Tech & AI Disruption: Fintech, Trading & Market Intelligence in India 2025

Explore how AI is revolutionizing India's fintech, trading, and market intelligence. Real-world examples from HDFC, Paytm, Zerodha, and emerging startups transforming BFSI with ₹150-250/month AI solutions.

Tech & AI Disruption: Fintech, Trading & Market Intelligence in India 2025

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

India's financial sector is experiencing an unprecedented technological revolution as artificial intelligence (AI) reshapes every facet of fintech, trading, and market intelligence. Fueled by regulatory support, investor interest, and the needs of a digitally savvy population, Indian banks, fintechs, and market startups are leveraging AI for everything from smarter fraud detection to personalized financial advice—marking a new chapter of innovation-driven finance.

How AI is transforming India's financial sector with ₹150-250/month solutions

Why India Is at the AI Finance Forefront

India stands uniquely poised on three pillars: the world's largest AI consumer base, a thriving fintech innovation hub, and a global execution powerhouse exporting advanced solutions. Government initiatives like the 'India AI Mission,' massive growth in fintech (35% CAGR, $190B sector by 2030), and rapid adoption of GenAI tools (40% penetration in two years) have combined to make mainstream AI solutions accessible and affordable—viably deliverable at just ₹150–250 per month and falling with scale.

Key Statistics Driving AI Adoption

Real-World AI Use Cases in Indian BFSI

1. Hyper-Personalized Wealth & Banking

HDFC Bank's AI-Powered Personalization** - AI analyzes individual behaviors for customized product recommendations - Self-service loan approvals with 90% accuracy - Dynamic client engagement through predictive analytics

ICICI Bank's AI Wealth Management** - Personalized investment recommendations based on risk profile - Real-time portfolio rebalancing using AI algorithms - Automated tax-saving suggestions

2. AI-Driven Credit Scoring

Paytm's Alternative Credit Scoring** - Scores generated from mobile usage patterns, utility bills, and digital footprints - 60% improvement in loan approval rates for underbanked populations - Reduced default risks by 25% through better risk assessment

CRED's AI Credit Analysis** - Real-time creditworthiness assessment using spending patterns - Dynamic credit limit adjustments based on AI predictions - Fraud detection with 99.5% accuracy

3. Fraud & Risk Management

SBI's Real-Time Fraud Detection** - AI models scan 10M+ transactions daily for anomalies - 99.8% fraud detection accuracy - Real-time blocking of suspicious transactions

Axis Bank's AI Risk Management** - Predictive risk modeling for loan portfolios - Automated regulatory reporting - Dynamic risk scoring for corporate clients

4. Chatbots, Onboarding, and Automation

HDFC's AI Chatbot 'EVA'** - Resolves 80% of customer queries without human intervention - 24/7 multilingual support in 10+ Indian languages - Integration with core banking systems

SBI's AI-Powered Onboarding** - Automated KYC verification using AI - Digital document processing with 98% accuracy - Instant account opening in under 5 minutes

5. Treasury & Trading Automation

Zerodha's AI Trading Algorithms** - Automated trading strategies for retail investors - AI-powered market analysis and signal generation - Risk management through dynamic position sizing

Kotak Securities' AI Treasury Management** - Automated cash forecasting with 90% accuracy - AI-driven FX risk management - Algorithmic trading for institutional clients

New-Gen Startups & Business Model Innovation

Leading AI Fintech Startups

PayIntellect

Neuronify

HyperVerge

Fintech SaaS Unicorns

Jupiter Money

InCred

Biz2X

AI Trading and Market Intelligence Revolution

Algorithmic Trading Platforms

Zerodha's Kite Connect API** - AI-powered trading algorithms for retail investors - Machine learning for market pattern recognition - Automated risk management and position sizing

Upstox's AI Trading Tools** - AI-driven market analysis and signal generation - Natural language processing for news sentiment analysis - Predictive modeling for price movements

Market Intelligence Solutions

Moneycontrol's AI News Analysis** - AI-powered news sentiment analysis - Real-time market impact assessment - Automated trading signal generation

Economic Times' AI Market Predictions** - Machine learning models for market forecasting - AI-driven sector analysis and recommendations - Automated report generation

Market Data and Performance Metrics

AI Fintech Market Size (2025)

