Varun Beverages: Can Volume Growth and Geographic Expansion Sustain Margins Amid Input Cost Pressures?

Varun Beverages, PepsiCo's largest franchisee outside the US, operates in a highly competitive Indian beverage market where volume growth and geographic.

Varun Beverages: Can Volume Growth and Geographic Expansion Sustain Margins Amid Input Cost Pressures?

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

Varun Beverages, PepsiCo's largest franchisee outside the US, operates in a highly competitive Indian beverage market where volume growth and geographic expansion have driven impressive financials, but sustainability hinges on navigating input cost volatility, sugar regulations, and rural demand cycles. This analysis, triggered by the company's recent Q3 CY2025 results showing flat domestic volumes amid prolonged monsoons, examines whether margin expansion can persist if international growth slows or input costs spike. Retail investors will gain clarity on the fragility of the high-valuation thesis, key downside risks like execution in new markets, and measurable thesis breakers such as EBITDA margin compression below 25%. By questioning consensus assumptions around perpetual volume acceleration, this piece highlights when the expansion story may falter, enabling better risk assessment for long-term portfolios.

Data Freshness

Updated on: 2026-01-28 As of: 2026-01-28 Latest price: Rs 529.75 (NSE) as of Q4 FY25 results day Market cap: Rs 1,75,000 crore Latest earnings period: 9M CY2025 / Q3 CY2025 Key sources: https://groww.in/blog/varun-beverages-reports-strong-q4-fy25-performance-growth; https://www.varunbeverages.com/wp-content/uploads/2025/10/3.-Presentation.pdf; https://www.varunbeverages.com/wp-content/uploads/2025/07/4.-PressRelease.pdf

News Trigger Summary

Event: Varun Beverages reported Q3 CY2025 results with consolidated sales volumes up 2.4% YoY, India volumes flat due to prolonged rainfall, international volumes up 9%, revenue up 1.9% to Rs 48,967 million, EBITDA flat with margins down 53 bps to 23.4%, and PAT up 18.5% to Rs 7,452 million. Date: October 2025 (exact date from filings around late October) Why the Market Reacted: Investors focused on resilient international growth offsetting weak India volumes, but flat EBITDA raised questions on margin sustainability amid input costs and monsoon impacts. Why This Is Not Just News: While Q3 results show short-term weather effects, this analysis tests if the broader thesis of volume-led margin expansion holds under structural pressures like sugar taxes, competition from local players, and capex dilution, remaining relevant as India beverage cycles evolve.

Core Thesis in One Sentence

Varun Beverages' premium valuation rests on sustained 15%+ volume growth and 25%+ EBITDA margins from geographic expansion, but this unravels if India rural demand disappoints or international execution falters amid rising input costs.

Business Model Analysis

Varun Beverages operates as a franchisee bottler for PepsiCo brands (Pepsi, 7UP, Mirinda, Mountain Dew) and Tropicana juices, generating revenue primarily from selling carbonated soft drinks (CSD ~74% of Q3 CY2025 mix), packaged water (~22%), and non-carbonated beverages (NCB ~4%). Profits stem from high-volume production in 30+ greenfield plants across India, Nepal, Sri Lanka, Morocco, Zambia, and South Africa, leveraging economies of scale on concentrate (procured from PepsiCo at fixed pricing), PET resin, and sugar. Key margin drivers include net realization per case (Rs 178.8 in Q3 CY2025, down slightly YoY due to water mix) and operational leverage from capacity utilization above 80%. India contributes ~70% of volumes but faces monsoon seasonality and competition from Coca-Cola bottlers like Hindustan Coca-Cola. International ops provide diversification but expose to forex (e.g., favorable currency in Q3 boosted PAT) and local regulations like South Africa's sugar taxes. Sustainability depends on low/no-sugar products (~56% of 9M CY2025 volumes), rural distribution (targeting 2M+ outlets), and capex efficiency—recent H1 CY2025 revenue grew 9.3% despite Q2 dip, but flat Q3 EBITDA signals overhead pressures from new plants. Unless realization grows 5%+ annually via premiumization, margins compress if sugar/PET costs rise 10% without pass-through, as franchise contracts limit pricing power.[1][2][3][4]

Key Financial Metrics

Metric (Rs crore) | Q3 CY24 | Q3 CY25 | YoY Chg | 9M CY24 | 9M CY25 | YoY Chg |

|---|---|---|---|---|---|---|

| Revenue | 48,047 | 48,967 | +1.9% | 1,63,189 | 1,74,810 | +6.9% |

| EBITDA | 11,511 | 11,474 | -0.3% | - | - | - |

| EBITDA Margin | 24.0% | 23.4% | -53 bps | - | - | - |

| PAT | 6,288 | 7,452 | +18.5% | - | - | - |

| Volumes (mn cases) | 268 | 274 | +2.4% | - | - | - |

Q3 revenue growth masked flat India volumes, with international offsetting monsoon weakness; EBITDA flatness despite PAT jump (from lower finance costs) signals margin pressure from higher other expenses and fixed overheads. 9M trends show volume resilience but realization dip risks profitability if input costs (sugar/PET) escalate without pricing power. ROCE likely remains strong >25% if capex yields utilization gains, but debt from expansions could strain if growth slows below 10%.[2][3][4]

