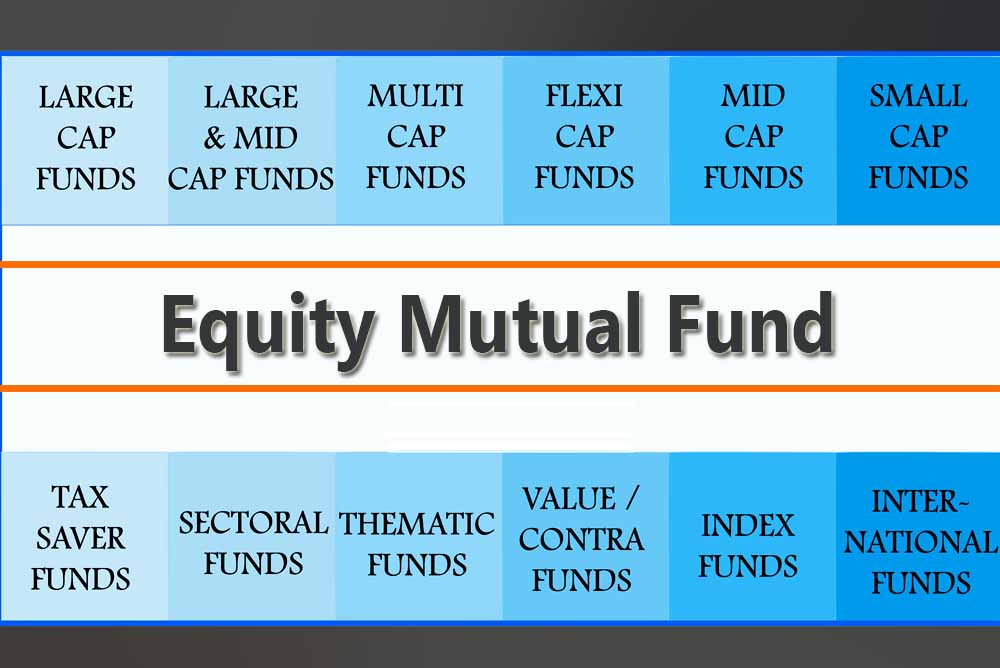

In India, there are several types of equity funds, including:

- Large-Cap Funds: These funds invest in the shares of large and well-established companies with a market capitalization of more than Rs. 20,000 crore. These funds are considered to be relatively safe, as the companies in which they invest are well established and financially stable.

- Mid-Cap Funds: These funds invest in the shares of companies with a market capitalization between Rs. 2,000 crore and Rs. 20,000 crore. These funds can offer higher returns compared to large-cap funds, but they are also considered to be riskier.

- Small-Cap Funds: These funds invest in the shares of companies with a market capitalization of less than Rs. 2,000 crore. These funds are considered to be high-risk investments, as the companies in which they invest are relatively new and less established compared to large-cap and mid-cap companies.

- Multi-Cap Funds: These funds invest in a mix of large-cap, mid-cap, and small-cap stocks. These funds can offer a balance of growth and stability, and they can be a good option for investors who want exposure to a diversified portfolio of stocks.

- Sector Funds: These funds invest in the stocks of companies operating in specific industries or sectors, such as technology, healthcare, or energy. These funds can offer higher returns compared to diversified equity funds, but they are also considered to be riskier as they are more focused on a specific sector or industry.

- Tax-Saving Funds (ELSS): These funds invest in a mix of equity and debt securities, and they offer tax benefits to investors under Section 80C of the Income Tax Act, 1961.

- Value Funds: These funds invest in undervalued companies with a strong financial track record, in the hope of realizing capital appreciation when the market recognizes the company’s true value.

- Growth Funds: These funds invest in companies that are expected to grow faster than the overall market, with the goal of realizing capital appreciation over the long-term.

These are some of the most common types of equity funds available in India, and investors can choose the type of fund that best aligns with their investment goals, risk tolerance, and time horizon.

In India, there are several providers of equity mutual funds, including:

- HDFC Asset Management Company (HDFC AMC)

- Reliance Nippon Life Asset Management Limited (Reliance Nippon AMC)

- ICICI Prudential Asset Management Company (ICICI Prudential AMC)

- Birla Sun Life Asset Management Company (Birla Sun Life AMC)

- Franklin Templeton Asset Management (India) Private Limited (Franklin Templeton AMC)

- Kotak Mahindra Asset Management Company (Kotak AMC)

- SBI Funds Management Private Limited (SBI Funds Management)

- Aditya Birla Sun Life Asset Management Company (Aditya Birla Sun Life AMC)

- Axis Asset Management Company Limited (Axis AMC)

- UTI Asset Management Company Limited (UTI AMC)

- These are some of the largest and most well-established mutual fund providers in India, and they offer a range of equity funds to meet the investment needs of a diverse range of investors. When choosing a mutual fund provider, it is important to consider factors such as the provider’s track record, the quality of the investment management team, and the fees and expenses associated with the funds offered by the provider.