Master Your Money,Navigate the Market

Featured Articles

Our most comprehensive and trending analysis

Latest Articles

Discover our most recent and trending investment insights

Bajaj Housing Finance: Can Affordable Housing Lending Scale Sustain Margins Amid Rising NPAs and Competition?

Bajaj Housing Finance Limited (BHFL) has emerged as India's second-largest housing finance company by loan disbursement, with Assets Under Management (AUM) crossing Rs 1,26,749 crore as of Septembe...

Kaynes Technology: Can Electronics Manufacturing Localization Sustain Margins Amid Import Duties and Supply Chain Localization?

Kaynes Technology India Ltd (NSE: KAYNES) operates in India's burgeoning electronics manufacturing services (EMS) sector, capitalizing on government-led localization under PLI schemes and rising do...

Zomato: Can Quick Commerce Scale Sustain Margins Amid Rising Competition and Logistics Costs?

Zomato stands at the intersection of India's food delivery and quick commerce markets, commanding a market cap exceeding Rs 2 lakh crore as of early 2026, yet its path to sustained profitability hi...

Suzlon Energy: Can Wind Turbine Revival Sustain Margins Amid Supply Chain Constraints and Policy Shifts?

Suzlon Energy, India's leading wind turbine manufacturer with a 35% market share in installations, is riding a wave of renewable energy demand driven by India's net-zero ambitions and hybrid power ...

L&T Finance: Can Retail Lending Expansion Sustain Margins Amid Rising Credit Costs and Regulatory Scrutiny?

L&T Finance Holdings (LTFH), a leading non-banking financial company (NBFC) listed on NSE and BSE, matters today as it executes a high-stakes pivot from wholesale to retail lending amid India's com...

Varun Beverages: Can Volume Growth and Geographic Expansion Sustain Margins Amid Input Cost Pressures?

Varun Beverages, PepsiCo's largest franchisee outside the US, operates in a highly competitive Indian beverage market where volume growth and geographic expansion have driven impressive financials,...

Borosil Renewables: Can Solar Glass Export Growth Sustain Margins Amid Global Supply Chain Shifts?

Borosil Renewables Ltd (NSE: BORORENEW), India's leading solar glass manufacturer, operates in a high-growth but volatile segment tied to global photovoltaic (PV) module demand and domestic renewab...

Private Markets Liquidity: Can Democratized Access to Unlisted Equities Reshape Retail Investment Portfolios?

NSE-listed CAMS (Computer Age Management Services Ltd) operates as a critical intermediary in India's mutual fund ecosystem, processing transactions and maintaining investor records for asset manag...

Mazagon Dock: Can Defence Order Pipeline and Export Push Sustain Margins Amid Geopolitical Shifts?

Mazagon Dock Shipbuilders (MDL) has emerged as a focal point for Indian defence investors following reported progress on an $8 billion Indo-German submarine deal involving air-independent propulsio...

Latest Articles by Category

Explore our latest and most popular articles across all categories

Equity Research

AI-generated stock analysis focusing on trending stocks in the news with fundamental analysis and investment insights

Bajaj Housing Finance: Can Affordable Housing Lending Scale Sustain Margins Amid Rising NPAs and Competition?

Bajaj Housing Finance Limited (BHFL) has emerged as India's second-largest housing finance company by loan disbursement, with Assets Under Management (AUM) crossing Rs 1,26,749 crore as of Septembe...

Kaynes Technology: Can Electronics Manufacturing Localization Sustain Margins Amid Import Duties and Supply Chain Localization?

Kaynes Technology India Ltd (NSE: KAYNES) operates in India's burgeoning electronics manufacturing services (EMS) sector, capitalizing on government-led localization under PLI schemes and rising do...

Zomato: Can Quick Commerce Scale Sustain Margins Amid Rising Competition and Logistics Costs?

Zomato stands at the intersection of India's food delivery and quick commerce markets, commanding a market cap exceeding Rs 2 lakh crore as of early 2026, yet its path to sustained profitability hi...

