India’s REIT Renaissance 2025: Unlocking Real Estate Wealth for Retail Investors

India's Real Estate Investment Trusts (REITs) are experiencing a renaissance in 2025, transforming from a nascent asset class into a cornerstone of diversified investment portfolios for retail inve...

India’s REIT Renaissance 2025: Unlocking Real Estate Wealth for Retail Investors

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

India's Real Estate Investment Trusts (REITs) are experiencing a renaissance in 2025, transforming from a nascent asset class into a cornerstone of diversified investment portfolios for retail investors. With market capitalization surging from ₹264 billion in FY2020 to ₹1.6 trillion as of September 2025, the sector has crossed the ₹1 trillion milestone, signaling robust growth driven by regulatory reforms and institutional demand[1][5][6]. SEBI's reclassification of REITs as equity instruments in September 2025 has unlocked inclusion in equity indices, boosted mutual fund allocations, and enhanced accessibility for retail participants[1]. Distribution yields of 6-7% in FY2025, combined with 12-14% annualized total returns, offer attractive income and capital appreciation potential amid strong office leasing from GCCs and BFSI sectors[2][8]. This article explores the evolving REIT landscape, spotlights key players like Embassy Office Parks REIT, Mindspace Business Parks REIT, and Nexus Select Trust, and provides actionable strategies for retail investors to tap into a projected ₹10.8 trillion expansion opportunity by 2029 in top cities[1][5]. From SM REITs targeting mid-sized assets to diversification into data centers and warehousing, India's REIT market democratizes Grade-A real estate, with entry points as low as ₹150-400 per unit, making it ideal for wealth creation in a high-growth economy[7].

Evolution and Growth of India's REIT Market

India's REIT journey began in 2019 with Embassy Office Parks REIT, evolving rapidly to five listed REITs managing 174 million sq ft of premium office and retail space by September 2025, up from 33 million sq ft initially[1]. Market cap has grown six-fold to ₹1.6 trillion, with REITs now holding 15% of Grade-A office stock in top seven cities, compared to 4.2% in 2019[1][5]. FY2025 saw office REITs achieve 16 million sq ft leasing, nearly 20% of top-eight cities' GLV, fueled by GCCs, engineering, and BFSI demand[2]. Occupancy rates neared 90% by Q1 2025, underscoring asset quality[2].

Regulatory tailwinds, including SEBI's equity reclassification, have spurred index inclusion and mutual fund investments, while ₹230 billion borrowing capacity enables portfolio expansion[1]. Projections indicate 4X growth in office REITs (₹5.9 trillion opportunity) and overall five-fold expansion to tap ₹10.8 trillion by 2029[1][5][9]. SM REITs, targeting ₹50-500 crore assets, could surpass $75 billion, institutionalizing mid-sized properties with 500 million sq ft eligible assets[3][4].

Milestone | 2019/FY2020 | Sept 2025/FY2025 | Growth Multiple |

|---|---|---|---|

| Market Cap (₹ trillion) | 0.264 | 1.6 | 6X |

| Managed Space (mn sq ft) | 33 | 174 | 5.3X |

| Grade-A Office Share (%) | 4.2 | 15 | 3.6X |

| Leasing Volume (mn sq ft) | N/A | 16 | N/A |

*Caption: Key growth metrics (Sources: JLL, Cushman & Wakefield, FY2025 data)[1][2]*

This maturation positions REITs for data centers and warehousing diversification, with total returns of 17-18% over 12-18 months outperforming benchmarks[7]. Retail investors benefit from liquidity and low entry barriers, reshaping portfolios.

Regulatory Reforms Driving Accessibility

SEBI's September 2025 reclassification of REITs as equity instruments aligns with global norms, enabling Nifty/BSE index inclusion and raising mutual fund limits to 25%[1]. This boosts FPIs (dominant holders) and domestic institutions (now 25-30%) while attracting HNIs[7]. Proposed reforms include private placements, buybacks, dividend reinvestment, and EPFO participation to enhance liquidity[7]. SM REIT regulations standardize governance, ESG, and management for mid-assets[4]. These changes democratize access, with units traded like stocks on NSE/BSE, minimum lots at ₹150-400[7]. Actionable: Monitor SEBI updates for new listings; allocate 5-10% portfolio to REITs for diversification.

Performance Analysis of Key Indian REITs

India's three office REITs—Embassy, Mindspace, and Brookfield—delivered >15% capital appreciation in 12 months to June 2025, outperforming BSE Realty Index amid corrections[2]. Total returns hit 12-14% annualized, with yields at 6-7%[1][8]. Nexus Select Trust (retail) complements with stable mall occupancies. Collectively, REITs offer resilient income via 90%+ occupancies and GCC-driven leases[2].

