Index Funds vs Active Funds: Which Wins in 2025?

Complete comparison of index funds vs active funds for 2025. Analyze performance, costs, and suitability to make informed investment decisions between passive and active investing.

Index Funds vs Active Funds: Which Wins in 2025?

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

The debate between index funds and active funds has intensified in recent years, with both approaches offering distinct advantages. Index funds provide low-cost, market-matching returns, while active funds aim to outperform the market through skilled fund management. As we enter 2025, understanding the pros and cons of each approach is crucial for making informed investment decisions that align with your financial goals and risk tolerance.

Understanding Index Funds vs Active Funds

Index Fund Characteristics

Active Fund Characteristics

Performance Analysis: 2025 Perspective

Large Cap Fund Performance

Mid & Small Cap Performance

Cost Analysis: The Expense Ratio Impact

Cost Impact Examples

Hidden Costs

Market Efficiency & Outperformance Potential

Efficiency Analysis

Outperformance Factors

Risk & Volatility Comparison

Risk Analysis

Risk-Adjusted Returns

Suitability Analysis

Index Fund Suitability

Active Fund Suitability

Hybrid Approach: Best of Both Worlds

Portfolio Construction

Implementation Strategy

2025 Market Outlook & Recommendations

Market Trends

Conclusion

Frequently Asked Questions

Which is better for beginners: index funds or active funds?

Index funds are generally better for beginners due to their simplicity, low costs, and predictable performance. They provide market-matching returns without the complexity of fund manager selection or performance evaluation. Beginners can start with index funds and gradually learn about active funds as they gain experience.

Can active funds consistently outperform index funds?

Studies show that only 20-30% of active funds consistently outperform their benchmarks over long periods. In large cap space, this percentage is even lower (10-20%). However, in mid and small cap spaces, skilled fund managers have better chances of outperformance due to market inefficiencies.

What are the hidden costs of active funds?

Active funds have several hidden costs beyond the expense ratio: higher transaction costs due to frequent trading, potential tax impact from higher turnover, performance fees in some funds, and opportunity costs from cash holdings. These costs can significantly impact net returns over time.

How do I choose between index and active funds?

Consider your investment goals, risk tolerance, and cost sensitivity. If you want low-cost, predictable returns and are comfortable with market performance, choose index funds. If you seek outperformance, are willing to pay higher costs, and can evaluate fund managers, consider active funds. Many investors use a hybrid approach with both.

What is the ideal allocation between index and active funds?

A balanced approach typically allocates 60-70% to index funds and 30-40% to active funds. For large cap exposure, use more index funds (70-80%). For mid and small cap exposure, use more active funds (60-70%). The exact allocation depends on your risk tolerance, investment goals, and market outlook.

Disclaimer: This analysis is for educational purposes only and should not be considered as investment advice. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making investment decisions. Mutual fund investments are subject to market risks.