Suzlon Energy: Can Wind Turbine Revival Sustain Margins Amid Supply Chain Constraints and Policy Shifts?

Suzlon Energy, India's leading wind turbine manufacturer with a 35% market share in installations, is riding a wave of renewable energy demand driven by India's net-zero ambitions and hybrid power ...

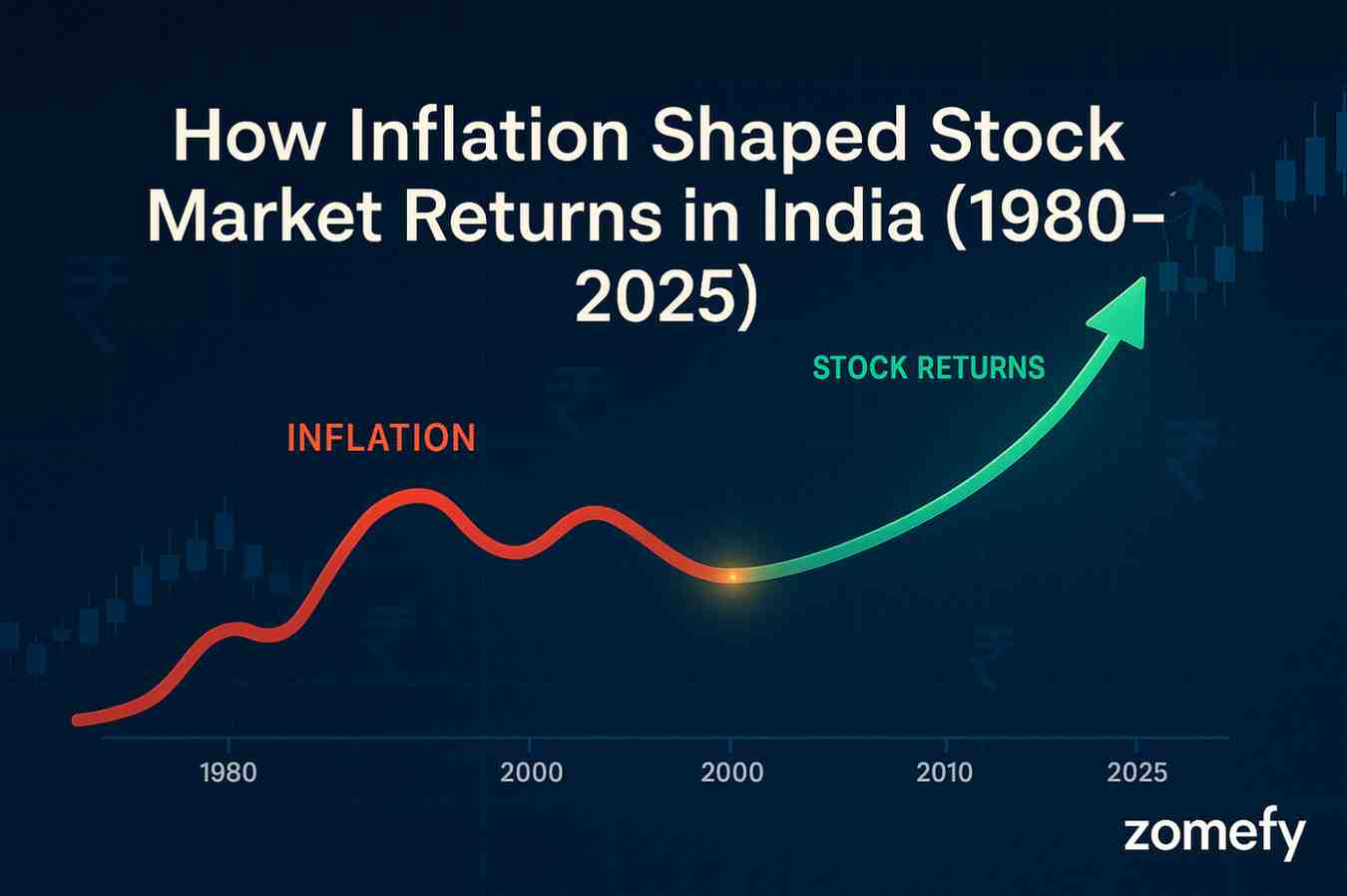

Financial Insights

Deep analytical content covering financial history, market trends, and investment perspectives with lasting value