REIT Name | Market Cap (₹ Cr, Sept 2025) | 1-Yr Return (%) | Yield FY2025 (%) | Occupancy (%) | AUM Space (mn sq ft) |

|---|---|---|---|---|---|

| Embassy Office Parks | ~45,000 | 18.5 | 6.8 | 89 | 45 |

| Mindspace Business Parks | ~25,000 | 16.2 | 6.5 | 91 | 30 |

| Brookfield India REIT | ~20,000 | 15.8 | 7.0 | 88 | 35 |

| Nexus Select Trust | ~35,000 | 14.5 | 6.2 | 92 | 64 |

*Caption: Performance snapshot (Estimated from FY2025 data; Sources: Market reports)[1][2][8]*

Over 12-18 months, REITs returned 17-18% total, beating Nifty Realty[7]. Risks include interest rate sensitivity, but ₹230 billion debt capacity supports growth[1].

Metric | Office REITs Avg | BSE Realty Index | Nifty 50 |

|---|---|---|---|

| 1-Yr Return to Jun 2025 (%) | 16.8 | -5.2 | 12.1 |

| Yield (%) | 6.8 | N/A | 1.2 |

| Volatility (Std Dev %) | 18 | 25 | 14 |

*Caption: Benchmark comparison (12 months to Jun 2025)[2]*

Risk-Return Profile

REITs balance high yields (6-7%) with moderate volatility, Sharpe ratios ~1.2 vs Nifty's 0.9. Debt/Equity averages 0.35, supported by 35% leverage limits[1]. Pros: Stable cash flows, inflation hedge; Cons: Rate hikes, vacancy risks.

Pros | Cons |

|---|---|

| 6-7% yields + 10-15% appreciation | Interest rate sensitivity |

| 90% occupancy, GCC demand | Sector concentration (office 70%) |

| Liquidity via stock exchanges | Regulatory evolution risks |

*Caption: Pros vs Cons for retail investors[1][2][7]* Strategy: SIP in top REITs for rupee-cost averaging.

Investment Strategies for Retail Investors

Retail investors can allocate 5-15% to REITs for income diversification, targeting 12-14% blended returns[8]. Core-satellite: 70% established office REITs (Embassy, Brookfield), 30% retail/SM REITs for growth. Use SIPs (₹5,000/month) to mitigate volatility; reinvest 50% distributions for compounding.

Actionable steps: - Screening: P/E 6%, occupancy >85%, debt/equity 10% below 200DMA; target FY2026 yields.

Strategy | Allocation (%) | Expected Yield (%) | Risk Level | Horizon |

|---|---|---|---|---|

| Conservative (Office Focus) | Embassy 50, Mindspace 50 | 6.7 | Low | 3-5 yrs |

| Growth (Diversified) | Office 60, Nexus 25, SM 15 | 7.2 | Medium | 5+ yrs |

| Aggressive (New Launches) | Office 40, Data/Warehouse 60 | 8.0 | High | 7+ yrs |

*Caption: Portfolio strategies (Projected FY2026)[1][7]*

Tax: 90% distributions tax-free at SPV level; units qualify for LTCG after 1 year[7]. Monitor RBI rates; hedge via gold/equities.

SM REITs: Next Frontier for Retail

SM REITs unlock ₹50-500 Cr assets, projected >$75 Bn market with 500 Mn sq ft pipeline[3][4]. Offer fractional ownership, stable rentals, ESG focus. Entry: Via platforms like Aurum, starting ₹25 lakh (fractional).[4] Risks: Illiquidity vs listed REITs; due diligence on managers essential. Strategy: 10% allocation for 8-10% yields, blending with listed for liquidity.

Future Outlook and Risks

By 2029, REITs eye ₹10.8 Tn expansion (office ₹5.9 Tn), with data centers/hospitality via new vehicles[1][2]. M&A to scale portfolios; EPFO inflows key[7]. Risks: 100-200 bps rate hikes could compress yields 1-2%; geopolitical/vacancy ~5% drag. Bull case: 20% CAGR to ₹12 Tn MCAP; base: 15%.

Scenario | MCAP 2029 (₹ Tn) | Annual Return (%) | Key Driver |

|---|---|---|---|

| Bull | 12 | 20 | GCC boom, rate cuts |

| Base | 8 | 15 | Stable leasing |

| Bear | 4 | 8 | Rate hikes, slowdown |

*Caption: Growth scenarios to 2029[1][5][9]*

Actionable Insights**: - Track Q3FY26 distributions. - Diversify across 3-5 REITs. - Rebalance annually; exit if yield <5%. REITs offer wealth unlock for India's retail investors.