Continue Your Investment Journey

Discover more insights that match your interests

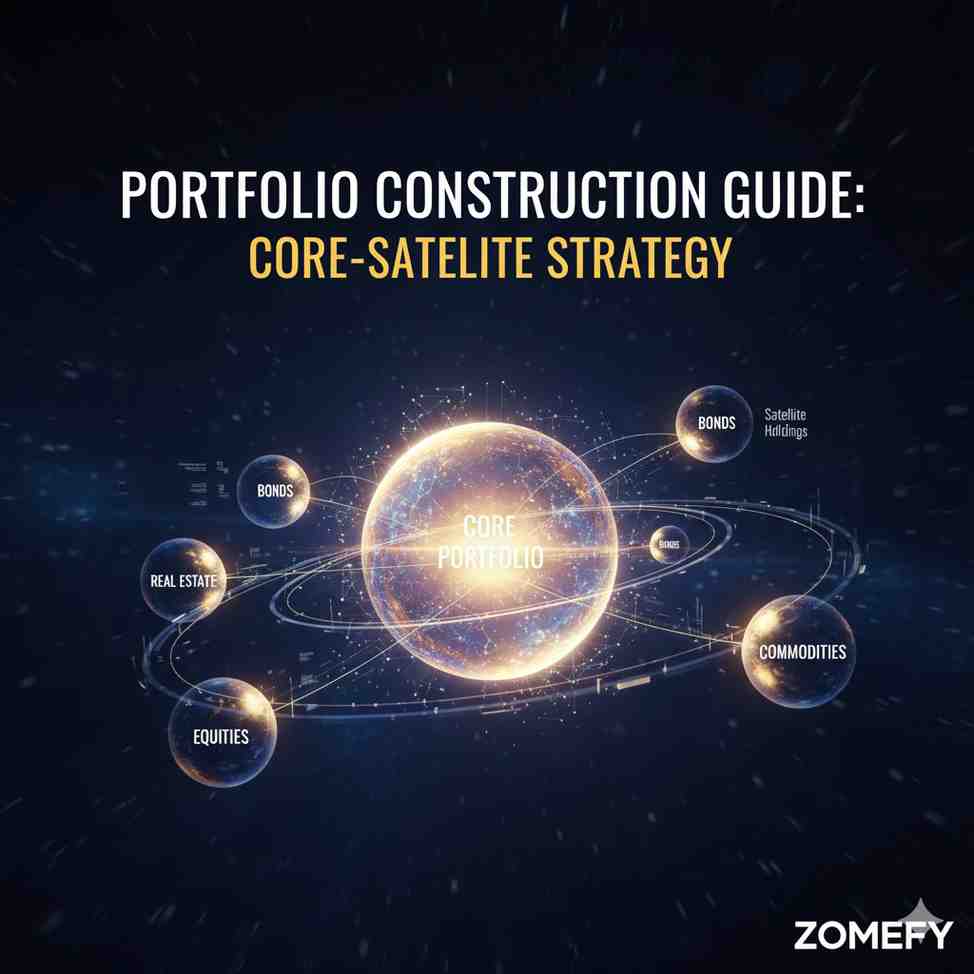

Portfolio Construction Guide: Core-Satellite Strategy

Step-by-step guide to building a diversified portfolio using core-satellite strategy with mutual funds and direct equity.

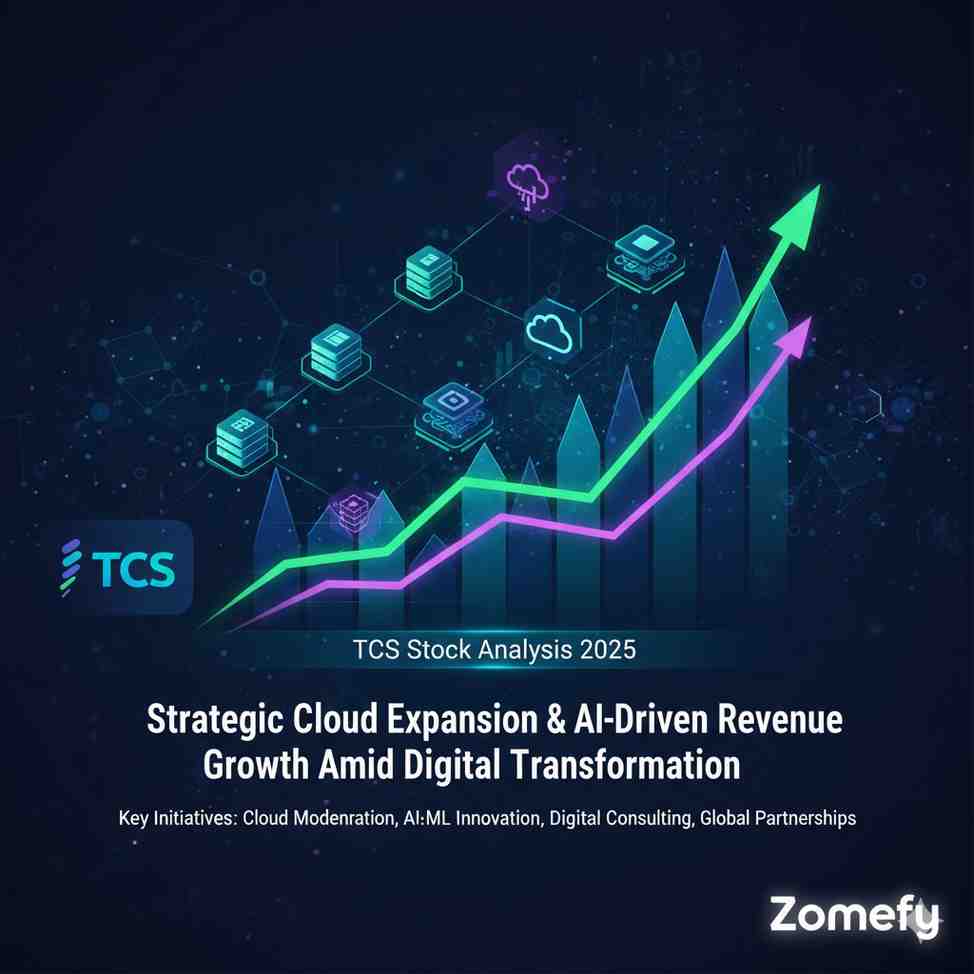

TCS Stock Analysis 2025: Strategic Cloud Expansion & AI-Driven Revenue Growth Amid Digital Transformation

