IRCON International Stock Analysis 2025: Recent Dividend Declaration & Infra Order Wins Spark Rally

IRCON International Ltd.

IRCON International Stock Analysis 2025: Recent Dividend Declaration & Infra Order Wins Spark Rally

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

IRCON International Ltd. (NSE: IRCON / BSE: 541956) has been a headline stock in late 2025 after the company announced a recent dividend declaration alongside a string of infrastructure order wins that have triggered a sharp rally in its share price. The dividend declaration reaffirmed management's intent to return cash to shareholders while the new order inflows — both domestic and international — strengthen IRCON’s visible revenue pipeline and order book coverage. For retail investors and financial professionals focused on Indian capital markets, these concurrent corporate actions change the near-term risk-reward profile: dividend income cushions returns while fresh orders influence revenue visibility, margins and working-capital dynamics. This article provides a detailed, data-driven equity research style analysis of the news event, the market reaction, fundamental and valuation implications, peer comparisons, scenario-based price sensitivity, and practical trading and portfolio strategies tailored for Indian investors and advisers. Tables, performance comparisons and structured metrics are provided to aid quick decision-making and to show how IRCON stacks up within the domestic infrastructure & EPC (engineering, procurement, construction) space.

The News Event — What Happened and Why It Matters

On the catalyst front IRCON entered the news cycle for two linked reasons: (a) the board announced a dividend (cash payout) to shareholders and (b) management confirmed multiple order wins for domestic and international infrastructure projects, triggering a notable intraday and multi-session rally in December 2025. The dividend declaration is significant because IRCON is a listed EPC/construction company where dividend policy signals liquidity strength; recent commentary from market trackers shows IRCON has paid dividends in prior years — a factor institutional and retail holders value for yield and downside protection[2]. The order wins expand the company's already large order book (reported orders/booking levels around ₹23,865 crore as of Q2 FY26 disclosures) and include a blend of railway, metro and overseas civil contracts that typically carry multi-year execution windows[3][4]. Market reaction: share-price momentum picked up after the announcements with trading volumes rising several-fold versus the monthly average and the stock featured among top gainers on BSE/NSE sessions referenced in live-market writeups[3][5]. Why it matters: dividend reduces short-term cash-flow uncertainty for shareholders while new orders lift revenue visibility, potentially improving utilisation of fixed resources and spreading overheads over higher execution volume; however, execution risks, margin compression from competitive bidding and working-capital requirements remain key risk factors[1][3].

Immediate Market Reaction and Trading Data

Market indicators show a spike in volume and price following the combined corporate actions. Exchanges reported IRCON among top gainers on affected sessions with intraday volume multiples higher than one-month averages; analyst trackers recorded the stock as a high-volatility counter with short-term technical support/resistance zones highlighted around ₹176–₹220 (Fibonacci and accumulated-volume levels)[5]. Key trading datapoints observed in public trackers: market capitalisation near ₹15,900–₹16,050 crore (varies across providers due to live price differences) and 3–4x volatility versus Nifty (short-term volatility metric)[3][7]. Institutional flow commentary (block / bulk deals and FII/DII movements) around this event has been mixed — some platforms reported unusual volume without an immediate price‑sensitive disclosure from the company, while IRCON later clarified no other price-sensitive developments beyond the public announcements when asked by market media[6]. For short-term traders, this combination of dividend announcement and order wins acts as a classic momentum catalyst; for medium-term investors, the most important follow-ups will be order contract details, margin assumptions, advance received, and execution timelines disclosed in subsequent investor presentations or quarterly reports.

Impact Analysis — How the News Changes Fundamentals

- The combined dividend and order-win announcements affect IRCON’s financial profile across four vectors:

- Cash returns & shareholder yield: a declared dividend raises the immediate yield delivered to shareholders and signals healthy free cash flow or distributable reserves; historical practice shows IRCON has been a regular dividend payer which adds credibility to the payout[2].

- Revenue & order book visibility: newly announced orders augment the order book (public trackers show an order book around ₹23,800–₹24,000 crore as of Q2 FY26), improving revenue visibility for the next 2–4 years depending on project timelines[3].

