refining and telecom | Capital-intensive with moderate ROE |

| Strong digital & fintech growth potential | Regulatory risks in telecom & fintech |

| Robust cash flow & improved credit rating | Commodity price volatility impact |

Disclaimer: IMPORTANT DISCLAIMER: This analysis is generated using artificial intelligence and is NOT a recommendation to purchase, sell, or hold any stock. This analysis is for informational and educational purposes only. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making any investment decisions. The author and platform are not responsible for any investment losses.

Continue Your Investment Journey

Discover more insights that match your interests

Kaynes Technology: Can Electronics Manufacturing Localization Sustain Margins Amid Import Duties and Supply Chain Localization?

Kaynes Technology India Ltd (NSE: KAYNES) operates in India's burgeoning electronics manufacturing services (EMS) sector, capitalizing on government-led localization under PLI schemes and rising do...

Trident: Can Textile Export Diversification Sustain Margins Amid Global Demand Shifts and Raw Material Volatility?

Trident Ltd, a major player in India's textile and paper segments, derives over 70% of its revenue from exports, particularly home textiles to the US market, making it highly sensitive to global tr...

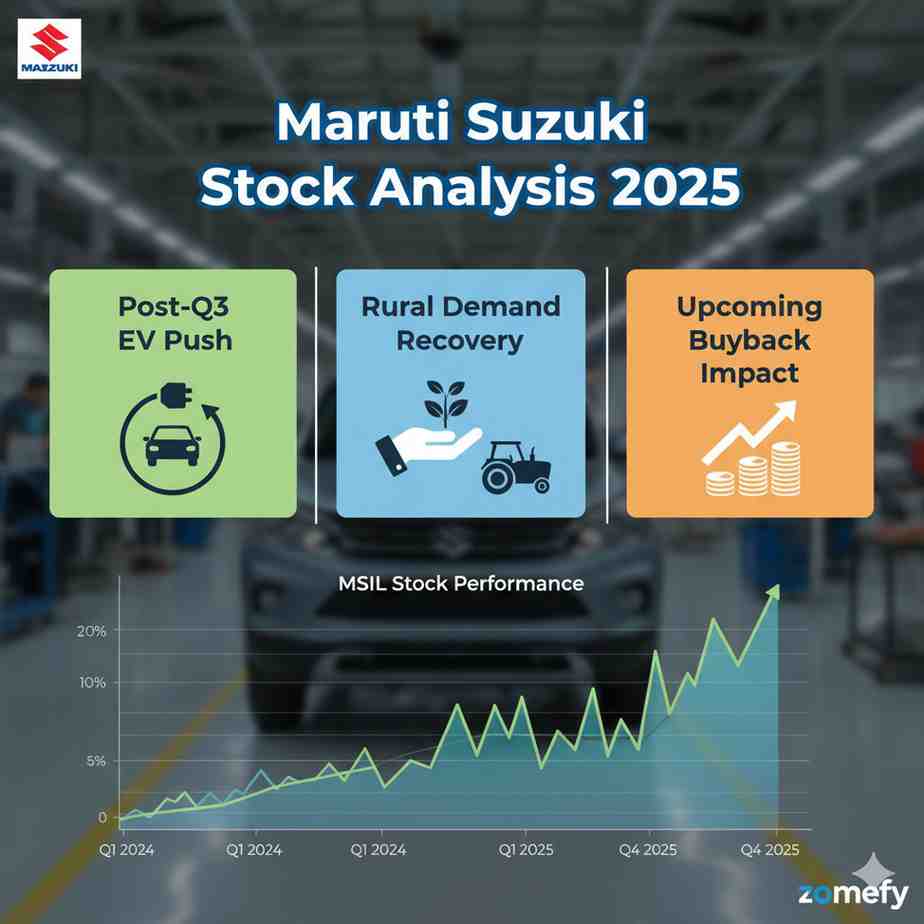

Maruti Suzuki Stock Analysis 2025: Post-Q3 EV Push, Rural Demand Recovery & Upcoming Buyback Impact

Maruti Suzuki India Limited (NSE: MARUTI), India's largest passenger vehicle manufacturer, has once again demonstrated its market dominance with stellar Q3 FY25 results announced on January 29, 2025.

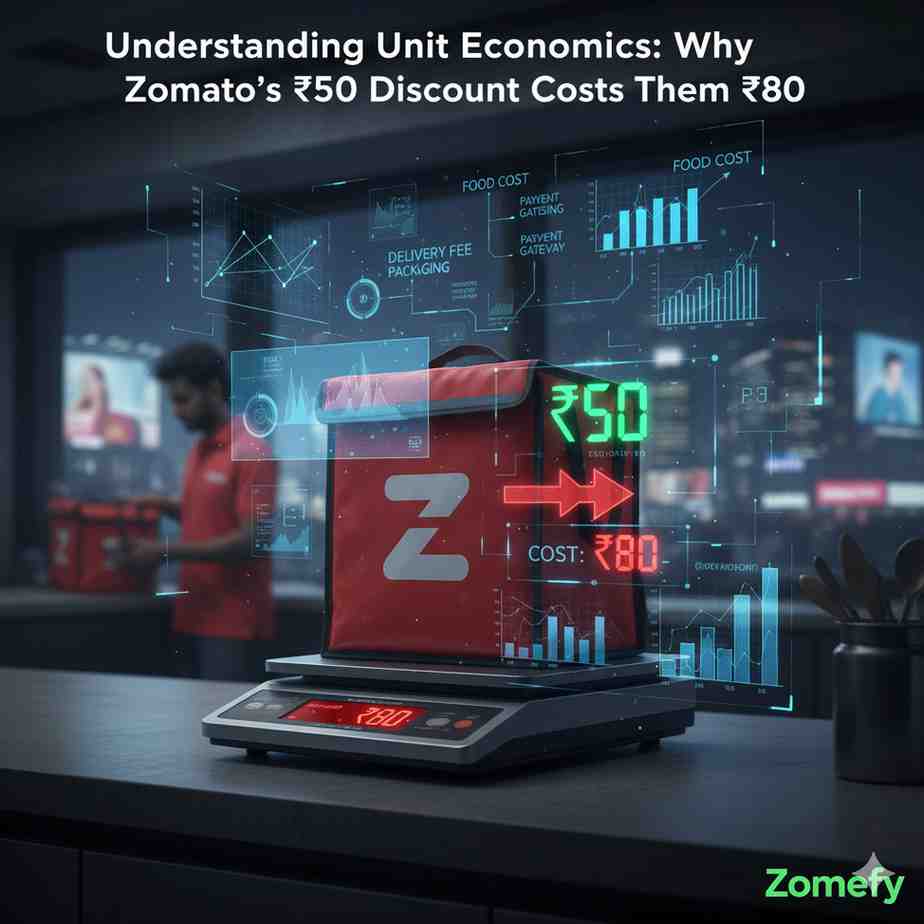

Understanding Unit Economics: Why Zomato's ₹50 Discount Costs Them ₹80

Deep dive into Zomato's unit economics revealing how a ₹50 customer discount actually costs ₹80. Learn about CAC, LTV, contribution margins, and what it means for startup investing.

Explore More Insights

Continue your financial education journey