Oil & Gas Sector Valuation: Integrated vs Pure-Play Analysis

Comprehensive oil & gas sector valuation analysis with integrated vs pure-play framework. Analyze Reliance, ONGC, Oil India, GAIL performance and investment opportunities in Indian oil & gas sector.

Oil & Gas Sector Valuation: Integrated vs Pure-Play Analysis

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

The Indian oil & gas sector is characterized by two distinct business models: integrated companies with end-to-end operations and pure-play companies focused on specific segments. As we enter 2025, understanding the integrated vs pure-play dynamics becomes crucial for investors. This comprehensive analysis examines the oil & gas sector's valuation metrics, business models, and investment opportunities.

Oil & Gas Sector Overview 2025

Sector Characteristics

2025 Growth Outlook

Integrated vs Pure-Play Analysis

Integrated Model

Pure-Play Model

Company-Specific Analysis

Reliance Industries - The Integrated Leader

ONGC - The Exploration Leader

Oil India - The Pure-Play Explorer

GAIL - The Gas Leader

Energy Transition Impact

Renewable Energy

Clean Fuels

Valuation Framework & Metrics

Valuation Metrics

Investment Framework

Investment Recommendations

Top Picks by Category

Risk Management

Conclusion

Frequently Asked Questions

What are the key differences between integrated and pure-play oil & gas companies?

Integrated companies have end-to-end operations from exploration to retail with diversified revenue streams and risk mitigation. Pure-play companies focus on specific segments like exploration, refining, or marketing with specialized expertise and operational efficiency. Both models have their advantages and challenges.

What are the key growth drivers for oil & gas sector in 2025?

Key growth drivers include energy transition towards renewable energy and clean fuels, infrastructure development and industrial demand, export opportunities for refined products, government support for energy security and transition, and investment in renewable energy infrastructure and clean technologies.

How to evaluate oil & gas sector companies for investment?

Evaluate companies based on energy transition strategy and execution, business model and diversification, financial health and cash flows, growth prospects and expansion plans, ESG practices and sustainability focus, and competitive advantages and market position. Consider both fundamental analysis and technical analysis for better decision making.

What are the key risks in oil & gas sector investments?

Key risks include energy transition challenges and disruption, volatile commodity prices and market cycles, regulatory changes and environmental compliance, competition and market share loss, and technology disruption and innovation risks. Diversification and risk management are crucial.

How to value oil & gas sector companies?

Use multiple valuation methods: P/E ratios (5-20x range), P/B ratios (0.5-3x range), EV/EBITDA (3-12x range), and DCF analysis considering energy transition impact. Consider energy transition strategy, business model diversification, and competitive advantages. Focus on companies with strong fundamentals and growth prospects.

Disclaimer: This analysis is for educational purposes only and should not be considered as investment advice. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making investment decisions. Oil & gas sector investments are subject to market risks and energy transition challenges.

Continue Your Investment Journey

Discover more insights that match your interests

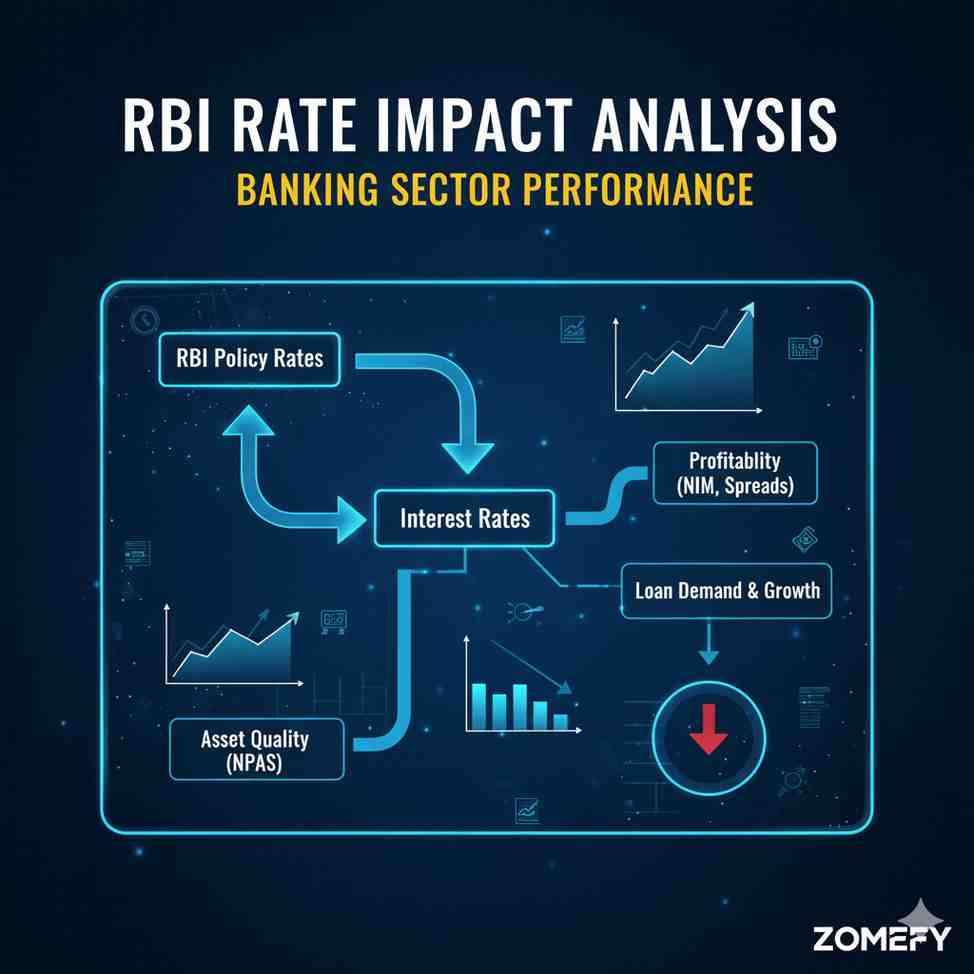

RBI Rate Impact Analysis: Banking Sector Performance

Comprehensive analysis of how RBI rate changes impact banking sector performance with historical data and future outlook.

Crypto 2025: How Blockchain, AI, and Tokenization Are Shaping the Next Financial Revolution

Comprehensive analysis of crypto market trends for 2025, covering blockchain technology, AI integration, tokenization, and regulatory developments shaping the future of finance.

Small Cap Mutual Funds 2025: High Risk, High Reward Champions

Explore small cap mutual funds for 2025 with high risk, high reward analysis. Compare top performing small cap funds with growth potential and investment strategies.

Multiple Timeframe Analysis: Professional Trading Strategy for Indian Markets

Master multiple timeframe analysis for professional trading in Indian markets. Learn top-down analysis and timeframe confluence.

Explore More Insights

Continue your financial education journey