RSI Trading Strategy: Complete Guide for Indian Markets

Complete guide to RSI trading strategy with Indian stock examples. Learn how to use RSI for entry, exit, and trend analysis in Nifty, BankNifty, and individual stocks.

RSI Trading Strategy: Complete Guide for Indian Markets

What You Can Do Next

- Read the full article for complete insights

- Save for later reference

- Share with others learning about this topic

Image not available

The Relative Strength Index (RSI) is one of the most powerful and widely used technical indicators in stock market analysis. Developed by J. Welles Wilder, RSI helps traders identify overbought and oversold conditions, trend reversals, and momentum shifts. As we navigate through 2025's dynamic market conditions, understanding RSI and its practical applications becomes crucial for successful trading and investing. This comprehensive guide provides you with everything you need to know about RSI trading strategy with real Indian stock examples.

Understanding RSI: The Foundation

RSI is a momentum oscillator that measures the speed and magnitude of price changes. It oscillates between 0 and 100, with values above 70 typically indicating overbought conditions and values below 30 indicating oversold conditions. The indicator helps traders identify potential reversal points and trend strength.

RSI Calculation and Interpretation

RSI is calculated using the formula: RSI = 100 - (100 / (1 + RS)), where RS is the average gain divided by the average loss over a specified period (typically 14 days). The indicator helps identify when a stock is overbought (RSI > 70) or oversold (RSI < 30), providing potential entry and exit signals.

Key RSI Levels and Their Significance

Traditional RSI levels are 70 (overbought) and 30 (oversold), but these can be adjusted based on market conditions and stock characteristics. Some traders use 80/20 levels for more sensitive signals, while others use 75/25 for less frequent but more reliable signals.

RSI Trading Strategies for Indian Markets

RSI trading strategies can be adapted for different market conditions and stock characteristics. Indian markets have unique characteristics that require specific approaches to RSI trading.

Basic RSI Strategy

The basic RSI strategy involves buying when RSI crosses above 30 (oversold) and selling when RSI crosses below 70 (overbought). This strategy works well in ranging markets but may generate false signals in trending markets.

RSI Divergence Strategy

RSI divergence occurs when price and RSI move in opposite directions. Bullish divergence (price makes lower lows while RSI makes higher lows) indicates potential upward reversal. Bearish divergence (price makes higher highs while RSI makes lower highs) indicates potential downward reversal.

RSI Trend Following Strategy

In trending markets, RSI can be used to identify trend strength and potential continuation signals. RSI above 50 indicates bullish momentum, while RSI below 50 indicates bearish momentum. RSI staying above 50 during uptrends and below 50 during downtrends confirms trend strength.

Practical Examples with Indian Stocks

Real-world examples help understand how RSI works in different market conditions and with different stocks. These examples demonstrate various RSI strategies and their effectiveness.

Reliance Industries RSI Analysis

Reliance Industries, being a large-cap stock, shows clear RSI patterns. During the 2024 bull run, RSI consistently stayed above 50, indicating strong bullish momentum. Oversold conditions (RSI < 30) provided excellent buying opportunities, while overbought conditions (RSI > 70) often led to short-term corrections.

TCS RSI Trading Example

TCS, as an IT stock, shows different RSI characteristics due to its defensive nature. The stock tends to have more moderate RSI movements, with overbought conditions often lasting longer. RSI divergence has been particularly effective in identifying major trend reversals in TCS.

Banking Stocks RSI Patterns

Banking stocks like HDFC Bank and ICICI Bank show more volatile RSI patterns due to their sensitivity to interest rate changes and economic conditions. RSI levels of 75/25 are often more effective for banking stocks than the traditional 70/30 levels.

Advanced RSI Techniques

Advanced RSI techniques can enhance trading effectiveness and reduce false signals. These techniques require more experience but can significantly improve trading performance.

RSI with Moving Averages

Combining RSI with moving averages can provide more reliable signals. For example, buying when RSI crosses above 30 and price is above the 50-day moving average can reduce false signals and improve success rates.

RSI with Volume Analysis

Volume confirmation can enhance RSI signals. High volume during RSI oversold conditions often indicates strong buying interest, while high volume during overbought conditions may signal distribution and potential reversal.

RSI for Different Timeframes

RSI can be used across different timeframes for various trading strategies. Daily RSI is suitable for swing trading, while hourly RSI is useful for day trading. Longer timeframes (weekly, monthly) provide trend context and major reversal signals.

Conclusion

RSI is a powerful technical indicator that can significantly enhance your trading and investing decisions when used correctly. The key to successful RSI trading lies in understanding its limitations, combining it with other indicators, and adapting strategies to different market conditions and stock characteristics. Remember that no single indicator is perfect, and RSI should be used as part of a comprehensive trading strategy. Practice with paper trading and start with small positions to gain experience and confidence in RSI-based strategies.

Frequently Asked Questions

What is the best RSI period for Indian stocks?

The standard 14-period RSI works well for most Indian stocks, but you can adjust it based on stock characteristics. For volatile stocks, use 10-12 periods for more sensitive signals. For stable stocks, use 16-20 periods for more reliable signals. Test different periods to find what works best for your trading style.