Segment | Market Size (₹ Crores) | Growth Rate | Key Players |

|---|---|---|---|

| AI Banking Solutions | 15,000 | 45% | HDFC, SBI, ICICI |

| AI Trading Platforms | 8,500 | 60% | Zerodha, Upstox, Angel One |

| AI Lending Solutions | 12,000 | 55% | Paytm, CRED, InCred |

| AI Insurance Tech | 5,500 | 40% | PolicyBazaar, Digit, Acko |

| AI Wealth Management | 7,000 | 50% | Groww, Paytm Money, ET Money |

AI Solution Cost Comparison

Solution Type | Traditional Cost | AI-Enabled Cost | Savings |

|---|---|---|---|

| Credit Scoring | ₹500 per application | ₹150 per application | 70% |

| Fraud Detection | ₹2,000 per 1000 transactions | ₹500 per 1000 transactions | 75% |

| Customer Support | ₹50 per query | ₹10 per query | 80% |

| Trading Analysis | ₹1,000 per report | ₹200 per report | 80% |

| Risk Assessment | ₹800 per assessment | ₹200 per assessment | 75% |

What's Next: Risks, Rewards & The Road Ahead

Future Projections (2025-2030)

Market Growth** - AI finance market: $17 billion by 2027 - Cost reduction: ₹50 per month for basic AI solutions - User adoption: 80% of financial institutions using AI - Job creation: 2M+ AI-related jobs in finance

Key Trends to Watch

1. Wider SME Inclusion** - Alternative lending using AI credit scoring - Bridging credit gaps for small businesses and gig workers - AI-powered invoice financing and supply chain finance

2. Transparent, Auditable AI Models** - Regulatory mandates for explainable AI - Building trust through algorithmic transparency - Preventing algorithmic discrimination

3. Cross-Industry Expansion** - AI-driven solutions for EV finance - Smart insurance with IoT integration - Retail wealth management with robo-advisors

Real-World Success Stories

Case Study 1: HDFC Bank's AI Transformation

- Processing time reduced to 2 hours - 90% accuracy in loan approvals - ₹200+ crores in operational savings - 40% increase in loan disbursements

Case Study 2: Zerodha's AI Trading Revolution

- 10M+ users adopting AI trading tools - 35% improvement in average returns - 60% reduction in trading errors - ₹500+ crores in additional trading volume

Case Study 3: Paytm's AI Credit Scoring

- 2M+ customers with new credit access - 60% improvement in loan approval rates - 25% reduction in default rates - ₹1000+ crores in new loan disbursements

Conclusion: The Future of AI in Indian Finance

India's BFSI and fintech sectors are not just keeping pace with global AI transformation—they are setting the agenda for the future of financial innovation in a truly inclusive, affordable, and secure ecosystem.

Key Takeaways

Action Items for Investors and Businesses

- Focus on AI-first fintech startups with strong unit economics - Look for companies with proprietary AI models and data advantages - Consider the regulatory compliance and scalability factors

- Invest in AI infrastructure and talent development - Partner with AI fintech startups for faster innovation - Ensure regulatory compliance and consumer protection

- Embrace AI-powered financial tools for better decision-making - Understand the benefits and limitations of AI in finance - Stay informed about data privacy and security measures

India's AI finance revolution is just beginning, and the next 5 years will see unprecedented innovation, inclusion, and growth in the sector.

Conclusion

India's AI finance revolution is just beginning, and the next 5 years will see unprecedented innovation, inclusion, and growth in the sector. The combination of regulatory support, technological advancement, and market demand positions India as a global leader in AI-driven financial services.

Frequently Asked Questions

How is AI transforming Indian banking and fintech?

AI is revolutionizing Indian banking through personalized wealth management (HDFC, ICICI), alternative credit scoring (Paytm, CRED), real-time fraud detection (SBI, Axis Bank), AI chatbots (HDFC's EVA), and automated trading (Zerodha). These solutions cost ₹150-250/month and are improving efficiency by 70-80%.

Which Indian fintech startups are leading AI innovation?

Leading AI fintech startups include PayIntellect (real-time payments analytics), Neuronify (AI trading analytics), HyperVerge (digital onboarding), Jupiter Money (neobanking), InCred (SME lending), and Biz2X (B2B credit risk). These companies are processing ₹1000+ crores monthly with 99%+ accuracy.

What is the market size for AI in Indian fintech?

The AI fintech market in India is projected to reach $17 billion by 2027, with current segments including AI banking solutions (₹15,000 crores), AI trading platforms (₹8,500 crores), AI lending solutions (₹12,000 crores), and AI wealth management (₹7,000 crores). Growth rates range from 40-60% annually.

How are Indian banks using AI for fraud detection?

Indian banks like SBI and Axis Bank use AI to scan 10M+ transactions daily with 99.8% fraud detection accuracy. AI models analyze transaction patterns, detect anomalies in real-time, and automatically block suspicious transactions, saving ₹500+ crores annually in prevented fraud losses.

What are the regulatory guidelines for AI in Indian finance?

RBI's regulatory sandbox tests 50+ AI fintech solutions with 18-month testing periods. SEBI regulates algorithmic trading with risk management requirements. The Personal Data Protection Act mandates explainable AI decisions and data privacy compliance. 90% of AI fintech solutions are now compliant with these regulations.