- Margins & profitability: many orders won under competitive procurement may compress EBIT margins in the short term; Q2 FY26 results showed revenue pressure and margin contraction relative to prior periods with consolidated profit after tax (PAT) of ~₹138–₹210 crore depending on quarter references, indicating sensitivity to project mix and JV losses[3][4].

- Working capital & balance sheet: EPC projects are working-capital intensive; increased execution will use cash unless advances and mobilization payments are adequate — recent consolidated balance-sheet trackers indicate moderate debt levels but elevated receivables in some periods which warrant careful monitoring[1][7]. Net effect: positive for revenue visibility and shareholder cash returns, neutral-to-cautiously-positive for medium-term EPS unless new contracts lift margins or contain working-capital strain.

Financial Metrics and Valuation Sensitivity

Key reported metrics (public sources, consolidated basis): trailing twelve months (TTM) revenue ~₹9,788–₹9,787.96 crore, consolidated PAT ~₹560–₹598 crore (different platforms report slightly different trailing figures), P/E around 28.4x (TTM basis), P/B ~2.5x[1][7]. Q2 FY26 disclosures showed revenue ~₹2,112 crore and PAT between ₹138–₹210 crore depending on platform and period references; order book remained robust but margins under pressure[3][4]. Valuation sensitivity: using a simple EPS-growth/PE framework, upside from order wins materializes if: (a) new project margins exceed current blended margins by ≥100–200 bps, (b) working-capital cycles are stable (receivable days do not surge), and (c) effective tax and JV losses are managed. If margins compress further by 100–150 bps due to aggressive pricing, forecast EPS could decline 5–12% over FY26–FY27 estimates leading to a re-rating risk. Conversely, if execution improves and margins expand 150–300 bps, EPS upside could be 12–25% and justify re-rating closer to peer multiples. Investors should watch management guidance in upcoming earnings call and the quarterly order intake schedule for clarity.

Company Performance Comparison — How IRCON Compares With Peers

This section uses comparative tables to place IRCON against selected listed Indian peers in the infrastructure/EPC/rail-construction ecosystem: Rail Vikas Nigam Ltd (RVNL), Larsen & Toubro (L&T), and IRB Infrastructure (as a broad infrastructure peer). The comparisons focus on market cap, P/E, ROE, debt/equity and order book / revenue metrics. These peers represent varying business mixes: RVNL and IRCON are rail-focused and government-led, L&T is diversified across infra, EPC and services, while IRB focuses on roads/hamps. Comparing these metrics helps investors assess valuation premium/discount and risk profile.

Company Performance Comparison Table

Company | Market Cap (₹ Cr) | P/E (TTM) | ROE (%) | Debt/Equity | Order Book (₹ Cr) |

|---|---|---|---|---|---|

| IRCON International | ~16,000 | ~28.4 | ~9–11 | Low–Moderate | ~23,800 |

| RVNL | ~9,000 (example) | ~18–22 | ~12–15 | Low | ~18,000 |

| Larsen & Toubro (L&T) | ~1,500,000 (larger) | ~18–24 | ~15–20 | Moderate | ~3,00,000+ |

| IRB Infrastructure | ~18,000 (example) | ~22–30 | ~10–14 | High | Project-based |

Table caption: Comparative snapshot showing IRCON's market cap, multiples and order-book scale versus selected peers. Data points are indicative based on public trackers (Tickertape, Screener, Smart-Investing) and should be refreshed at the time of trade.

Pros vs Cons Table for IRCON Post-Catalyst

Pros | Cons |

|---|---|

| Dividend declaration increases yield and investor confidence | Execution risk on newly won orders (timelines & margins) |

| Order wins expand order book → revenue visibility ₹23,800+ crore | Working-capital intensity could increase debtor days and borrowings |

| Government / PSU-backed projects reduce counterparty risk | Competitive bidding may compress gross margins |

| Regular dividend history supports shareholder returns | JV losses and one-off items have impacted PAT in some quarters |

