SIP Strategy Optimization: Beyond Monthly Investments

Advanced SIP strategies beyond monthly investments. Learn about weekly, fortnightly SIPs, and optimization techniques for maximum returns in 2025.

SIP Strategy Optimization: Beyond Monthly Investments

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

Systematic Investment Plans (SIPs) have revolutionized wealth creation in India, but most investors limit themselves to monthly SIPs. Advanced SIP strategies, including weekly and fortnightly investments, can significantly enhance returns through better rupee cost averaging and market timing. As we navigate through 2025's dynamic market conditions, understanding and implementing optimized SIP strategies becomes crucial for maximizing wealth creation potential.

Understanding SIP Frequency Impact

The frequency of SIP investments significantly impacts returns through rupee cost averaging. More frequent investments provide better market timing, especially in volatile markets. Understanding the mathematical and practical implications of different SIP frequencies is essential for optimization.

Mathematical Advantage of Higher Frequency

Weekly and fortnightly SIPs provide better rupee cost averaging compared to monthly SIPs. In volatile markets, higher frequency investments capture more market lows, leading to better average purchase prices. This mathematical advantage becomes more pronounced in volatile market conditions.

Market Timing Benefits

Higher frequency SIPs reduce the impact of market timing on investments. Instead of investing once a month, weekly SIPs spread the investment across 4-5 different market conditions, reducing the risk of investing at market peaks.

Weekly SIP Strategy

Weekly SIPs offer the highest frequency for retail investors, providing maximum benefits of rupee cost averaging. This strategy is particularly effective for volatile markets and high-growth funds.

Implementation Framework

Weekly SIPs require careful planning and execution. Investors should consider their cash flow, fund selection, and monitoring requirements. The strategy works best with equity funds and during volatile market periods.

Performance Comparison

Historical analysis shows that weekly SIPs can outperform monthly SIPs by 0.5-1.5% annually in volatile markets. The advantage is more pronounced in mid and small cap funds due to their higher volatility.

Fortnightly SIP Strategy

Fortnightly SIPs provide a balanced approach between monthly and weekly investments. This frequency offers good rupee cost averaging while maintaining manageable investment discipline.

Optimal Implementation

Fortnightly SIPs work well for investors who receive bi-weekly salaries or prefer a middle ground between monthly and weekly investments. The strategy provides good market timing benefits without the complexity of weekly investments.

Cost-Benefit Analysis

Fortnightly SIPs offer 80-90% of the benefits of weekly SIPs with lower transaction costs and easier management. This makes them an attractive option for many investors.

Advanced SIP Optimization Techniques

Beyond frequency optimization, several advanced techniques can enhance SIP returns. These include dynamic SIP amounts, sector rotation, and market-based adjustments.

Dynamic SIP Amounts

Adjusting SIP amounts based on market conditions can enhance returns. Increasing SIP amounts during market corrections and reducing during peaks can improve overall performance.

Sector Rotation Strategy

Rotating SIP investments between different sectors based on market cycles can enhance returns. This strategy requires active monitoring and market analysis.

Conclusion

SIP optimization goes far beyond simple monthly investments. Weekly and fortnightly SIPs, combined with advanced optimization techniques, can significantly enhance wealth creation potential. The key is to choose the frequency that aligns with your financial situation, risk tolerance, and investment goals. Regular monitoring and adjustment of SIP strategies based on market conditions and personal circumstances can maximize long-term returns. Remember, the best SIP strategy is the one you can consistently follow over the long term.

Frequently Asked Questions

Is weekly SIP better than monthly SIP?

Weekly SIPs generally provide better returns than monthly SIPs due to improved rupee cost averaging, especially in volatile markets. However, the difference may be marginal (0.5-1.5% annually) and depends on market conditions. Weekly SIPs also require more active management and may have slightly higher transaction costs.

What is the minimum amount for weekly SIP?