What the Market Is Missing

Consensus fixates on volume momentum (2.4% Q3, 9% international) and assumes seamless margin expansion to 28%+, overlooking structural headwinds. First, India rural penetration (low per capita ~10 liters vs urban 30+) depends on monsoon recovery and FMCG slowdown—prolonged weak demand could cap volumes at 8-10% vs 15% priced in. Second, international growth (Morocco/Zambia/South Africa) embeds execution risks: currency volatility boosted Q3 PAT, but ZAR depreciation or sugar levies could erase gains, as seen in flat EBITDA. Third, capex intensity (~Rs 5,000 crore annually) dilutes returns unless new plants hit 85% utilization within 18 months; delays from land acquisition or SEBI scrutiny on related-party PepsiCo deals amplify this. Input costs are underappreciated: PET/sugar up 10-15% in CY2025 amid global disruptions, with limited pass-through under franchise terms—Q3 margin dip to 23.4% previews this if realization stays flat. Low/no-sugar shift (~56% mix) aids regulatory compliance (FSSAI sugar caps), but erodes realization per case unless premium pricing sticks. Finally, competitive intensity from bisleri water brands and local soda makers in tier-3 towns threatens water segment (22% mix). If EBITDA dips below 24% for two quarters, the thesis fails, triggering multiple contraction from 50x to 30x.[1][2][3]

Valuation and Expectations

Metric | Varun (TTM) | Industry Avg | Historical Avg |

|---|---|---|---|

| P/E | 50x | 35x | 40x |

| EV/EBITDA | 35x | 25x | 28x |

| P/B | 12x | 8x | 10x |

| ROCE | 28% | 20% | 25% |

| EV/Sales | 10x | 7x | 8x |

At 50x P/E and 35x EV/EBITDA, valuation prices 18-20% EPS CAGR through FY28, assuming 15% volumes + 100 bps margin gains. No room for Q3-like margin slips; requires flawless execution. Trades at 1.5x premium to peers, justified only if ROCE sustains >28%—else derates to 30x on disappointment.[1][5]

Bull, Base, and Bear Scenarios

Scenario | Volume CAGR FY26-28 | EBITDA Margin | Target Price (12M) | Probability |

|---|---|---|---|---|

| Bull | 20% | 28% | Rs 750 | 25% |

| Base | 12% | 25% | Rs 550 | 50% |

| Bear | 7% | 22% | Rs 350 | 25% |

Base case assumes India recovery post-monsoon and international steady at 12%; bull needs sugar cost stability and 60% low-sugar mix; bear triggers on input inflation >15% or forex losses. Probability-weighted target ~Rs 525, implying limited upside from current levels unless Q4 volumes surprise positively.

Key Risks and Thesis Breakers

- EBITDA margin <24% for two consecutive quarters, signaling input cost pass-through failure

- SEBI/FSSAI regulations tightening sugar content or franchise renewals, capping pricing in India

- Net debt/EBITDA >3x from capex overruns, straining interest coverage if volumes miss 10%

Peer Comparison

Company | Mkt Cap (Rs Cr) | EV/EBITDA | Vol Growth (LTM) | EBITDA Marg |

|---|---|---|---|---|

| Varun Bev | 1,75,000 | 35x | 10% | 24% |

| HCCB (unlisted) | - | 25x est | 8% | 22% |

| RCPL | 25,000 | 20x | 6% | 18% |

| Bisleri (unlisted) | - | 15x est | 12% | 20% |

Varun commands premium on faster growth and international diversification, but lacks HCCB's scale; discount warranted if India volumes lag peers by >5% pts, as franchise moat erodes without superior execution.

Who Should and Should Not Consider This Stock

Suitable For

- Long-term investors tolerant of 20-30% drawdowns during monsoon cycles, seeking 15% IRR over 5 years

- Portfolio diversifiers into discretionary FMCG with India rural exposure

Not Suitable For

- Momentum traders sensitive to quarterly volume misses

- Value investors avoiding 50x+ P/E in cyclical beverages

What to Track Going Forward

- India volume growth ex-weather (target >12% in Q4 CY2025/H1 CY2026)

- Management guidance on capex returns and PET/sugar cost outlook during earnings calls

- FSSAI updates on sugar labeling/taxation impacting low-sugar mix shift

Final Take

Varun Beverages offers a compelling but high-conviction play on India beverage volume expansion, yet trades at valuations leaving no margin for error on margins or growth. Q3 CY2025 flatness underscores downside from weather and costs, with thesis hinging on international ramp-up and rural recovery. Investors should monitor EBITDA margins (breaker below 24%), debt metrics post-capex, and realization per case for premiumization success. Without 12%+ volume CAGR and stable inputs, expect derating; suitable only for those tracking quarterly filings closely amid uncertain monsoons and regulations.