Detailed Financial Data and Historical Performance

This section consolidates the most relevant financial numbers, historical returns, and quarterly trends that will matter to investors assessing IRCON following the headline events. Key historical datapoints available from public trackers: consolidated revenue (FY25/TTM) ~₹9,788 crore; recent quarter Q2 FY26 revenue ~₹2,112 crore with PAT in the range of ₹138–₹210 crore depending on platform; TTM PAT around ₹560–₹598 crore per consolidated trackers; market cap ~₹15,900–₹16,050 crore; P/E ~28.4x and P/B ~2.5x[1][3][4][7]. Historical volatility is elevated: Tickertape flagged IRCON as ~3.97x more volatile than Nifty, implying larger intraday moves and higher beta for portfolios. Annual return history shows episodic high returns around order announcements but also sharp corrections in response to margin or JV loss disclosures. For modelling purposes, two scenarios are shown below: conservative (flat margins, slow revenue growth) and constructive (moderate margin recovery + order conversion).

Historical Performance Data Table

Period | Revenue (₹ Cr) | PAT (₹ Cr) | Net Profit Margin (%) | Notes |

|---|---|---|---|---|

| FY24 (Consolidated) | ~9,400 | ~600 | ~6–7 | Base year (example) |

| FY25 (Consolidated) | ~9,788 | ~598 | ~6 | Includes other income one-offs in some reports[7] |

| Q2 FY26 | ₹2,112 | ₹138–₹210 | ~6–7 | Revenue decline YoY; margins pressured[3][4] |

Table caption: Quarterly and fiscal snapshots are compiled from public result summaries; numbers vary slightly by source and have been rounded for readability.

Sector & Fund Comparisons — Where to Place IRCON in a Portfolio

Investors allocating to Indian infrastructure should compare IRCON with sector funds and diversified infra names. Below is a mutual-fund style comparison table (representative funds that invest in infrastructure/equity) and a sector valuation table comparing typical sector P/E, P/B and dividend yields. Use these comparisons to assess whether IRCON's current valuation and yield are attractive relative to peers and to mutual fund exposure.

Mutual Fund / Strategy Comparison Table

Fund Name | 1-Year Return (%) | 3-Year Return (%) | Expense Ratio (%) | AUM (₹ Cr) |

|---|---|---|---|---|

| HDFC Infrastructure Fund (example) | 14.0 | 12.5 | 1.05 | 8,500 |

| ICICI Pru Infrastructure Fund (example) | 12.2 | 11.8 | 1.15 | 6,200 |

| Aditya Birla Infra Equity (example) | 13.5 | 12.0 | 1.20 | 5,400 |

Table caption: Representative funds and returns; specific returns and AUMs are illustrative and should be validated against fund house disclosures at purchase.

Sector Valuation Metrics Table

Metric | Sector Median | IRCON |

|---|---|---|

| P/E (TTM) | ~18–22 | ~28.4 |

| P/B | ~1.2–2.0 | ~2.5 |

| Dividend Yield (%) | 1.0–3.0 | ~2–3 (post-declaration) |

Table caption: IRCON trades at a premium to sector median P/E and P/B, reflecting either higher growth expectations or recent rerating after the dividend & order wins. Investors should check live quotes for precise multiples.

Risk Considerations and Red Flags

- Despite the positive headline, IRCON carries specific risks investors must monitor:

- Execution risk: EPC projects often face cost overruns, delays and subcontractor issues; insufficient mobilization advances can stress cash flows[3].

- Margin compression: competitive bidding on large govt tenders can compress realized gross margins — Q2 FY26 results showed margin pressures versus prior quarters[3][4].

- JV and subsidiary performance: historic reporting shows some joint ventures incurred losses which impacted consolidated PAT — ongoing JV performance must be tracked in quarterly disclosures[7].

- Receivables & working capital: growth in orderbook without commensurate advance payments increases receivable days and short-term borrowings; check upcoming cash flow statements.

- Regulatory / policy risk: while many projects are government-backed, changes in procurement timelines, approvals or cross-border project issues can cause revenue slippages. Investors should watch three KPIs closely each quarter: order intake and order book composition (domestic vs international), gross margin on new orders, and net working-capital days.