India’s Union Budget 2026: Infrastructure Spending Surge, Tax Relief Impacts & Retail Investor Opportunities

India's Union Budget 2026 is poised to be a pivotal moment for the nation's economic trajectory, with experts advocating a massive surge in infrastructure spending to ₹12 lakh crore, building on th...

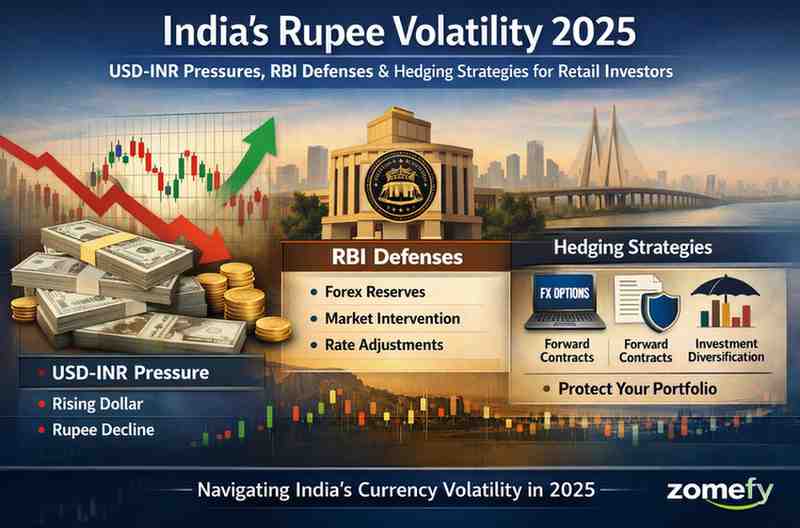

India’s Rupee Volatility 2025: USD-INR Pressures, RBI Defenses & Hedging Strategies for Retail Investors

The Indian Rupee (INR) experienced unprecedented volatility in 2025, breaching the 91 per USD mark for the first time amid US tariffs, record FII outflows of $18 billion, and restrained RBI interve...

India’s AI-Driven Fintech Revolution 2025: Cross-Border UPI Expansion, Wealth Tech Monetisation & Investor Plays

India's fintech sector is undergoing a seismic transformation powered by artificial intelligence, positioning the nation as a global leader in digital financial innovation by 2025.

India’s REIT Renaissance 2025: Real Estate Yield Surge, Commercial Revival & Portfolio Diversification Strategies

India's Real Estate Investment Trusts (REITs) are experiencing a remarkable renaissance in 2025, marking a pivotal shift from nascent experimentation to robust market maturity.

Mutual Funds

Comprehensive analysis of mutual funds with performance data and investment strategies

Tax-Smart ELSS Funds 2025: Section 80C Champions with 10-Year Return Comparisons for Indian Investors

Equity-Linked Savings Schemes (ELSS) have long been a cornerstone of tax planning for Indian investors seeking to optimize their tax liability under Section 80C of the Income Tax Act.

Mid Cap Momentum 2025: Identifying High-Growth, Risk-Adjusted Mutual Funds for Indian Investors

In the evolving landscape of Indian equity markets, mid-cap mutual funds have emerged as a compelling investment avenue for retail investors and financial professionals alike.

Large Cap Leaders 2025: Decoding the 10-Year Consistency of India’s Top Bluechip Funds

Indian retail investors and financial professionals often seek stable and consistent returns from their investments, particularly in the large-cap segment.