How do I avoid false RSI signals?

To avoid false RSI signals, combine RSI with other indicators like moving averages, volume analysis, and trend lines. Use RSI divergence for more reliable signals, and avoid trading against the overall trend. Also, consider market conditions and stock-specific characteristics when interpreting RSI signals.

Can RSI be used for all types of stocks?

RSI can be used for most stocks, but its effectiveness varies. It works best with liquid, actively traded stocks. For penny stocks or illiquid stocks, RSI may generate false signals due to low trading volume. Large-cap stocks generally provide more reliable RSI signals than small-cap stocks.

What is RSI divergence and how do I identify it?

RSI divergence occurs when price and RSI move in opposite directions. Bullish divergence: price makes lower lows while RSI makes higher lows (potential upward reversal). Bearish divergence: price makes higher highs while RSI makes lower highs (potential downward reversal). Divergence is more reliable when it occurs at extreme RSI levels (below 30 or above 70).

How do I use RSI for different market conditions?

In trending markets, use RSI to identify trend strength and potential continuation signals. In ranging markets, use RSI for overbought/oversold signals. In volatile markets, use wider RSI levels (75/25 instead of 70/30) to reduce false signals. Always consider the overall market trend and sector performance when using RSI.

Continue Your Investment Journey

Discover more insights that match your interests

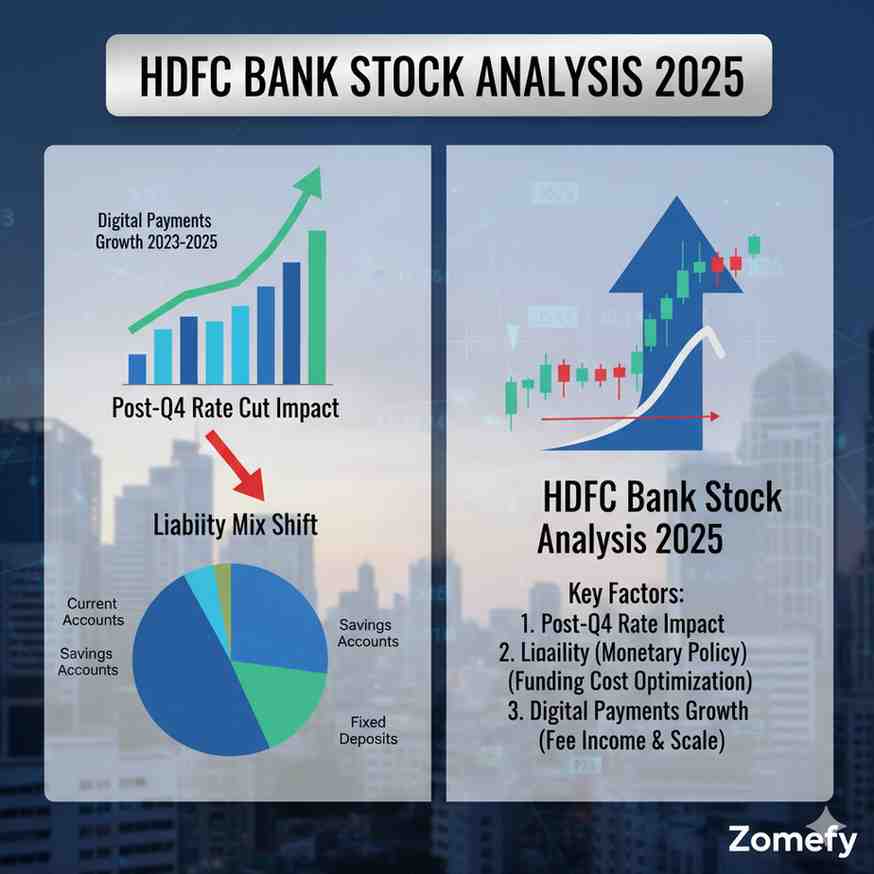

HDFC Bank Stock Analysis 2025: Post-Q4 Rate Cut Impact, Liability Mix Shift & Digital Payments Growth

HDFC Bank, India's largest private sector bank by market capitalization at ₹15.

Intangible Assets & Valuation Paradigm Shift 2025: How India's Top 500 Companies Are Redefining Market Value Beyond Traditional Metrics—A Deep Dive into Equity Research for Modern Investors

In the rapidly evolving Indian corporate landscape, intangible assets have emerged as pivotal drivers of value creation, fundamentally altering traditional valuation paradigms.

5 Metrics to Evaluate Loss-Making Tech Stocks

Learn the 5 essential metrics to evaluate loss-making tech stocks like Zomato, Paytm, and Nykaa. Master EV/Revenue, burn rate, CAC payback, and unit economics for startup investing.

Navigating India’s Surge in Financial Sector M&A and Foreign Investments: Strategic Insights for Retail Investors in 2025

India’s financial sector is undergoing a transformative phase in 2025, marked by a surge in mergers and acquisitions (M&A) and a notable influx of foreign investments.

Explore More Insights

Continue your financial education journey