Most fund houses allow weekly SIPs with a minimum of ₹500 per installment. However, to make weekly SIPs cost-effective, consider investing at least ₹1,000-2,000 per week. This ensures that transaction costs don't significantly impact returns.

How do I choose between weekly and fortnightly SIP?

Choose weekly SIP if you have regular cash flow and want maximum rupee cost averaging benefits. Choose fortnightly SIP if you prefer a balanced approach with easier management. Consider your salary cycle, investment amount, and time available for monitoring when making this decision.

Can I change SIP frequency later?

Yes, most fund houses allow you to modify SIP frequency, amount, and date. However, frequent changes may impact the benefits of systematic investing. It's better to choose an appropriate frequency from the beginning and stick to it for at least 1-2 years.

Do weekly SIPs work better in all market conditions?

Weekly SIPs work best in volatile markets where frequent investments can capture more market lows. In trending markets (consistently rising or falling), the advantage may be minimal. The strategy is most effective for equity funds and during uncertain market conditions.

Continue Your Investment Journey

Discover more insights that match your interests

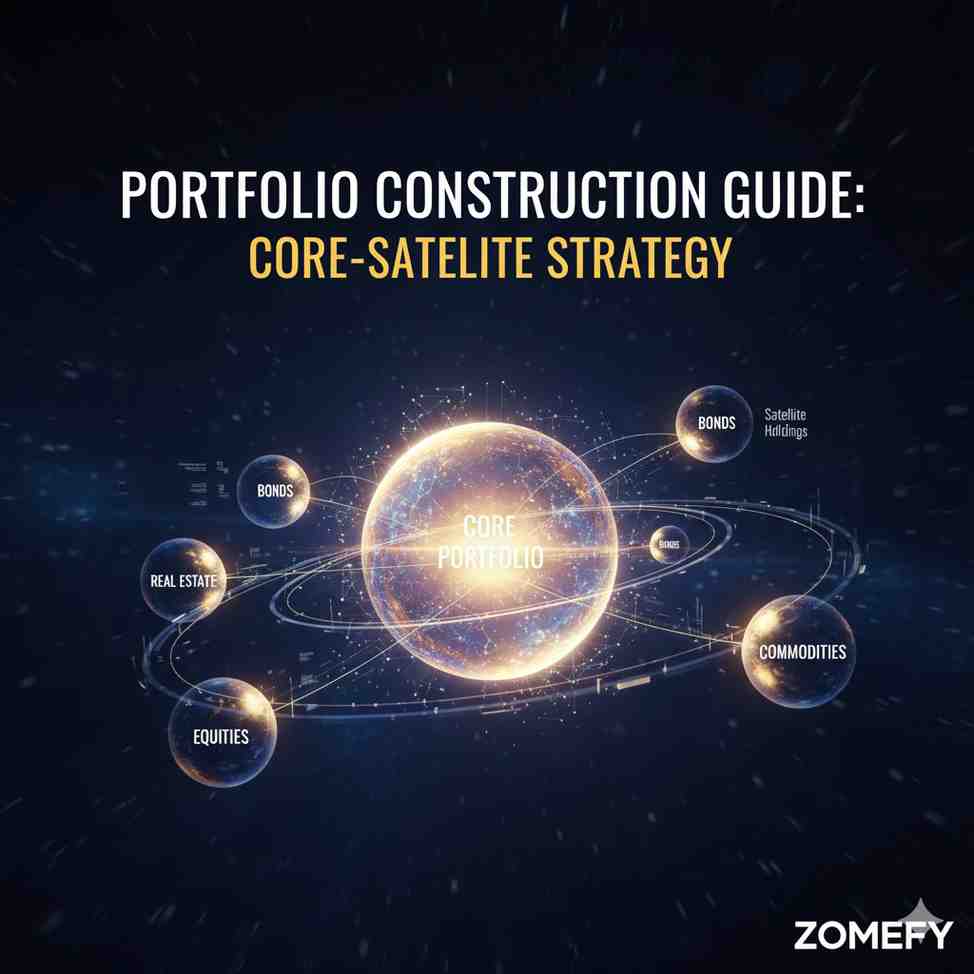

Portfolio Construction Guide: Core-Satellite Strategy

Step-by-step guide to building a diversified portfolio using core-satellite strategy with mutual funds and direct equity.