Unlocking Investment Potential in 2025: A Beginner's Guide to ETFs and Index Funds in India

As Indian retail investors increasingly seek efficient, cost-effective ways to build wealth, Exchange-Traded Funds (ETFs) and index funds have emerged as powerful tools to unlock investment potenti...

Sector Analysis

Deep-dive analysis of Indian sectors with valuation frameworks and growth prospects

IT Sector Outlook 2025: Navigating AI Adoption, Cloud Migration, and Margin Pressures for Sustainable Growth

India’s IT sector is at a pivotal juncture in 2025, shaped by rapid AI adoption, accelerating cloud migration, and persistent margin pressures.

Banking Sector Trends 2025: Credit Growth Challenges and NPA Management Strategies

The Indian banking sector in 2025 stands at a critical juncture characterized by evolving credit growth dynamics, asset quality challenges, and strategic shifts in non-performing asset (NPA) manage...

TCS Stock Analysis 2025: DCF Model and Growth Prospects

Complete fundamental analysis of TCS with DCF valuation model, growth prospects, and investment recommendation for 2025.

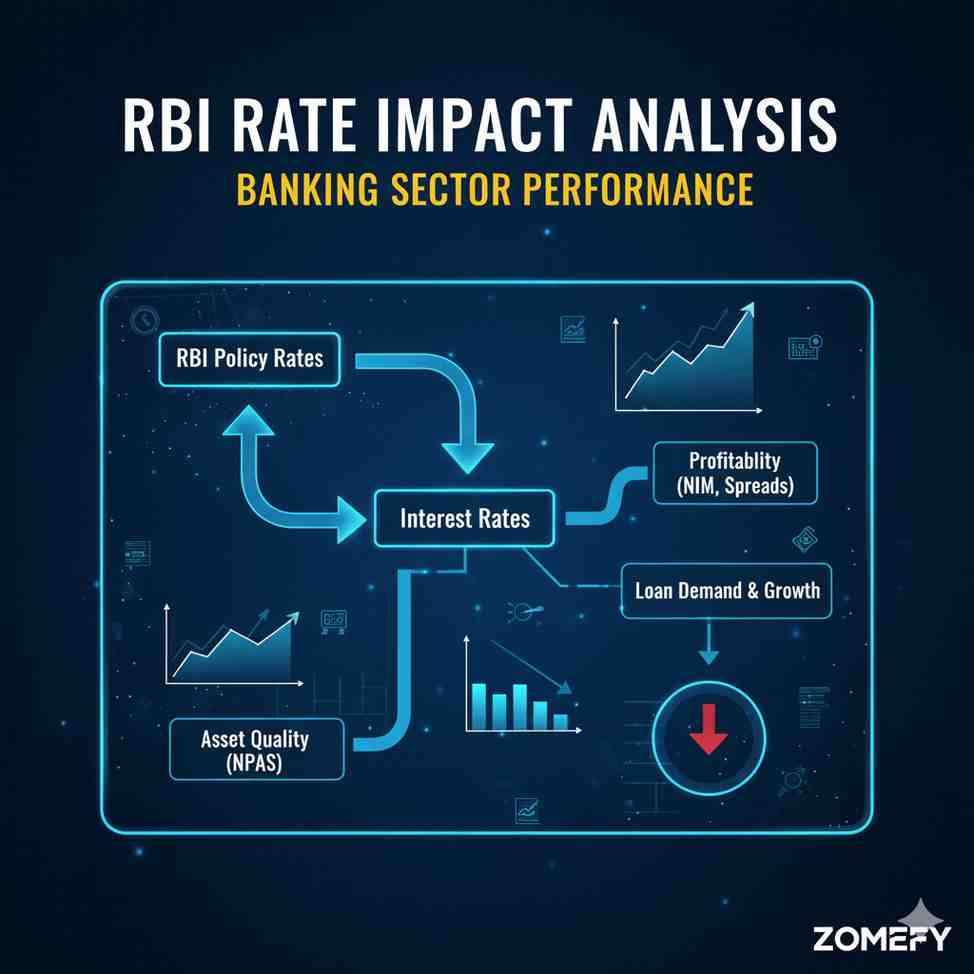

RBI Rate Impact Analysis: Banking Sector Performance

Comprehensive analysis of how RBI rate changes impact banking sector performance with historical data and future outlook.

