Navigating India’s Emerging High-Yield Debt Market in 2025: Opportunities and Risks for Retail Investors

India's high-yield debt market is emerging as a dynamic and increasingly attractive segment for retail investors in 2025, driven by evolving macroeconomic conditions, regulatory reforms, and a grow...

Navigating India’s Emerging High-Yield Debt Market in 2025: Opportunities and Risks for Retail Investors

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

India's high-yield debt market is emerging as a dynamic and increasingly attractive segment for retail investors in 2025, driven by evolving macroeconomic conditions, regulatory reforms, and a growing corporate bond ecosystem. As India's bond market expands to approximately ₹238 lakh crores (US$ 2.78 trillion) with corporate bonds comprising over ₹53 lakh crores, retail investors now have access to diverse debt instruments offering higher yields than traditional government securities. This growth is supported by the Reserve Bank of India's accommodative monetary policy, steady liquidity injections, and fiscal reforms including GST improvements that strengthen tax revenues and fiscal stability. However, this opportunity comes with risks such as credit quality concerns, interest rate volatility, and liquidity constraints. Navigating this market requires a nuanced understanding of the yield spreads, issuer profiles, regulatory landscape, and investment strategies tailored to different risk appetites and investment horizons. This article provides a comprehensive guide to the opportunities and risks in India's high-yield debt market in 2025, with practical insights, data-driven analyses, and actionable recommendations for retail investors and financial professionals.

Overview of India's High-Yield Debt Market in 2025

India’s bond market has witnessed remarkable growth, with the total market size reaching ₹238 lakh crores (US$ 2.78 trillion) as of March 2025. Corporate bonds, the core of the high-yield debt segment, constitute ₹53.64 lakh crores, representing 22.51% of the total bond market. Progressive SEBI regulations and improved market infrastructure have facilitated retail participation. The Indian government and state development loans (SDLs) dominate the sovereign space, but corporate bonds are gaining traction due to attractive yields and longer durations. The 10-year government bond yield has hovered around 6.52-6.57%, providing a benchmark for high-yield corporate issuances which typically offer spreads of 60-75 basis points or higher depending on credit risk and sector. The Reserve Bank of India’s (RBI) dovish stance with multiple rate cuts totaling 125 basis points in 2025, alongside liquidity support through Variable Rate Repo (VRR) auctions and Open Market Operations (OMO), has created a conducive environment for fixed income instruments. However, the widening yield spread between state SDLs and central government securities, now around 80 bps, signals credit risk differentials that investors must consider. The market is also poised for global integration, with expected inclusion in major global bond indices, likely attracting foreign institutional inflows and enhancing liquidity and pricing efficiency.

Market Size and Composition

The Indian bond market’s rapid expansion is led by government securities (G-Secs), SDLs, and corporate bonds. As of 2025, the composition is:

Segment | Size (₹ Lakh Crores) | Percentage of Total Market |

|---|---|---|

| Central Government Securities (G-Secs) | 108 | 45.4% |

| State Development Loans (SDLs) | 63.15 | 26.5% |

| Corporate Bonds | 53.64 | 22.5% |

| Treasury Bills (Short Term) | 7.9 | 3.3% |

The corporate bond market is rapidly evolving with increasing issuance from sectors such as infrastructure, NBFCs, and private credit. Retail investors are gaining access through mutual funds and direct bond platforms. The growth in SDLs reflects states’ increased borrowing needs due to higher fiscal deficits, pushing spreads and yields higher relative to G-Secs.

Opportunities for Retail Investors in High-Yield Debt

Mutual Fund Options and Performance

Retail investors can access high-yield debt through specialized mutual funds. Below is a comparison of leading Indian debt funds focused on corporate bonds and short-term accrual strategies (data as of November 2025):

Fund Name | 1-Year Return (%) | 3-Year Return (%) | Expense Ratio (%) | AUM (₹ Cr) |

|---|---|---|---|---|

| ICICI Prudential Corporate Bond Fund | 7.2 | 7.8 | 0.85 | 6,500 |

| HDFC Short Term Debt Fund | 6.8 | 7.5 | 0.95 | 7,200 |

| Aditya Birla Sun Life Corporate Bond Fund | 7.0 | 7.7 | 0.90 | 5,800 |

Investors with investment horizons of 1-2 years should prioritize funds with accrual strategies and low duration to reduce volatility. For longer horizons, a blend of corporate bond funds with barbell duration positioning can optimize risk-return trade-offs.

Sector and Issuer Selection

High-yield debt issuers span multiple sectors, each with unique risk-return profiles. Below is a sector-wise comparison of average yield spreads and credit ratings for prominent sectors in 2025:

Sector | Average Yield Spread (bps) | Credit Rating Range | Key Issuers |

|---|---|---|---|

| Infrastructure | 110 - 140 | AA to BBB | Larsen & Toubro, IRB Infrastructure |

| NBFCs | 120 - 150 | AA to A | Mahindra Finance, Bajaj Finance |

| Manufacturing | 90 - 130 | AA to BBB | Tata Steel, JSW Steel |

| Private Credit | 130 - 160 | A to BBB | Smaller NBFCs, Private Lenders |

Investors should favor issuers with stable cash flows, strong credit ratings (AAA to AA), and transparent governance. Due diligence on issuer financials and sector outlook is critical to avoid defaults and downgrades.