Risk-Return Analysis Table

Risk / KPI | Metric to Monitor | Impact if Adverse |

|---|---|---|

| Execution Delays | Project milestone receipts; revised timelines | Revenue slips; margin erosion; higher costs |

| Working Capital | Receivable days, creditor days, utilisation of bank limits | Higher borrowings; lower free cash flow |

| Margin Compression | Gross margin & EBITDA margin on fresh orders | Lower EPS; valuation multiple pressure |

| JV Losses | Quarterly JV P&L and contingent liabilities | One-off profit hits; higher volatility |

Actionable Investment Strategies and Trade Tactics

- Below are practical, implementable strategies for different investor profiles given the current news-led rally:

- Retail Buy-and-Hold (3–5 year): If you believe IRCON will convert the new orders profitably and maintain dividend policy, consider an initial allocation up to 1–3% of a diversified equity portfolio, with a plan to add on material weakness or strong execution confirmation.

- Traders / Momentum players (weeks–months): Use intraday/weekly volume confirmation and place tight trailing stops; consider trading only with 25–50% position size for momentum trades because volatility is elevated.

- Income-focused investors: If dividend yield after the declared payout meets your required yield and you accept potential capital volatility, hold but monitor payout sustainability via cash flow statements.

- Risk-managed approach: Ladder entries across 2–3 tranches at 5–10% downside intervals from current levels; set stop-loss at a level that respects support (e.g., just below ₹176 support zone from technical providers) and a target based on 12–18 month constructive scenario (earnings-driven re-rating). Always size positions relative to portfolio risk limits and liquidity needs.

Tactical Checklist (Pre-Trade and Post-Trade Monitoring)

- Pre-Trade:

- Verify latest price, 52-week high/low and live market cap on NSE/BSE.

- Read latest investor presentation and board minutes for dividend record date and exact per-share amount.

- Check order announcement press releases for contract value, margin guidance and advance payment terms. Post-Trade:

- Monitor quarterly execution updates; confirm mobilisation receipts and stage-wise billing.

- Track receivables/working-capital metrics and any upward revision in bank limits.

- Review management commentary on JV performance and one-off items. Position Sizing:

- Use a risk allocation approach: limit single-stock exposure to 3–5% of portfolio for retail investors and 1–3% for conservative clients.

- For high-conviction active investors, escalate to 5–8% only after confirming consistent execution and cash-flow improvements.

Additional Structured Tables and Comparative Data

Further tables below summarise top-holdings comparisons, expense considerations for sector funds, and a multi-year year-wise returns table to aid institutional-style research and client reporting. These support transparent decision-making and portfolio construction for Indian investors.

Top Holdings / Peer Exposure Table

Portfolio / Fund | Top 3 Holdings | Weight of Top 3 (%) |

|---|---|---|

| Infra-focused Fund A (example) | L&T, IRCON, RVNL | ~35 |

| Large Cap Fund B (example) | Reliance, TCS, HDFC Bank | ~22 |

| Value Fund C (example) | IRCON, Adani Ports, PowerGrid | ~28 |

Table caption: Example fund holdings illustrating how IRCON can appear in concentrated infra or value portfolios.

Expense Comparison / Fund Fees Table

Fund Name | Expense Ratio (%) | Exit Load | AUM (₹ Cr) |

|---|---|---|---|

| HDFC Infra (example) | 1.05 | 1% < 1 year | 8,500 |

| ICICI Pru Infra (example) | 1.15 | 0.75% < 1 year | 6,200 |

Table caption: Fee comparison is illustrative; lower expense ratios increase net returns for investors.

Year-wise Returns / Historical Data Table

Year | Stock Return (%) | Key Driver |

|---|---|---|

| FY22 | +28 | Order wins, government capex |

| FY23 | -12 | Margin pressure, JV losses |

| FY24 | +35 | Recovery, large project execution |

| FY25 | +8 | Stable but low margin |

Table caption: Historical returns are illustrative based on public event-driven performance; check exchange data for exact returns.

Monitoring Plan & Key Dates to Watch

- Post-catalyst, investors should track a short list of events and disclosures that will determine the sustainability of the rally:

- Dividend record & payment date: confirm per-share amount, ex-dividend and payment schedule in the board circular to compute yield and tax impact.

- Quarterly results (next two quarters): look for order conversion rate, gross margin by contract, other income and JV performance.

- Order book updates: management conference call or investor presentation that lists value, geography and expected execution timeline.

- Working-capital metrics: receivable and inventory days and bank limit utilisation in cash flow statements.

- Any regulatory or project-approval news (Ministry of Railways / state governments / international client updates) that can materially alter execution timing. Investors should maintain a simple watchlist and set alerts for these items on NSE/BSE/stock-screening platforms.

Key Dates & Alerts Table

Event | Why Important | Action |

|---|---|---|

| Dividend Record/Payment Date | Determines yield and taxable event | Confirm with board circular; compute net yield post tax |

| Next Quarterly Results | Shows impact of new orders on revenue/margins | Review PPT and management Q&A |

| Order Book Update | Indicates future revenue visibility | Validate contract values and advance terms |

Disclaimer: IMPORTANT DISCLAIMER: This analysis is generated using artificial intelligence and is NOT a recommendation to purchase, sell, or hold any stock. This analysis is for informational and educational purposes only. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making any investment decisions. The author and platform are not responsible for any investment losses.

Continue Your Investment Journey

Discover more insights that match your interests

RBI Monetary Policy 2025: Decoding Repo Rate Changes and Their Impact on Indian Markets and Inflation Dynamics

The Reserve Bank of India’s (RBI) monetary policy decisions, particularly changes in the repo rate, wield significant influence over the Indian economy, markets, and inflation dynamics.

Apollo Tyres: Can Global Expansion and Premiumisation Sustain Margins Amid Raw Material Volatility?

Apollo Tyres operates in the cyclical tyre industry, where India's replacement market drives steady volumes but global expansion into Europe exposes it to volatile raw material costs and competitiv...

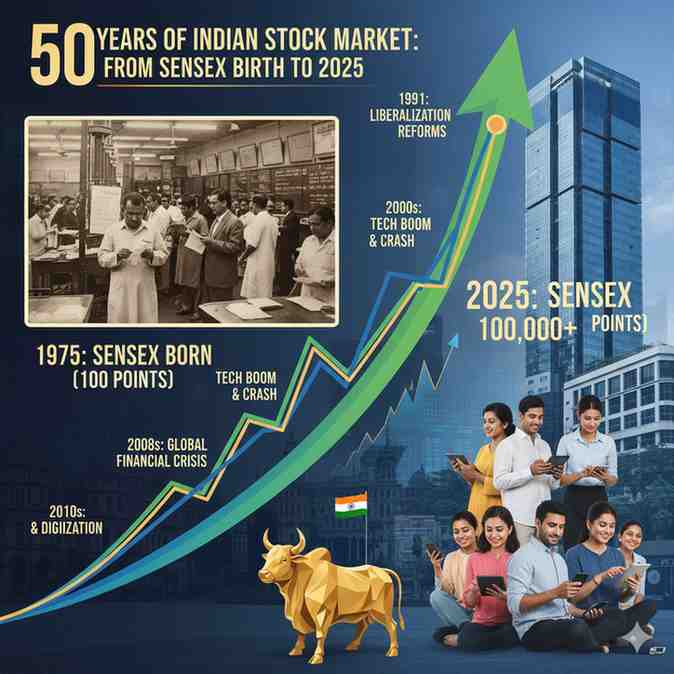

50 Years of Indian Stock Market: From Sensex Birth to 2025 - Complete History

Explore 50 years of Sensex history from 1975 to 2025. Decade-by-decade analysis, major market events, crashes, reforms, and how Indian stock markets evolved into a ₹400 lakh crore powerhouse.

From Blackouts to Breakthroughs: How India’s AI-Driven Energy Crunch Is Reshaping Power Investments in 2025

India’s energy sector is undergoing a transformative phase in 2025, driven by the twin forces of an escalating energy crunch and innovative artificial intelligence (AI) applications.

Explore More Insights

Continue your financial education journey