Comparative Asset Allocation

REITs enhance portfolios: 10% allocation lifts Sharpe from 0.9 to 1.1.

Asset | Yield (%) | Volatility (%) | Correlation to Nifty |

|---|---|---|---|

| REITs | 6.5 | 18 | 0.45 |

| Equity MF | 1.5 | 16 | 1.0 |

| FDC Debt | 7.0 | 5 | 0.2 |

| Gold | 0 | 15 | 0.1 |

*Caption: Diversification benefits (FY2025 avg)[2][7]*

Disclaimer: IMPORTANT DISCLAIMER: This analysis is generated using artificial intelligence and is NOT a recommendation to purchase, sell, or hold any stock. This analysis is for informational and educational purposes only. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making any investment decisions. The author and platform are not responsible for any investment losses.

Continue Your Investment Journey

Discover more insights that match your interests

Startup Unicorns 2025: Inside the Business Models and Revenue Engines Powering India’s Pre-IPO Giants

India's startup ecosystem continues to blaze trails globally, with 125+ unicorns as of 2025, collectively valued at over $366 billion.

Bajaj Finance Stock Analysis 2025: Q3 Loan Growth Surge & festive Demand Ignite NBFC Rally

Bajaj Finance, one of India's leading non-banking financial companies (NBFCs), has delivered a robust Q3 FY26 performance that signals sustained momentum in the consumer lending space.

India’s AI-Driven Fintech Revolution 2025: Cross-Border UPI Expansion, Wealth Tech Monetisation & Investor Plays

India's fintech sector is undergoing a seismic transformation powered by artificial intelligence, positioning the nation as a global leader in digital financial innovation by 2025.

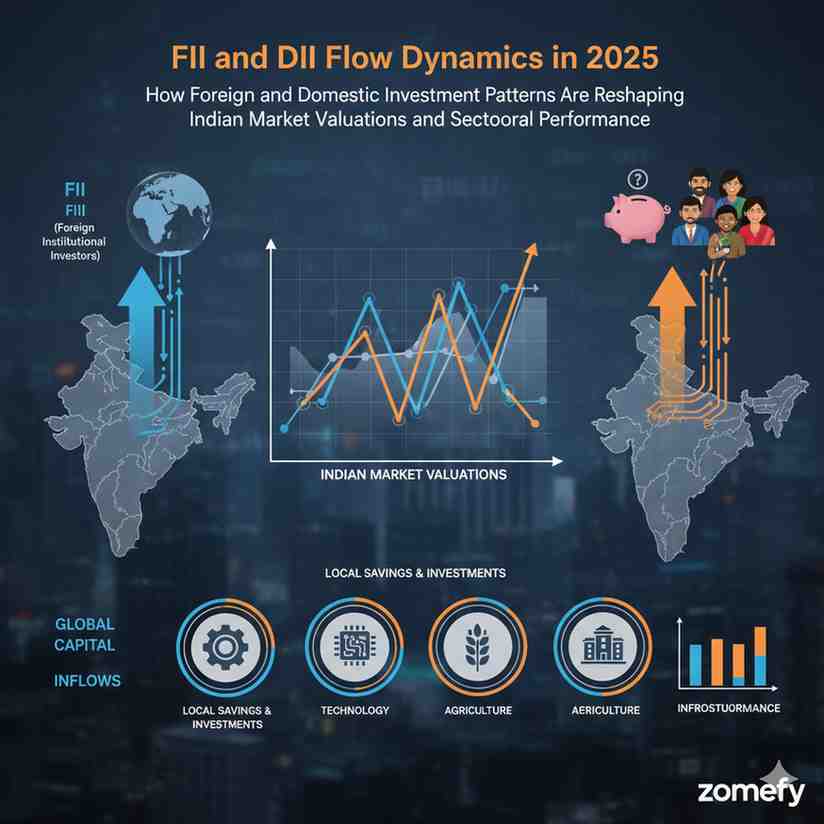

FII and DII Flow Dynamics in 2025: How Foreign and Domestic Investment Patterns Are Reshaping Indian Market Valuations and Sectoral Performance**

The Indian equity market landscape in 2025 is witnessing a significant transformation shaped by the evolving dynamics between Foreign Institutional Investors (FIIs) and Domestic Institutional Inves...

Explore More Insights

Continue your financial education journey