Risks and Challenges in India’s High-Yield Debt Market

Risk-Return Tradeoff and Credit Ratings

The credit rating spectrum significantly affects yields and risk profiles. Below is a risk-return comparison for Indian corporate bonds by rating category (2025 data):

Credit Rating | Average Yield (%) | Average Default Rate (%) (1-Year) | Typical Investor Profile |

|---|---|---|---|

| AAA | 7.0 - 7.3 | 0.1 | Conservative, capital preservation |

| AA | 7.5 - 8.0 | 0.5 | Moderate risk tolerance |

| A | 8.0 - 9.0 | 1.2 | Higher yield seekers |

| BBB and below (High Yield) | 9.0 - 11.0+ | 3.5+ | Speculative, aggressive investors |

Investors should align their portfolio allocation to their risk tolerance, with retail investors generally advised to limit exposure to BBB and below to avoid excessive credit risk.

Pros and Cons of Investing in High-Yield Debt

Pros | Cons |

|---|---|

| Higher income yields than government securities | Increased credit/default risk |

| Diversification benefits in fixed income portfolio | Lower liquidity and market depth |

| Access to growing sectors and issuers | Interest rate sensitivity and price volatility |

| Regulatory improvements enhancing transparency | Potential impact of macroeconomic shocks |

Actionable Strategies for Retail Investors

Mutual Fund Strategy Comparison

Below is a comparison of key fixed income mutual fund strategies suitable for retail investors in 2025:

Strategy | Typical Duration (Years) | Return Range (%) | Risk Level | Suitability |

|---|---|---|---|---|

| Liquid Funds | <1 | 5.75 - 6.0 | Low | Very short-term, parking funds |

| Money Market Funds | <1 | 5.75 - 6.5 | Low | Short-term horizon, low volatility |

| Short Duration Funds | 1 - 3 | 6.5 - 7.0 | Moderate | 1-2 year horizon, accrual focus |

| Corporate Bond Funds | 2 - 5 | 7.0 - 7.8 | Moderate to High | Medium-term, higher yield seekers |

Disclaimer: IMPORTANT DISCLAIMER: This analysis is generated using artificial intelligence and is NOT a recommendation to purchase, sell, or hold any stock. This analysis is for informational and educational purposes only. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making any investment decisions. The author and platform are not responsible for any investment losses.

Continue Your Investment Journey

Discover more insights that match your interests

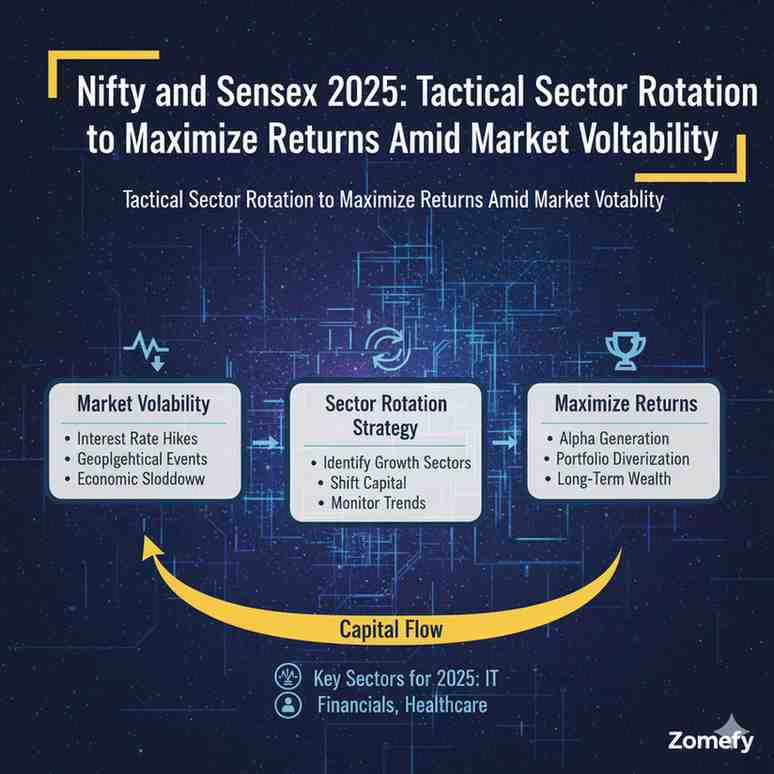

Nifty and Sensex 2025: Tactical Sector Rotation to Maximize Returns Amid Market Volatility

As we advance into 2025, the Indian equity markets represented by the Nifty 50 and BSE Sensex continue to navigate a complex environment marked by heightened volatility, geopolitical tensions, and ...

Startup Unicorns 2025: Unveiling the Profitability Playbooks of India’s Leading SaaS and Edtech Giants

India’s startup ecosystem has witnessed phenomenal growth with the emergence of unicorns—startups valued at over $1 billion—especially in the SaaS (Software as a Service) and EdTech sectors.

Wipro Stock Analysis 2025: Strategic Cloud Expansion & AI Integration Driving Next-Gen IT Services Growth

Wipro Limited, a stalwart in India's IT services sector, is poised for transformative growth in 2025 driven by strategic expansion in cloud computing and aggressive integration of artificial intell...

India Unicorns 2025: The Rise of Semiconductor & Chip Design Startups Fueling India’s Hardware Renaissance

India's semiconductor and chip-design startups are rapidly maturing into a strategic industry cluster that can transform the country's technology stack and industrial capability.

Explore More Insights

Continue your financial education journey