Tata Consultancy Services (TCS), India's largest IT services company and a bellwether for the Indian IT sector, is strategically navigating the evolving digital landscape through aggressive cloud e...

Mutual Fund Tax Planning 2025: Equity vs Debt Explained

Complete guide to mutual fund tax planning for 2025 with equity vs debt tax implications. Learn about LTCG, STCG, and tax-efficient investment strategies.

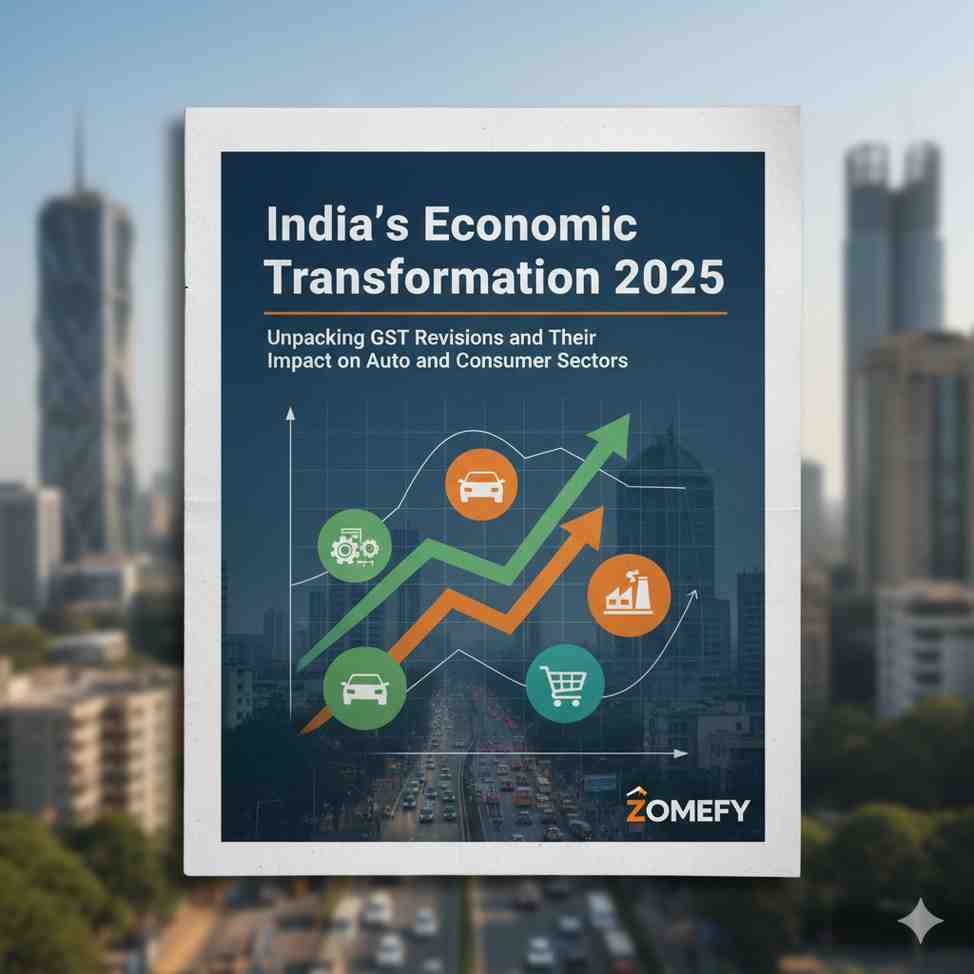

India's Economic Transformation 2025: Unpacking GST Revisions and Their Impact on Auto and Consumer Sectors

India’s economic landscape is undergoing a profound transformation in 2025, driven by landmark reforms to the Goods and Services Tax (GST) regime.

Explore More Insights

Continue your financial education journey