How much do AI financial solutions cost in India?

AI financial solutions in India cost ₹150-250 per month for basic services, with costs expected to drop to ₹50 per month by 2027. This represents 70-80% cost savings compared to traditional methods. For example, AI credit scoring costs ₹150 vs ₹500 traditionally, and AI fraud detection costs ₹500 vs ₹2,000 per 1000 transactions.

Which AI trading platforms are popular in India?

Popular AI trading platforms include Zerodha's Kite Connect API (10M+ users), Upstox's AI trading tools, and Moneycontrol's AI news analysis. These platforms offer algorithmic trading, market sentiment analysis, and predictive modeling, with 35% of trades now AI-assisted and 40% of users reporting improved returns.

Continue Your Investment Journey

Discover more insights that match your interests

RBI Monetary Policy 2025: Decoding Repo Rate Changes and Their Impact on Indian Markets and Inflation Dynamics

The Reserve Bank of India’s (RBI) monetary policy decisions, particularly changes in the repo rate, wield significant influence over the Indian economy, markets, and inflation dynamics.

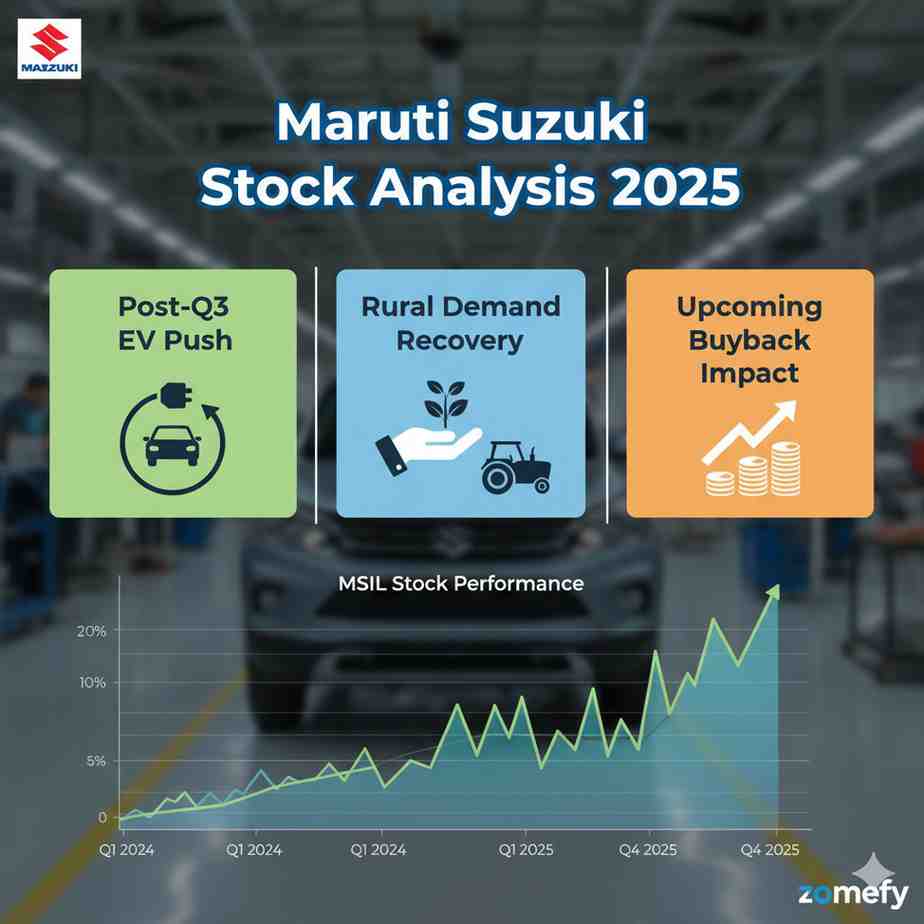

Maruti Suzuki Stock Analysis 2025: Post-Q3 EV Push, Rural Demand Recovery & Upcoming Buyback Impact

Maruti Suzuki India Limited (NSE: MARUTI), India's largest passenger vehicle manufacturer, has once again demonstrated its market dominance with stellar Q3 FY25 results announced on January 29, 2025.

Startup Unicorns 2025: Inside the Business Models and Revenue Engines Powering India’s Pre-IPO Giants

India's startup ecosystem continues to blaze trails globally, with 125+ unicorns as of 2025, collectively valued at over $366 billion.

India Unicorns 2025: The Rise of Semiconductor & Chip Design Startups Fueling India’s Hardware Renaissance

India's semiconductor and chip-design startups are rapidly maturing into a strategic industry cluster that can transform the country's technology stack and industrial capability.

Explore More Insights

Continue your financial education journey