India’s 2025 Pension Privatization Playbook: How New NPS Reforms and Foreign Pension Funds Will Transform Retirement Investing

India's 2025 pension landscape is undergoing a structural shift as sweeping NPS (National Pension System) reforms, a new Unified Pension Scheme (UPS) for select central employees, and increasing pa...

Adani Ports Stock Analysis 2025: Record Cargo Volumes & Global Terminal Wins Fuel Multibagger Momentum

Adani Ports and Special Economic Zone Limited (APSEZ), India's largest private port operator, is riding high on record cargo volumes and strategic global terminal wins, positioning the stock for mu...

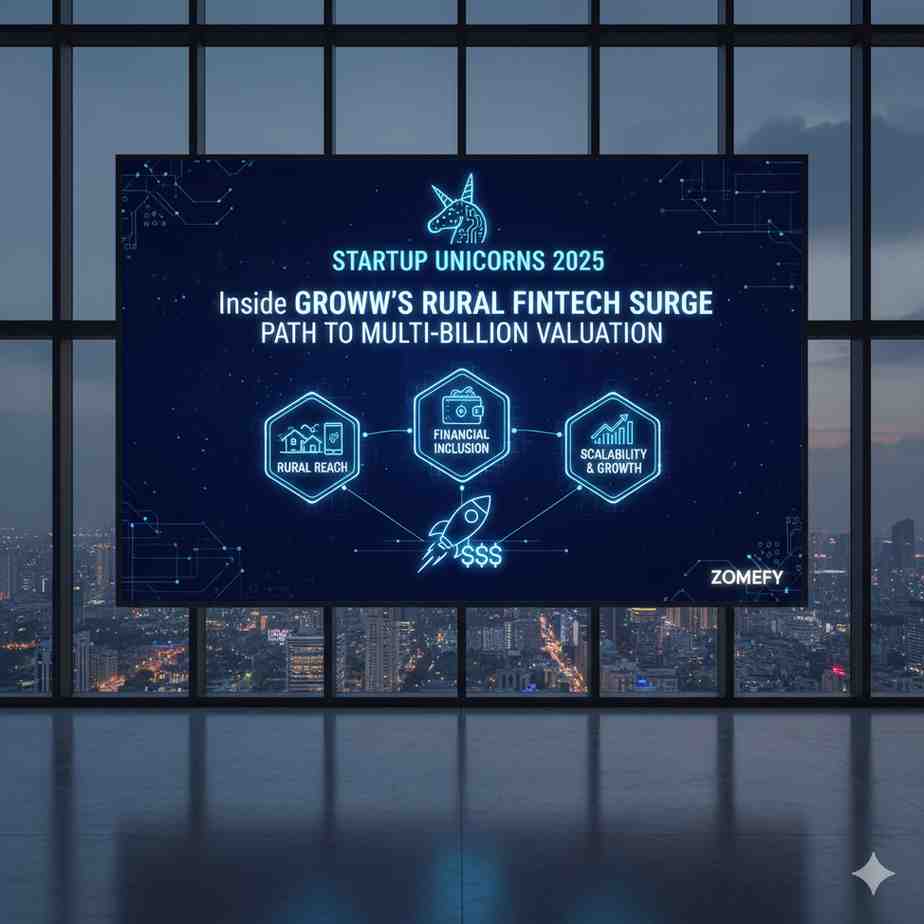

Startup Unicorns 2025: Inside Groww's Rural Fintech Surge and Path to Multi-Billion Valuation

In the dynamic landscape of India's fintech sector, Groww stands out as a beacon of innovation, particularly with its aggressive push into rural markets, positioning it for a multi-billion dollar v...

Explore More Insights

Continue your financial education journey