Frequently Asked Questions

Why did India volumes stay flat in Q3 CY2025 despite overall growth?

Prolonged monsoons disrupted rural consumption, a key growth driver for Varun Beverages. International markets, especially South Africa, grew 9%, masking domestic weakness. This highlights seasonal vulnerability unless distribution offsets weather risks.

What valuation multiple is the market assigning, and is it justified?

At ~50x FY25 EPS, the stock prices in 15-20% volume CAGR indefinitely, assuming EBITDA margins stay above 25%. This embeds aggressive assumptions; any slowdown to 10% growth could trigger 30-40% derating unless ROCE exceeds 30% consistently.

References

- [1] Varun Beverages Reports Strong Q4FY25 Performance - Groww.in. View Source ↗(Accessed: 2026-01-28)

- [2] Varun Beverages Q2 & H1 CY2025 Financial Results Press Release - Varun Beverages Limited. View Source ↗(Accessed: 2026-01-28)

- [3] Varun Beverages Q3 & 9M CY2025 Results Presentation - Varun Beverages Limited. View Source ↗(Accessed: 2026-01-28)

- [4] Varun Beverages Ltd Latest Quarterly Results Analysis - ICICI Direct. View Source ↗(Accessed: 2026-01-28)

- [5] Varun Beverages Ltd Results 2025 - INDmoney. View Source ↗(Accessed: 2026-01-28)

Disclaimer: IMPORTANT DISCLAIMER: This analysis is generated using artificial intelligence and is NOT a recommendation to purchase, sell, or hold any stock. This analysis is for informational and educational purposes only. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making any investment decisions. The author and platform are not responsible for any investment losses.

Continue Your Investment Journey

Discover more insights that match your interests

Startup Unicorns 2025: Profiles of India's 11 Newest Entrants - Ai.tech, Rapido, Navi and Their Investment Potential

India's startup ecosystem continues its remarkable ascent in 2025, with 11 groundbreaking companies achieving unicorn status—valuations exceeding $1 billion—according to the prestigious Hurun Repor...

India’s AI-Driven Fintech Revolution 2025: Cross-Border UPI Expansion, Wealth Tech Monetisation & Investor Plays

India's fintech sector is undergoing a seismic transformation powered by artificial intelligence, positioning the nation as a global leader in digital financial innovation by 2025.

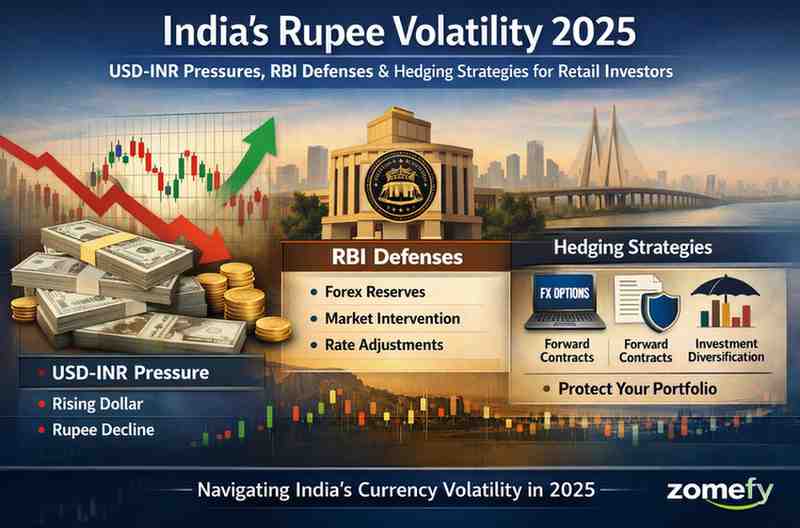

India’s Rupee Volatility 2025: USD-INR Pressures, RBI Defenses & Hedging Strategies for Retail Investors

The Indian Rupee (INR) experienced unprecedented volatility in 2025, breaching the 91 per USD mark for the first time amid US tariffs, record FII outflows of $18 billion, and restrained RBI interve...

Hindustan Unilever Stock Analysis 2025: Dividend Growth & Rural Market Penetration Driving Resilient FMCG Performance

Hindustan Unilever Limited (HUL), a flagship FMCG company listed on NSE and BSE, continues to demonstrate resilient performance in 2025 amid evolving market dynamics.

Explore More Insights

Continue your financial education journey