Technical Analysis

Essential technical indicators and trading strategies for Indian markets

Moving Average Crossover Strategies 2025: Mastering SMA & EMA for Reliable Trend Following in Indian Markets

In the dynamic landscape of Indian financial markets, mastering technical tools for reliable trend identification is crucial for retail investors and financial professionals alike.

Risk Management for Technical Traders: Position Sizing & Stop-Loss Strategies

Master risk management for technical traders with position sizing, stop-loss strategies, and portfolio heat management.

Breakout Trading Strategy: Channel Breaks & Volume Confirmation

Master breakout trading with channel breaks, volume confirmation, and false breakout protection for Indian markets.

Fibonacci Trading Strategy: Retracements & Extensions for Indian Markets

Master Fibonacci trading with retracements, extensions, and confluence analysis for Indian markets.

Startup & Unicorn

Deep-dive analysis of Indian startups, unicorns, and new-age tech companies. Understand business models, valuations, unit economics, and investment risks.

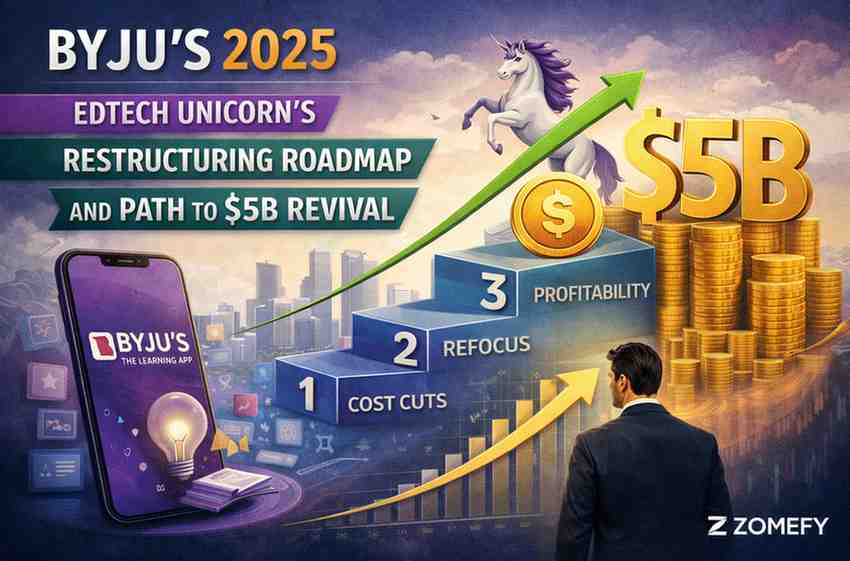

BYJU'S 2025: Edtech Unicorn's Restructuring Roadmap and Path to $5B Revival

Imagine a phoenix rising from the ashes of India's edtech boom and bust – that's BYJU'S in 2025, the once-$22 billion unicorn now charting a bold restructuring roadmap toward a $5 billion revival b...

Ola Electric 2025: EV Unicorn's Battery Tech Leap and Path to $10B Profitability

The search results provided contain **contradictory and incomplete information** that makes it impossible to write an accurate article titled "Ola Electric 2025: EV Unicorn's Battery Tech Leap and ...

Paytm 2025: Post-Listing Revival, Revenue Diversification and Path to Sustainable Profits

Imagine a phoenix rising from the ashes of regulatory turmoil – that's Paytm in 2025.

Meesho 2025: Social Commerce Unicorn's $5B IPO Path and Rural Reseller Economics

Imagine a Bengaluru garage in 2015 where two IIT Delhi alumni, Vidit Aatrey and Sanjeev Barnwal, spotted a goldmine in India's overlooked Tier-2 and Tier-3 cities.