Maintaining a trading journal is a valuable practice for any trader as it allows you to track your progress, identify areas for improvement, and make more informed trading decisions in the future. Here are some tips on how to maintain a trading journal:

- Choose a Format: Decide on the format you want to use for your trading journal. This can be a physical notebook, a spreadsheet, or a software program designed for trading journals. Whatever format you choose, make sure it is easily accessible and can be updated quickly and easily.

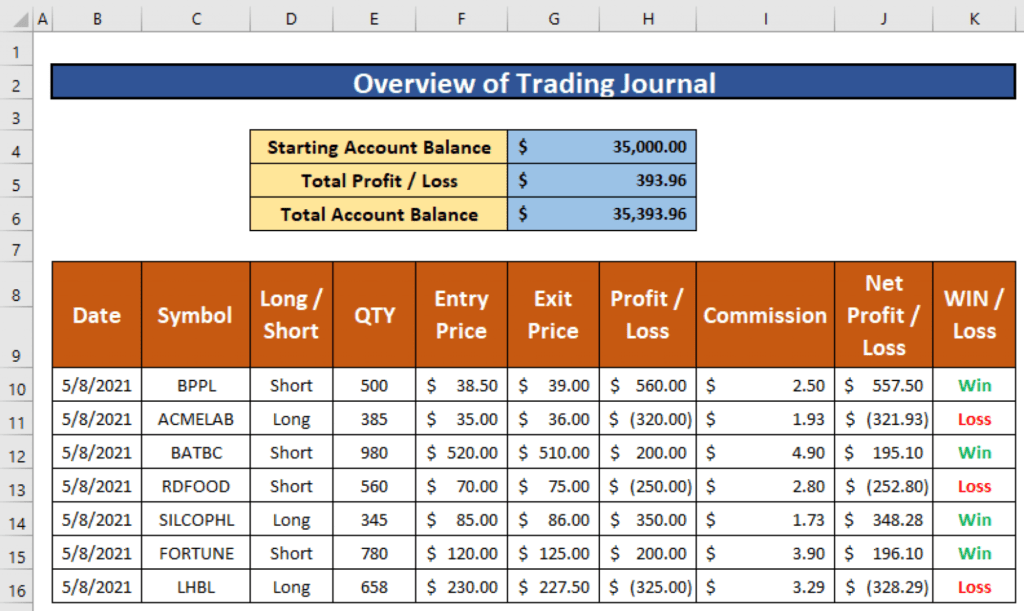

- Record All Trades: Make sure to record all your trades in your journal, including the date, time, entry and exit points, size of the position, and the reason for the trade. You should also include any relevant notes or observations, such as market conditions or news events that may have influenced the trade.

- Analyze Your Trades: Regularly review your journal to identify patterns and trends in your trading. Look for areas where you are consistently making profits or losses, and try to identify the reasons behind these outcomes. This can help you refine your trading strategy and make more informed decisions in the future.

- Set Goals: Use your trading journal to set goals and track your progress towards achieving them. This can include goals related to your trading performance (such as achieving a certain level of profitability), as well as goals related to your trading behavior (such as reducing the number of impulsive trades).

- Be Honest: Be honest with yourself when recording your trades and analyzing your performance. Don’t try to sugarcoat your losses or downplay your mistakes. Instead, use your journal as a tool to learn from your mistakes and improve your trading over time.

- Regularly Review and Update: Make sure to regularly review and update your trading journal. This can be done on a daily, weekly, or monthly basis, depending on your trading style and frequency. The more regularly you update your journal, the more effective it will be in helping you improve your trading performance.

- Use Charts and Visuals: Incorporate charts and visual aids in your trading journal to help you better visualize your trades and performance. This can help you identify patterns and trends more easily, and make more informed decisions based on your analysis.

- Keep It Simple: While it’s important to record all the relevant details of your trades, don’t overcomplicate your trading journal with unnecessary information. Keep it simple and easy to read, so you can quickly assess your performance and identify areas for improvement.

- Review Your Emotions: It’s important to track not just the technical details of your trades, but also your emotions and mindset when making the trades. Record how you felt before, during, and after the trade, and identify any emotions or biases that may have influenced your decision-making process.

- Identify Risk Management Strategies: Record your risk management strategies in your trading journal, such as your stop-loss levels or position sizing rules. This can help you evaluate the effectiveness of your risk management strategies over time, and make adjustments as necessary.

- Use it as a Learning Tool: Your trading journal should be viewed as a learning tool, not just a record of your trades. Use it to reflect on your performance, identify areas for improvement, and track your progress over time.

- Be Consistent: Finally, make sure to be consistent in your record-keeping and analysis. Use the same format and methodology each time you record your trades, so you can easily compare your performance over time. This will help you build a comprehensive record of your trading history and progress.

- Include Screenshots: Including screenshots of your trading platform in your journal can be a helpful visual aid. It can help you review your trades more effectively and make it easier to identify trends and patterns in your trading.

- Analyze Your Winning Trades: Don’t just focus on your losing trades. Analyze your winning trades as well to identify what you did right and what you can replicate in future trades.

- Review Your Journal Regularly: Review your trading journal regularly to identify areas for improvement and track your progress. It can be helpful to set aside time each week or month to review your journal and assess your performance.

- Adjust Your Trading Strategy: Use your trading journal to adjust your trading strategy as needed. If you notice patterns of consistent losses, adjust your strategy accordingly. If you find that you are consistently profitable with a certain approach, consider incorporating it into your trading plan.

- Be Honest with Yourself: It’s important to be honest with yourself when recording your trades and analyzing your performance. This means taking responsibility for your losses and acknowledging any mistakes you’ve made. By being honest with yourself, you can learn from your mistakes and improve your trading performance.

- Track Your Progress Over Time: Use your trading journal to track your progress over time. Set specific goals for yourself and track your progress towards achieving them. This can help you stay motivated and focused on improving your trading performance.

Overall, maintaining a trading journal can be a powerful tool for improving your trading performance. By recording your trades, analyzing your performance, and adjusting your trading strategy as needed, you can develop a more disciplined and informed approach to trading.

Few ex: